Mid-Week, Weekly Review of Gold, Silver, and Palladium

October 15, 2020

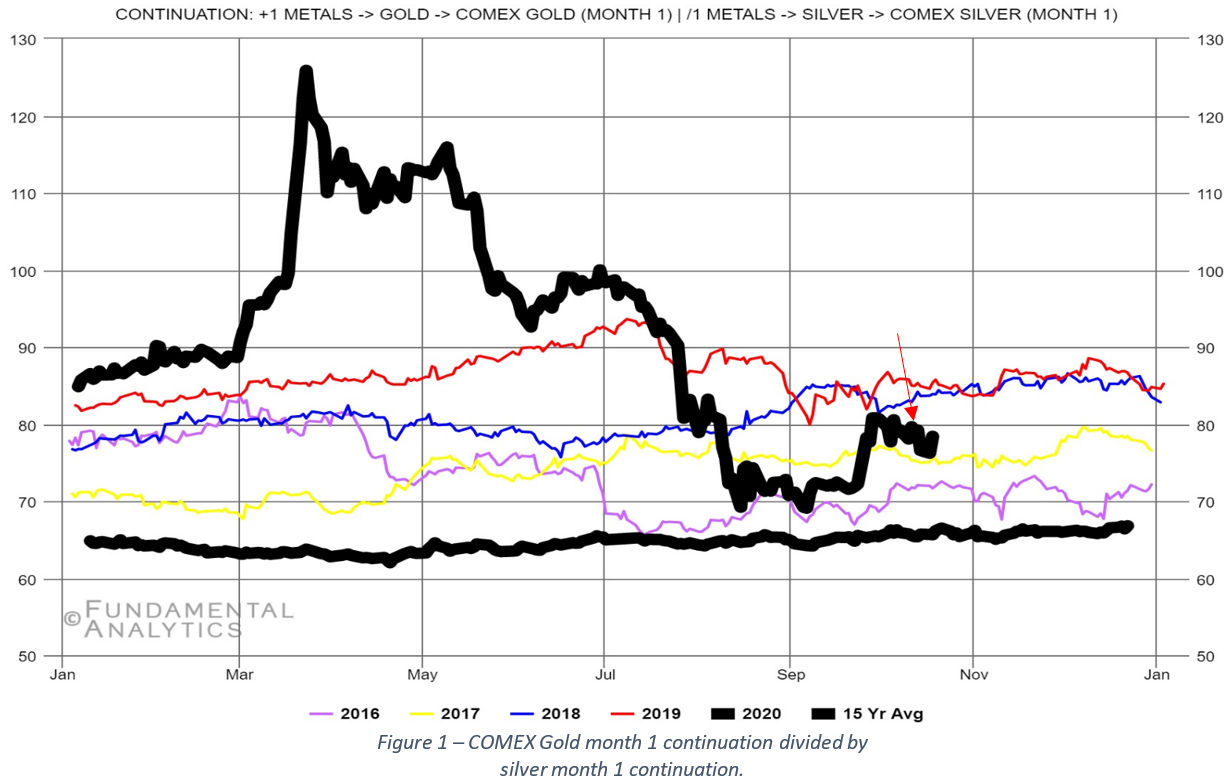

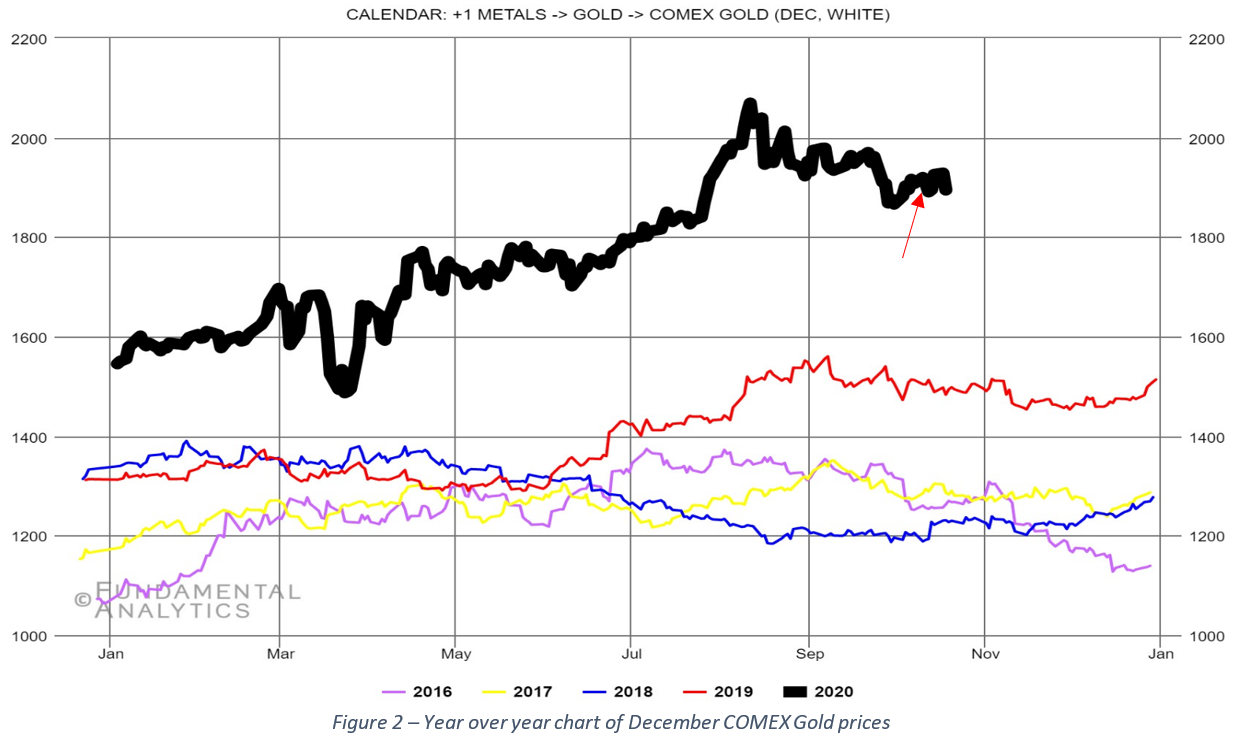

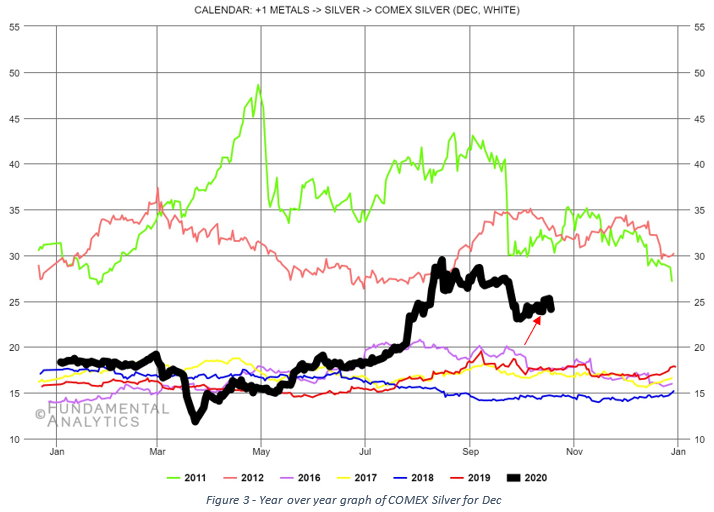

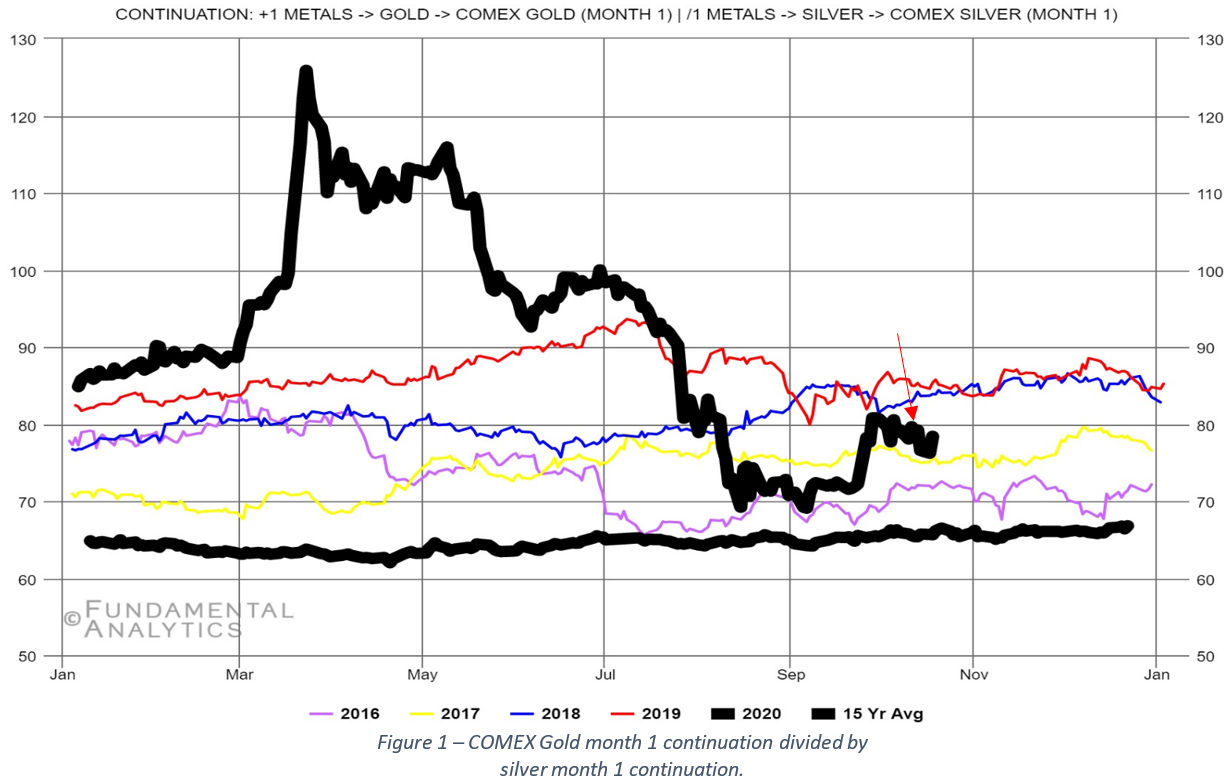

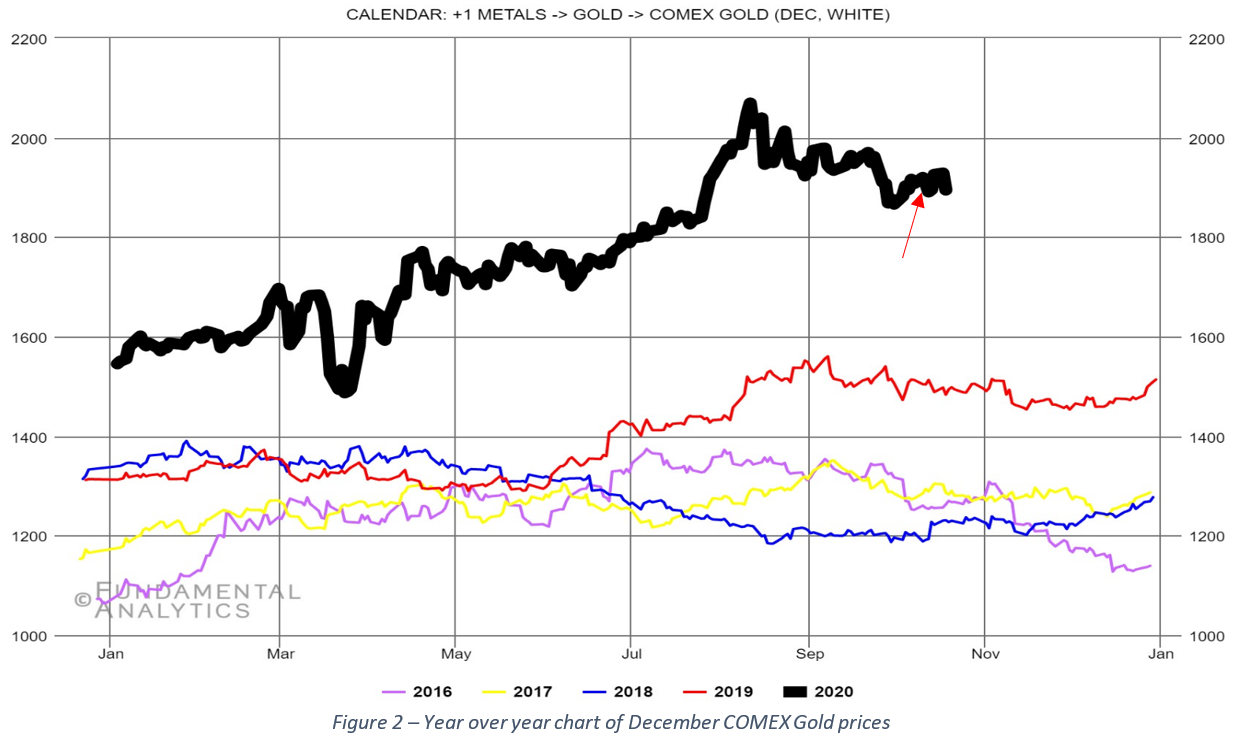

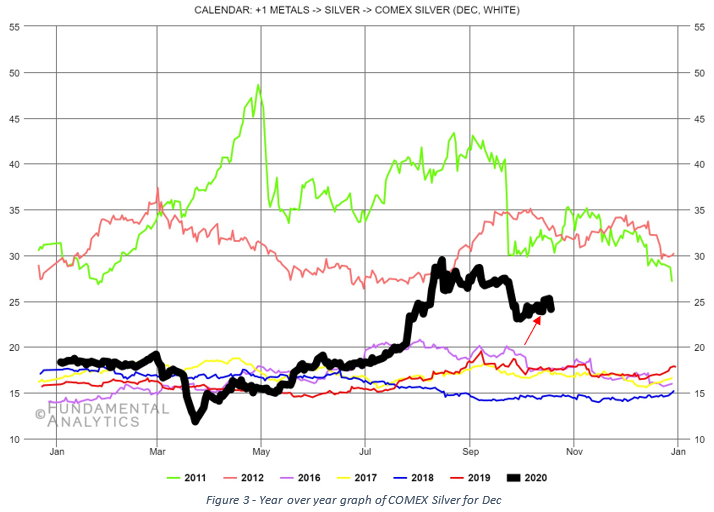

The front month contracts for gold and silver were mixed from the close on October 6, 2020, with gold down 0.66% and silver up 0.90% (red arrow identifies close on the 6th). The ratio of the month 1 Gold contract to the month 1 Silver contract (Figure 1) is down 1.55% compared to the close on the 6th. Since a falling gold/silver ratio tends to be positive for gold and it has been moving lower since its recent high at the end of September, we will need to continue to monitor this trend. With the front month gold and silver contracts closing Tuesday at $1894.60 and $24.13, respectively, the gold/silver ratio is now 78.41, 19.7% higher than the corresponding 15-year average. December gold (Figure 2) closed Tuesday at $1894.60, down 0.74% and December silver (Figure 3) closed at $24.13, up 0.87% from the close on October 6th.

From an open interest perspective, gold’s total open interest continues to fall and is down 0.4% from last week Tuesday, with volume remaining below its 50-day average. The latest CFTC report for gold (10/6) for non-commercial net position of funds show funds net long positions rose 2.5% from the previous week’s report. This rise in net long positions was driven by an increase in non-commercial longs and a reduction in non-commercial short positions. From a longer-term perspective, both the CFTC net positions and total open interest are moving in a similar manner. On to silver… Silver total open interest is up by 1.9% with respect to last week Tuesday. The latest CFTC data (10/6) show the silver non-commercial net positions of funds rose 0.6%, this while increasing both long and short positions. For the last several weeks the non-commercial funds have cut their short positions while holding their long positions near constant. For the first time since mid-September we see they increased their short positions in the 10/6 report.

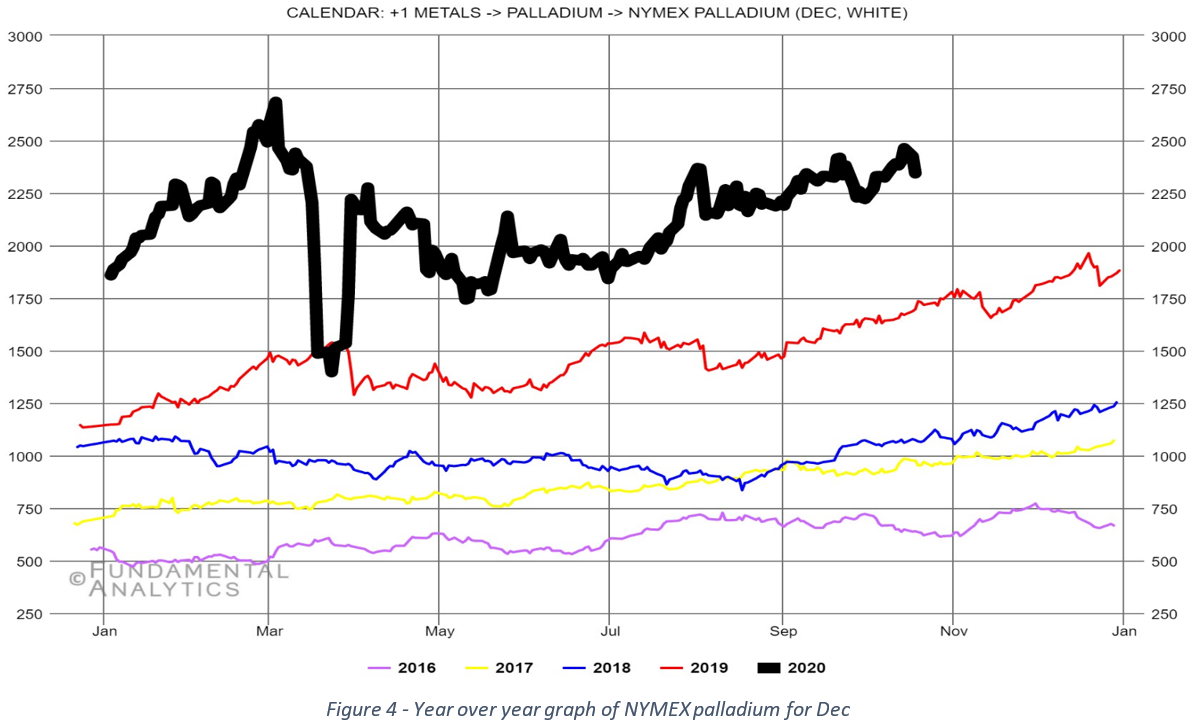

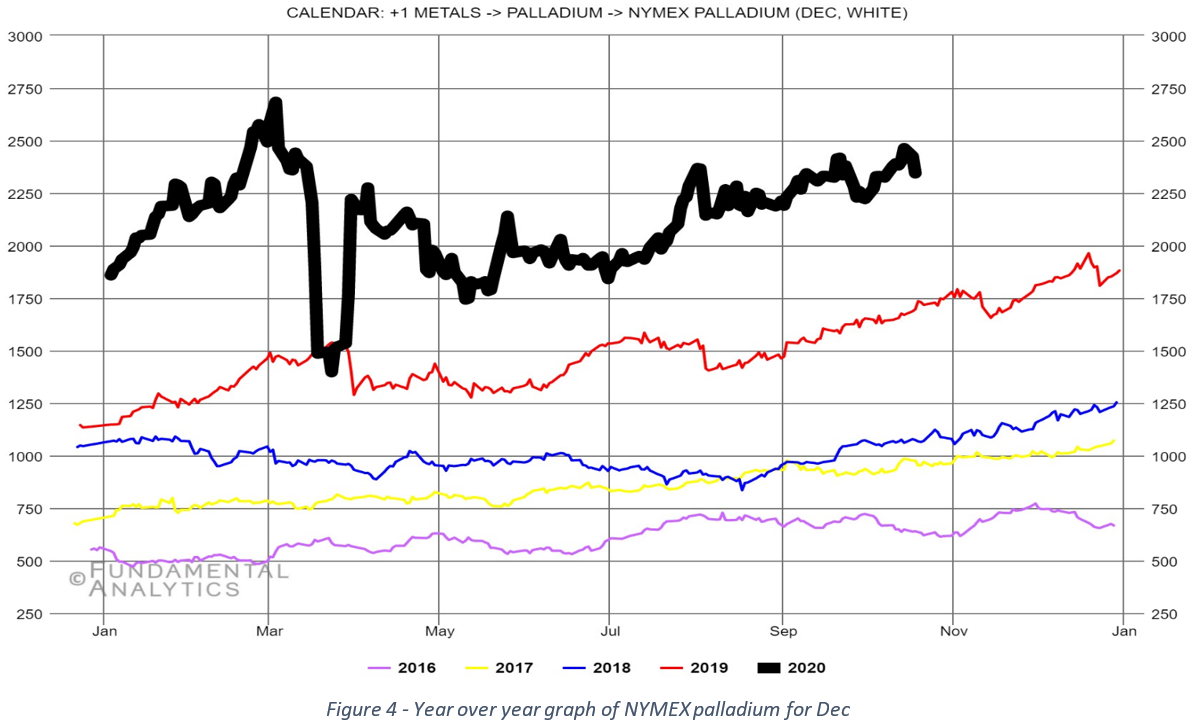

Now for Palladium. December Palladium closed at $2344.30.2 Tuesday, down 1.96% from the close last week Tuesday. Total open interest rose 4.3% from Tuesday last week and when viewing the last two weeks, rose 9.6% from two weeks ago. The 10/6 CFTC report shows an increase of 21% in non-commercial net fund positions. Rhodium is also remaining elevated in price which will tend to encourage manufacturers to substitute palladium for rhodium. This will drive the demand of palladium which should tend to support the price of palladium, assuming COVID does not result in a lessening demand for new autos.

The final thought I leave with you today is a reminder that the price of gold currently seems to be pegged to the strength of the dollar, as we mentioned last week. Inflation and inflation expectations have backed off from their highs mid-year and Treasury bond rates are slowly rising from the mid-year lows. Both moves are negative for gold in the short term. The IMF recently stated it believes that austerity measures are not inevitable to reduce the impact of the pandemic on public finances. Depending upon how the rest of the word perceives this message, it could be positive for the dollar. It could also be positive for inflation if the velocity of money increases from current lows. As per my comments from last week, I would recommend keeping an eye on inflation and the possible impacts that it may have on gold. Watching the price of copper with respect to gold while also keeping an eye on the direction of the gold/silver ratio may provide early notice of another move in gold.

If you would like access to the great insights and analysis provided by the Fundamental Analytics platform, sign up for a 15-day free trial and demonstration!

If you have any questions, please contact our Technology Manager, Mike Secen at [email protected]

We also invite you to read our other articles and follow us on social media!

Best Regards,

The Fundamental Analytics Team

The information provided here is for general informational purposes only and should not be considered individualized investment advice. All expressions of opinion are subject to change without notice in reaction to shifting market conditions.