|

Agriculture futures surged on President Trump’s decision to pause some of his planned tariff hikes and broad-based dollar weakness, but exports data sends mixed signals. |

|

|

|

Wheat |

|

Wheat futures found support but exports softened |

|

|

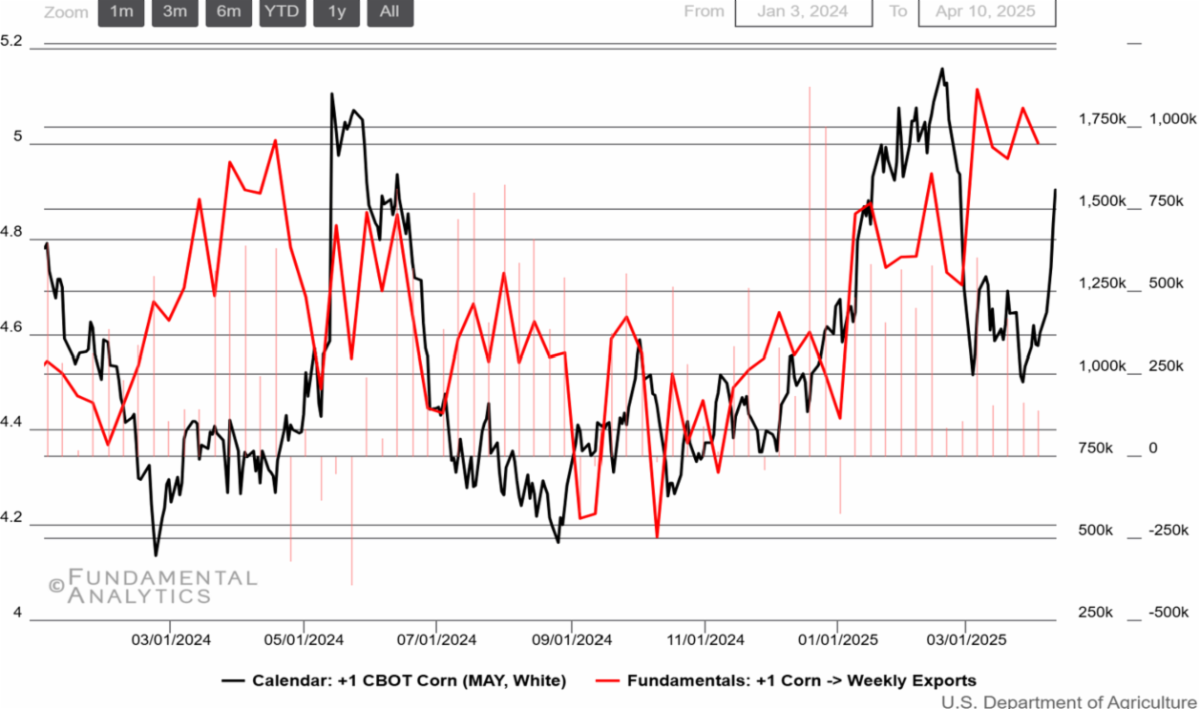

| Corn |

|

Corn skyrocketed on two-month high |

|

|

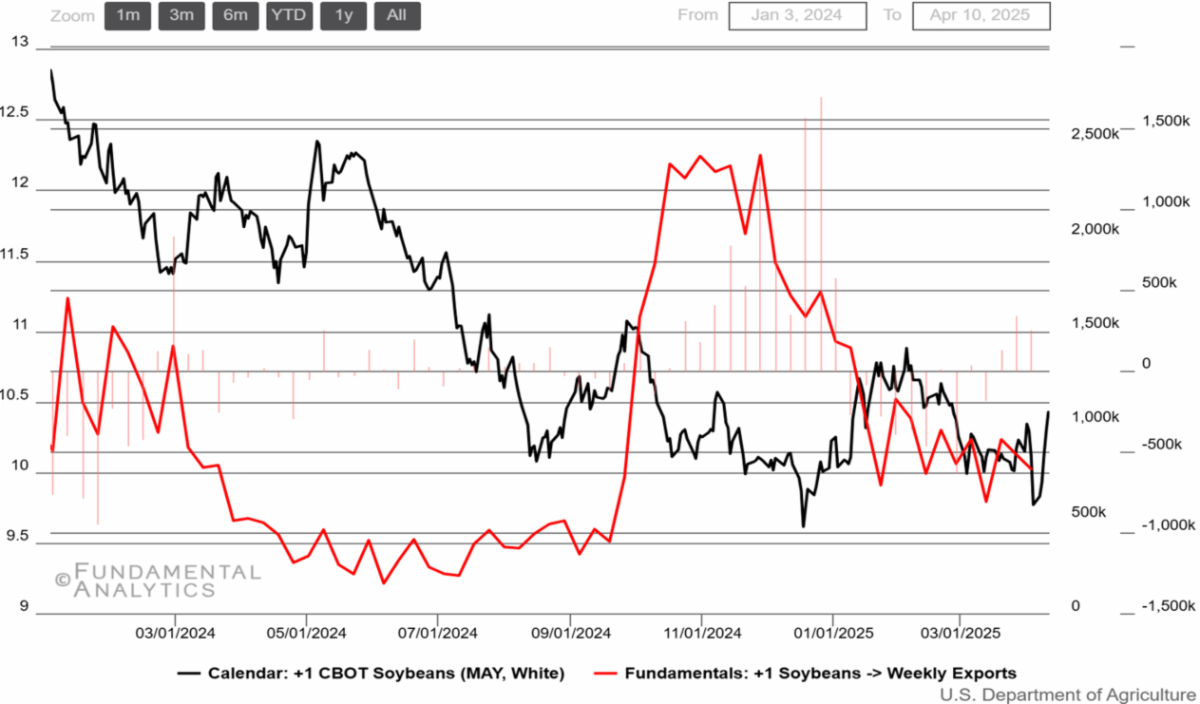

| Soybeans |

|

Soybean prices above $10 mark |

|

|