| Ahmad Al-Sati

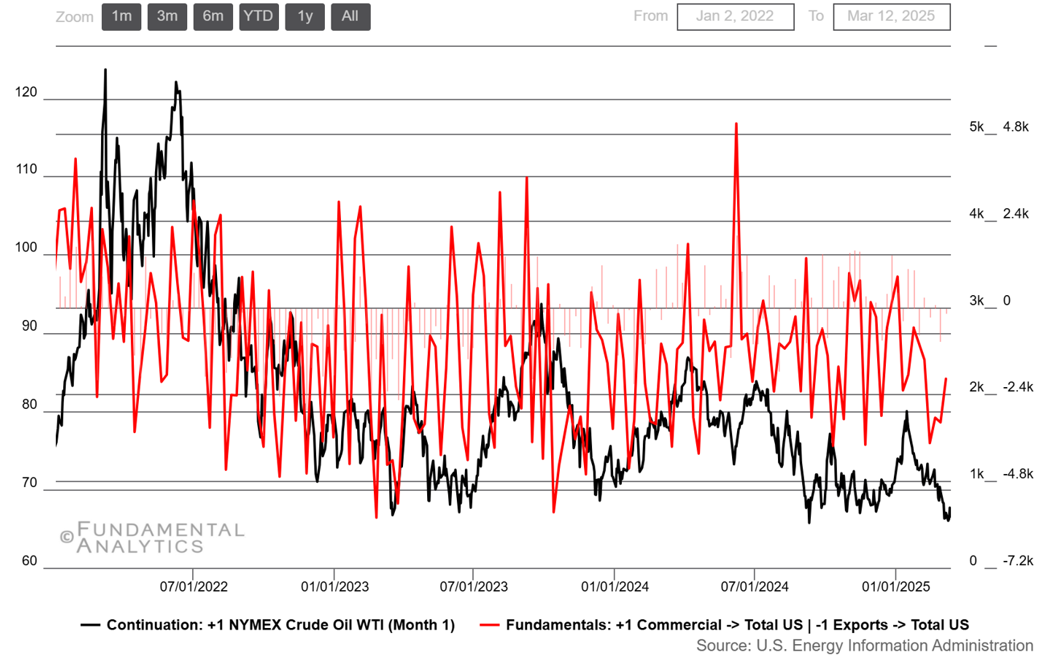

To read more insights from Ahmad Al-Sati, we invite you to visit his LinkedIn here. The U.S. energy sector is facing a pivotal moment, grappling with challenges shaped by outdated systems, shifting global demand, and infrastructure bottlenecks. Both the oil and natural gas industries are wrestling with issues that have been decades in the making. From the nation’s dependency on imported heavy crude to meet refining needs (Figure. 1), to its struggles to fully capitalize on surging global demand for natural gas, the energy landscape is a complex web of history, strategy, and economics. |

|

|

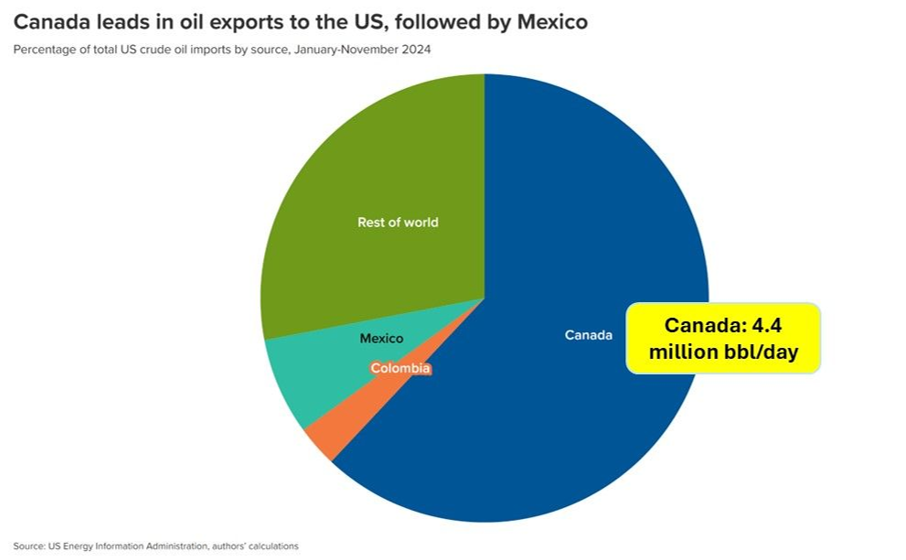

Figure 1 The U.S. oil complex faces a unique paradox. While the nation is the largest oil producer and possesses substantial refining capacity, it remains heavily reliant on imports—over 70% of the oil refined comes from foreign heavy crudes, primarily from Canada and Mexico. |

|

| This dependency is rooted in historical decisions from the 1970s when U.S. oil production declined and refineries were built to handle heavy, imported crude, notably from Venezuela. Even as the shale revolution dramatically increased domestic production (Figure. 2), it introduced light, sweet crude that is incompatible with these complex refineries. Recent trade tensions, including tariff hikes, have further complicated this co-dependency. Increased costs from tariffs may force refiners and Canadian suppliers to absorb expenses or pass them on to consumers, signaling an urgent need for significant down-stream investment—either by retooling refineries for lighter crude or by diversifying supply markets in Canada and Mexico—to secure long-term energy independence. |

|

|

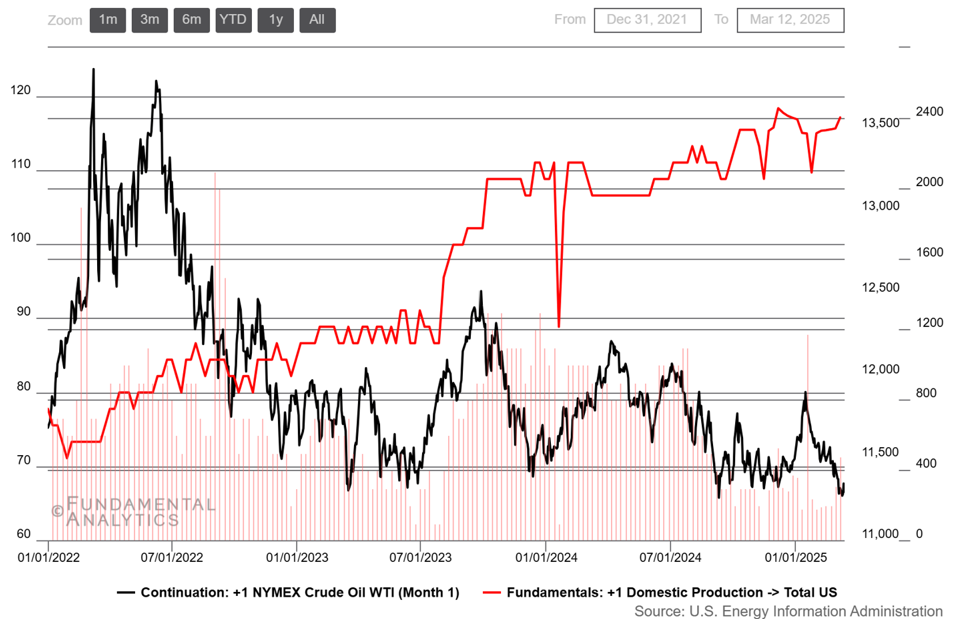

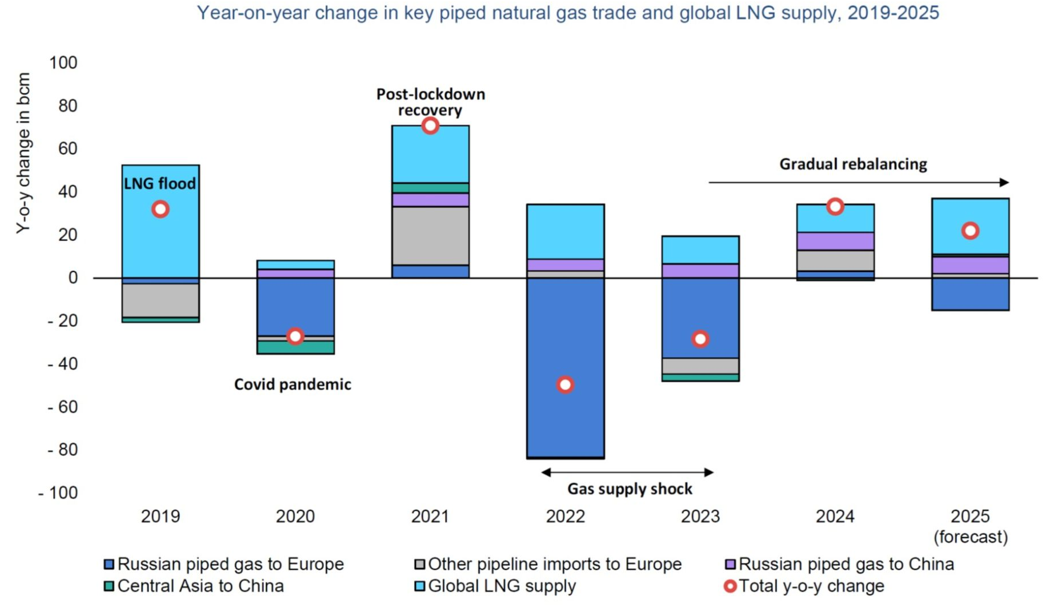

Figure 2 Meanwhile, the natural gas market is undergoing its own dramatic transformation. Record trading volumes at Henry Hub, up about 30% year-on-year by the end of last year, underscore a growing structural demand fueled by industrial expansion in Asia, reduced Russian gas supplies to Europe, and extreme weather conditions in regions like India and Latin America. |

|

|

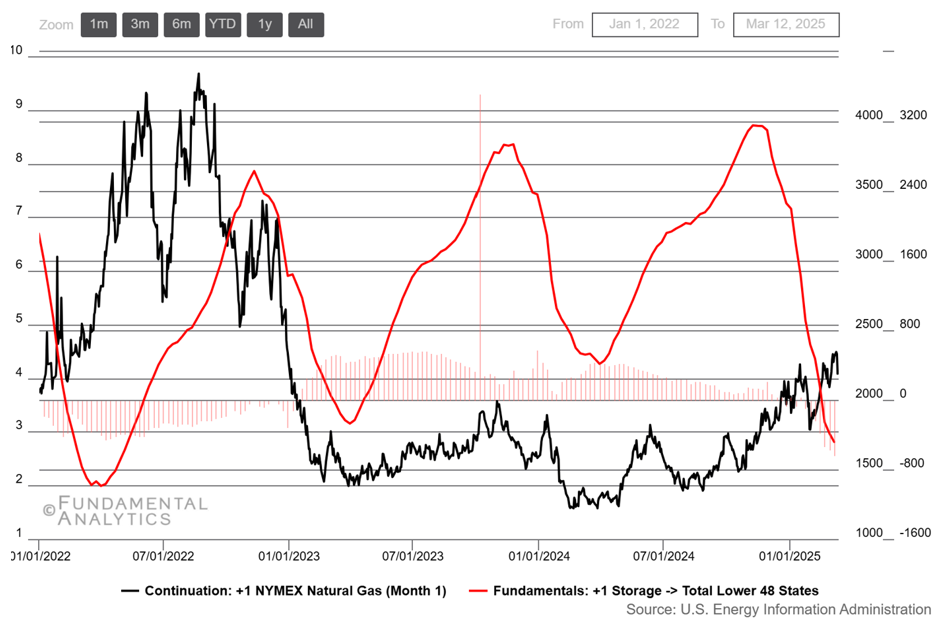

Source: The International Energy Agency Although U.S. natural gas prices remain low domestically owing to abundant supply (Figure. 3), shale gas production has declined in some areas as producers adjust to the less favorable pricing environment. At the same time, U.S. LNG exports are set to increase with new facilities such as Plaquemines LNG and Corpus Christi LNG Stage 3 coming online. However, logistical challenges, including geographic choke points like the Panama Canal and competition from cheaper alternatives in Europe and Asia, complicate the export landscape. These hurdles highlight the need for improved infrastructure to access higher-value markets, posing both challenges and opportunities for U.S. producers as they balance domestic supply with rising international demand. |

|

|

Figure 3 Together, these developments in oil and natural gas reveal a broader imperative: the U.S. must invest heavily in modernizing its energy infrastructure to capitalize on its domestic resource boom. In oil refining, transitioning to facilities that can process lighter crude would reduce the current reliance on heavy imports and secure more predictable margins, while for natural gas, enhanced export capabilities and targeted infrastructure improvements on the Pacific coast could unlock the high-value potential of Asian markets. Both scenarios underline the critical role of strategic, long-term investments in securing energy supply chains, stabilizing market dynamics, and fostering re-industrialization—all essential for maintaining the U.S.’s competitive edge in an increasingly complex global energy landscape. |