|

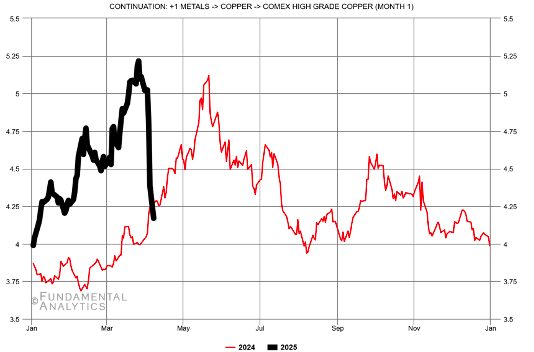

Dr. Ken Rietz “Doctor Copper” has been acting oddly. It hit an all-time high on March 25, and hovered for a bit, then plummeted in a display unseen since 2008, and continues to drop. Sometimes, it seems to follow its own whimsy, but most of this can be explained. The magic word is tariffs. In this commentary, we look at the factors that influenced the erratic behavior of copper’s price and give a tentative outlook for its price. But first, let’s look at the front-month futures price since January 2024. |

|

|

Figure 1: COMEX copper front month prices Now, let’s examine why the price of copper futures started climbing. At first, some people were cheering copper on, since a climb in copper’s price is a strong signal for a healthy economy, one that consumes a lot of copper for wires and pipes. But that didn’t hold for long, partly because the global economy wasn’t getting much better, and the price climb wasn’t tied to an increase in demand for more copper. Deeper examination showed that the increase in price was tied to potential tariffs. Back on February 25, Trump asked the Commerce Department whether imports of copper were a national security concern. The report was originally requested in 270 days but action is likely to be taken in less time. This increases market nervousness. All this caused the market to hit a new all-time high on March 25. After that, the market pulled back marginally, and continued just below the high for several days, as shown in this detailed graphic. |

|

|

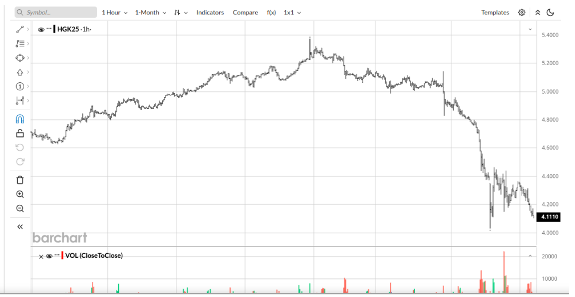

Figure 2: COMEX copper front month prices, hourly Barron’s put out a series of three articles that warned about the unlikelihood of these prices being able to continue increasing. The direction wasn’t clear until it became obvious that Trump intended to implement his “Liberation Day” tariffs, which happened after the close of the markets on April 2. The market was stunned by the number and magnitude of the tariffs. The result was dramatic drops over the next several days. The slight uptick at the end of the drop is almost certainly a brief profit-taking move before the drop continues. But why would the price of copper drop due to the implementation of tariffs? Won’t that cause the price to go up, as it did when tariffs were looking to be implemented, causing an all-time high? The difference is between tariffs on copper (causing its price to increase) and tariffs on everything, causing a reduction in the activities that use copper (causing a reduction in the need for copper, that is, its demand and therefore price). What is the direction of the price of copper? Clearly, the price is going down due to a reduction in demand. But of the 90+ countries on which the tariffs fell, at least 50 countries are now negotiating with Trump about doing what is necessary to reduce the new tariffs. The largest importer of copper is China, and they have taken a hard stance against the monumental-sized tariffs imposed on them. The trade war between the two largest economies will reverberate through the entire globe. That will have a direct effect on the price of copper. The most likely direction for the price to go is still down, but the net effect of the negotiated tariffs will have a large impact on the price of copper. |