October 24, 2023

Increased uncertainty, fueled by the Middle East conflict, hugely affects crude oil, gasoline and natural gas futures prices but fundamental data has made traders nervous.

Crude Oil

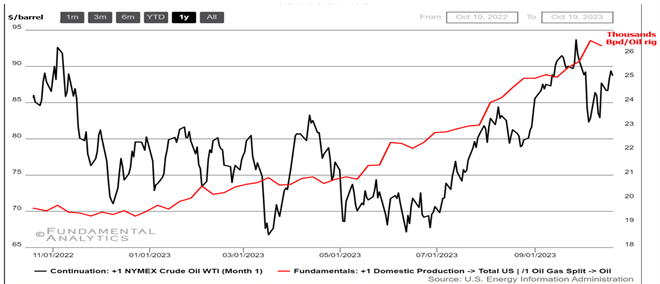

Increased production efficiency offsets soaring WTI prices amid Middle East conflict

- Strengthened crude oil production efficiency has been mainly driven by higher production volume as shown in the latest EIA report. US production surpassed the pre-Covid level and spurred relief among investors as a counterweight from the supply side amid increased geopolitical risk in the Middle East.

- The U.S. on Wednesday lifted most restrictions on Venezuela for six months for producing, selling and exporting oil to its chosen markets. This decision has acted as a release valve on some of the upward price pressure

- Οil prices have been supported by expectations of a wider market deficit in the fourth quarter after top producers Saudi Arabia and Russia extended supply cuts to the end of the year.

- The US is also planning to buy 6 million barrels of crude for delivery in December and January to replenish strategic reserves.

Gasoline

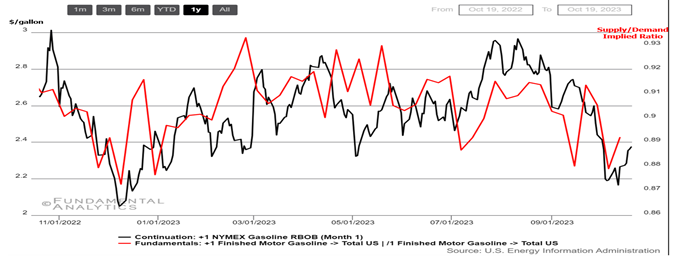

Demand strengthened more than supply sending gasoline prices go north

- Gasoline futures rose above $2.3 per gallon, the highest in two weeks, tracking the surge in oil prices driven by concerns that the situation in Israel and Gaza may disrupt oil production in the Middle East.

- Traders concern that the conflict could lead to transportation disruptions through critical chokepoints or result in stricter restrictions on Iranian oil exports.

- In addition to the Middle East tensions, the United States has implemented tighter sanctions against Russian crude oil exports, intensifying worries about supply constraints.

- Meanwhile, new data from the EIA showed US gasoline stocks fell by 2.4 million barrels in the week ending October 13th, the most since early September, and doubled compared to market expectations of a 1.1 million barrel draw.

Natural Gas

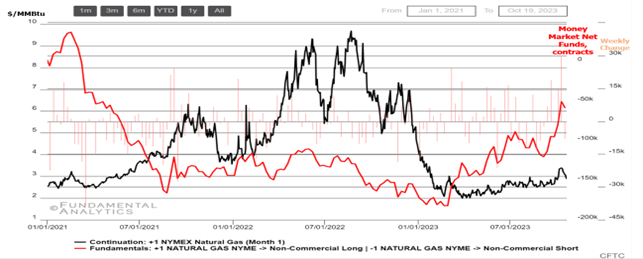

Speculators send bullish signal but output offsets it for now

- Money-managed net funds returned to early 2021 levels, as speculators bet on the scenario that energy companies will focus more on LNG trading amid Middle-East geopolitical risk inflammation.

- US natural gas futures fell more than 13.1% to below $3.0/MMBtu during the period October 6th-October 20th , the lowest in over two weeks following record output, mild weather and data showing a bigger-than-expected storage build last week.

- The latest EIA report showed US utilities added 97 Billion cubic feet (bcf) of gas into storage last week, more than market consensus of an +80 bcf increase. Also, natural gas production rose to 103.6 bcf/day so far in October, surpassing a record high of 103.1 bcf/day in July.

- Furthermore, US LNG facilities’ gas flow reached 13.5 bcfd in October, with the return of Cove Point.

- Looking ahead, forecasts for mild weather through early November are expected to keep heating and cooling demands lower.