August 15, 2023

Commercial traders have altered their preferences, expecting higher prices for corn and soybeans, while wheat continues at a decreasing trend from late July.

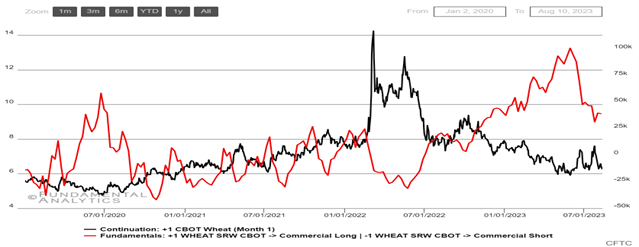

Wheat

Net Commercial Funds Lowered from Mid-June, Restraining Wheat Prices

- The net commercial position has decreased from a 4-year high (101,024 net long position) below 40k from late May, indicating a sharp change in expectations for a future rally in wheat prices.

- The main drivers are improved weather conditions in the key regions of the US, which led to eased concerns after summer droughts hindered better yields.

- Better-than-expected production increased wheat export volumes, but the excess supply could weigh on future prices.

- The latest WASDE report from the USDA revised global consumption forecasts down by 3.4 mt to 796.1 mt amid lower feed and residual use in the EU and reduced seed, food, and industrial use by China.

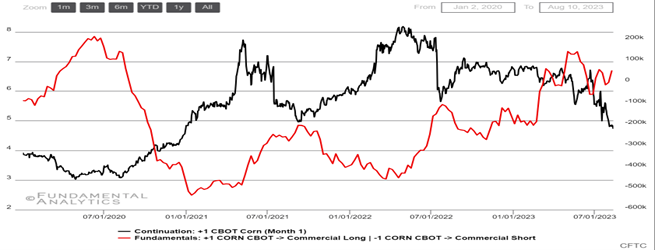

Corn

Corn Prices at 2-Year Low – Net Commercial Funds Have Increased from the Start of the Year

- Net commercial position has reached a 1-month high at 54.6k, reversing significantly from late February.

- Corn prices closed at $4.75/bushel for the week ended on August 11th, reaching a two-year low.

- U.S. government predicts that dry conditions early in the growing season would mean smaller harvests this fall.

- The corn crop would be the second biggest on record due to large acreage and improved growing conditions during July.

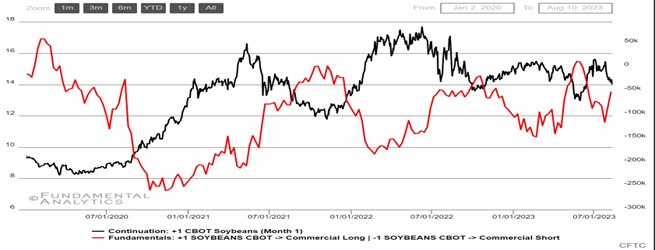

Soybeans

Soybeans Reached 1-Month Low, Net Commercial Positions Reversed

- Net commercial position increased for the second consecutive week (August 8th, 2023), after 2-months of sharp decline in placing long positions from commercial traders.

- Rainy weather across much of the key U.S. crop belt led to forecasts for good growing conditions for August, improving supply.

- On the demand side, private exporters reported the sale of 132k metric tons of soybeans to China for delivery in the 2023/24 marketing year, according to the latest report from USDA.