Gold, Silver, and Palladium Commentary

August 19, 2020

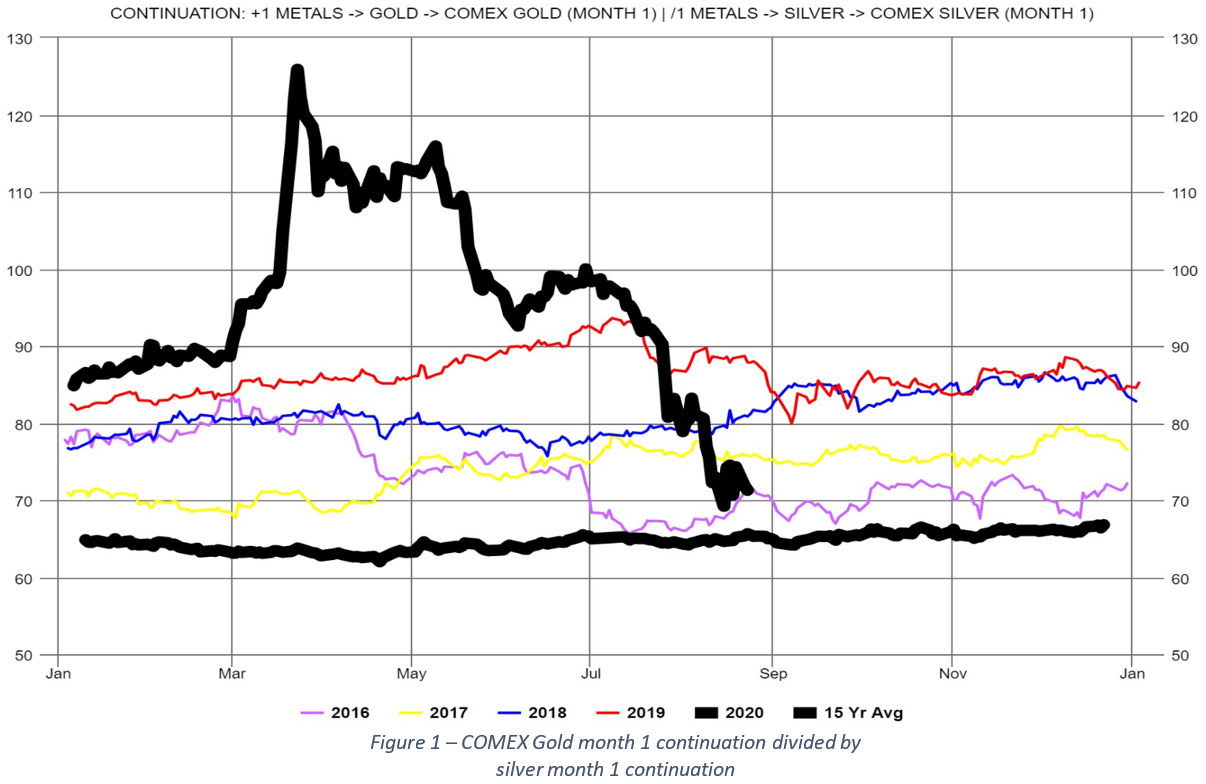

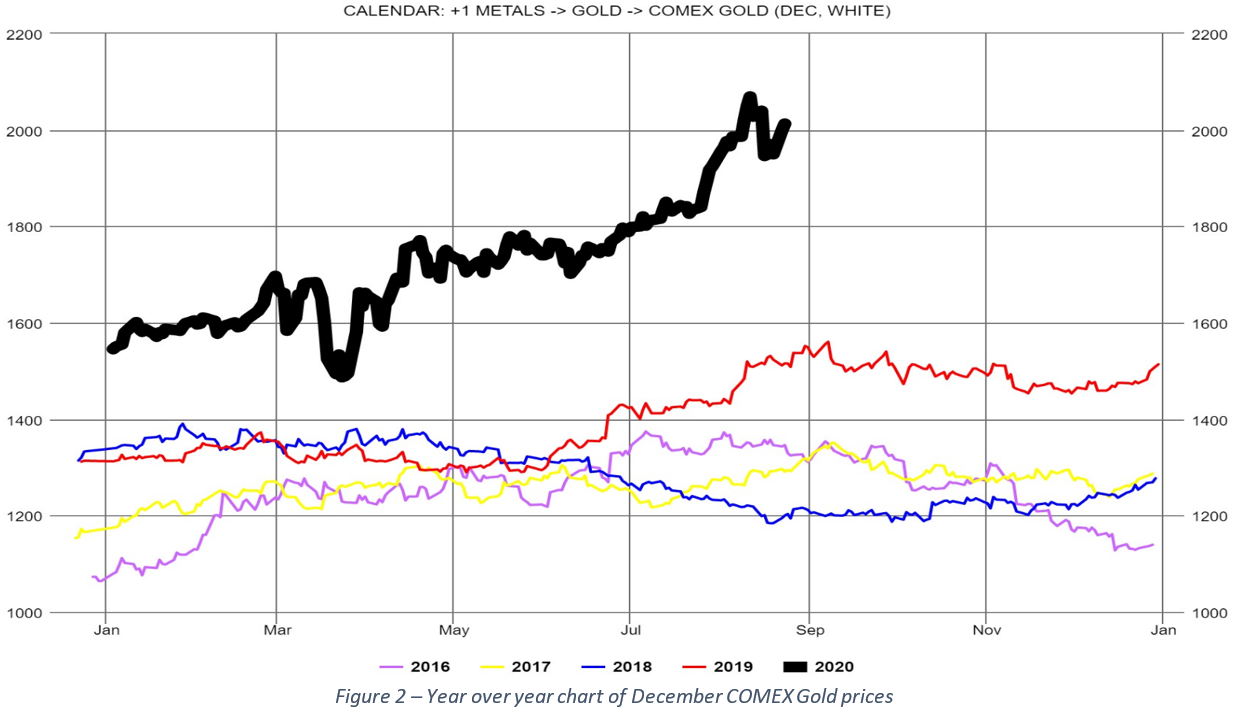

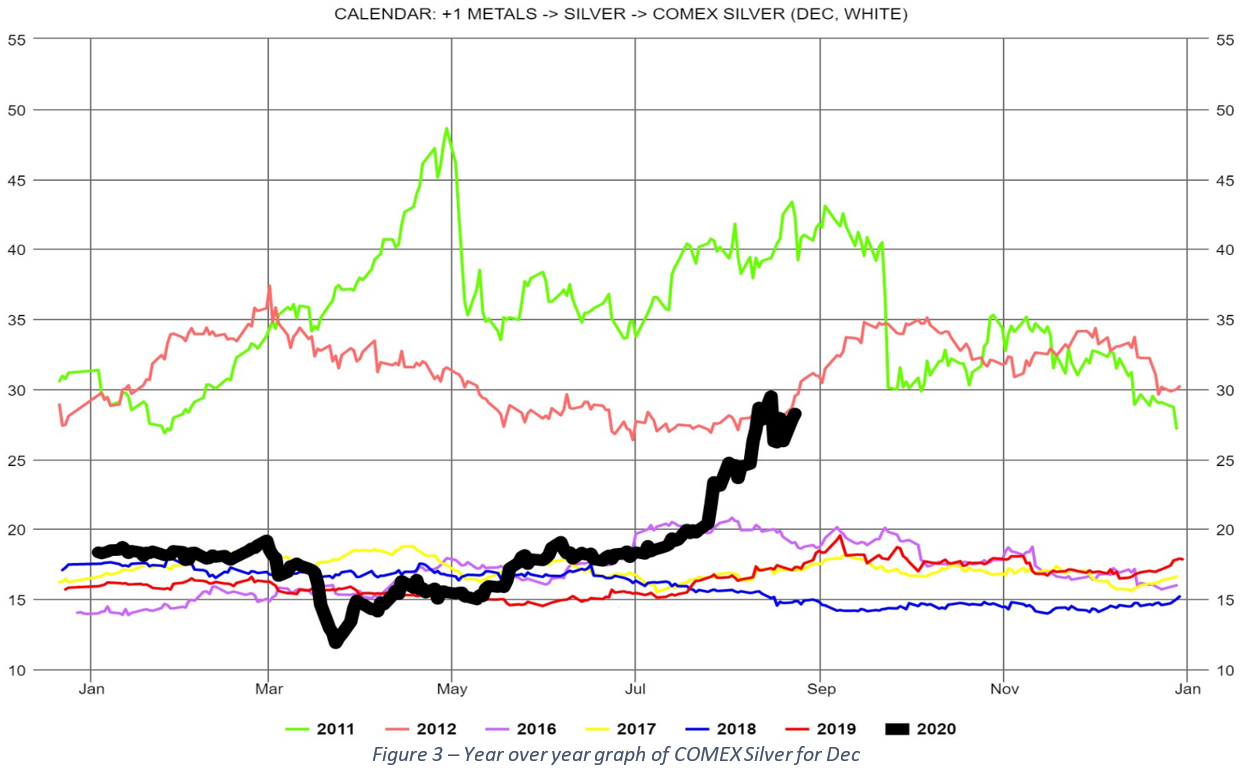

The front month contracts of gold and silver are up from last week 3.46% and 7.73%, respectively. This has resulted in the ratio of the 1-month Gold contract to the 1-month Silver contract (Figure 1) falling since last week, but essentially unchanged since Aug 6, 2020. With the front month gold and silver contracts closing yesterday at $1999.4 and $28.05, respectively, the gold/silver ratio is now 71.28, or 9.2% higher than the 15-year average. December Gold (Figure 2) closed yesterday at $2013.1, up 3.43% from the close on Aug 11, but essentially unchanged since Aug 4, 2020. December silver (Figure 3) closed at $28.24, up 7.6% since last week, but almost unchanged from its close on Aug 7, 2020.

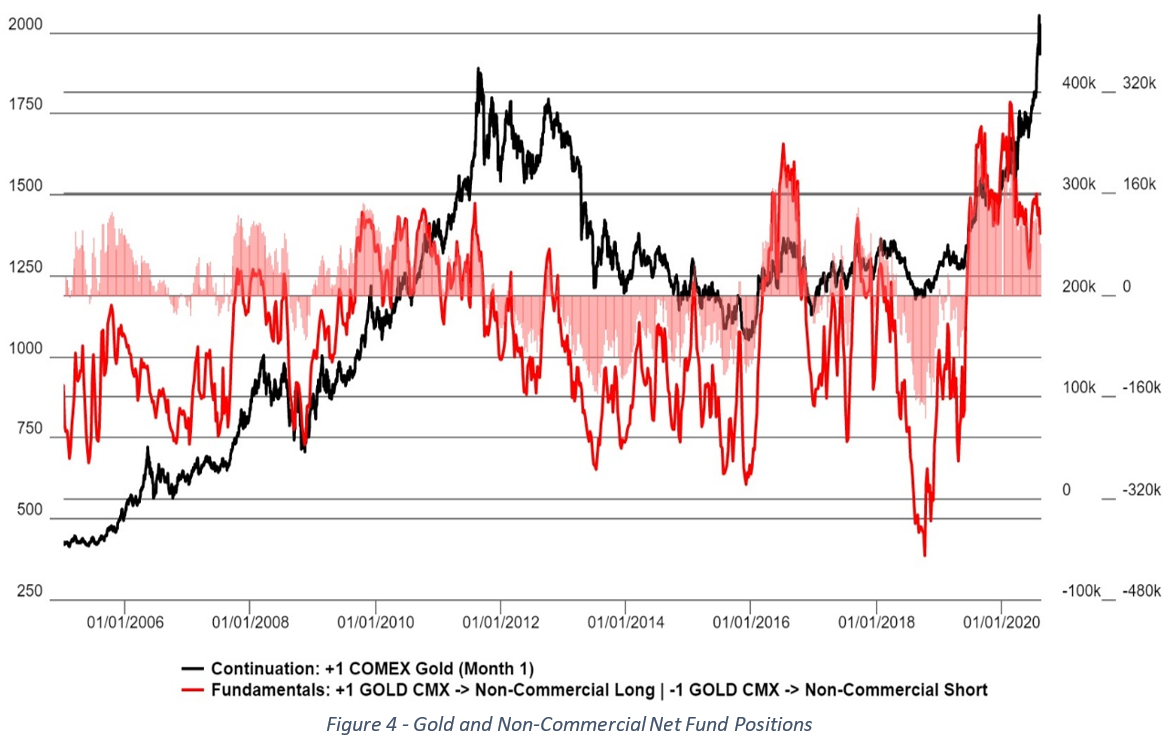

From an open interest perspective, gold’s open interest continues to fall, as it is down 1% for the last week and down 10.7% since recent open interest high on July 27. Silver total open interest is down 5% for the last week and down a similar amount from the peak in open interest on Aug 6, 2020. Both gold and silver saw a decrease in the CFTC COT net funds positions between the 8/4 and 8/11 reports, which continues the trend in net positions since the July 21, 2020. It should be noted that gold non-commercial net fund positions are well above their 5-year average where silver is below.

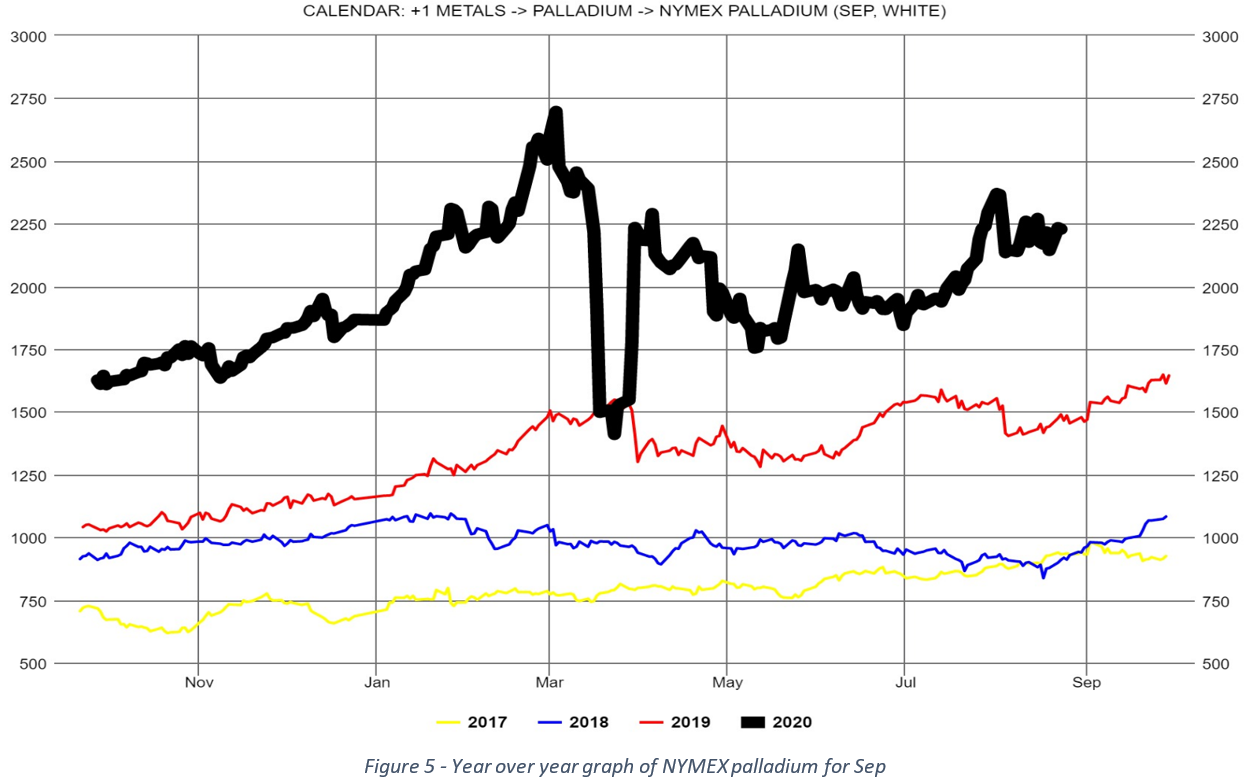

Now for Palladium. Palladium remains range bound between $2130 and $2365 and will likely remain there unless we see definite proof that automotive production in countries other than China are increasing or rhodium is in short supply (see below).

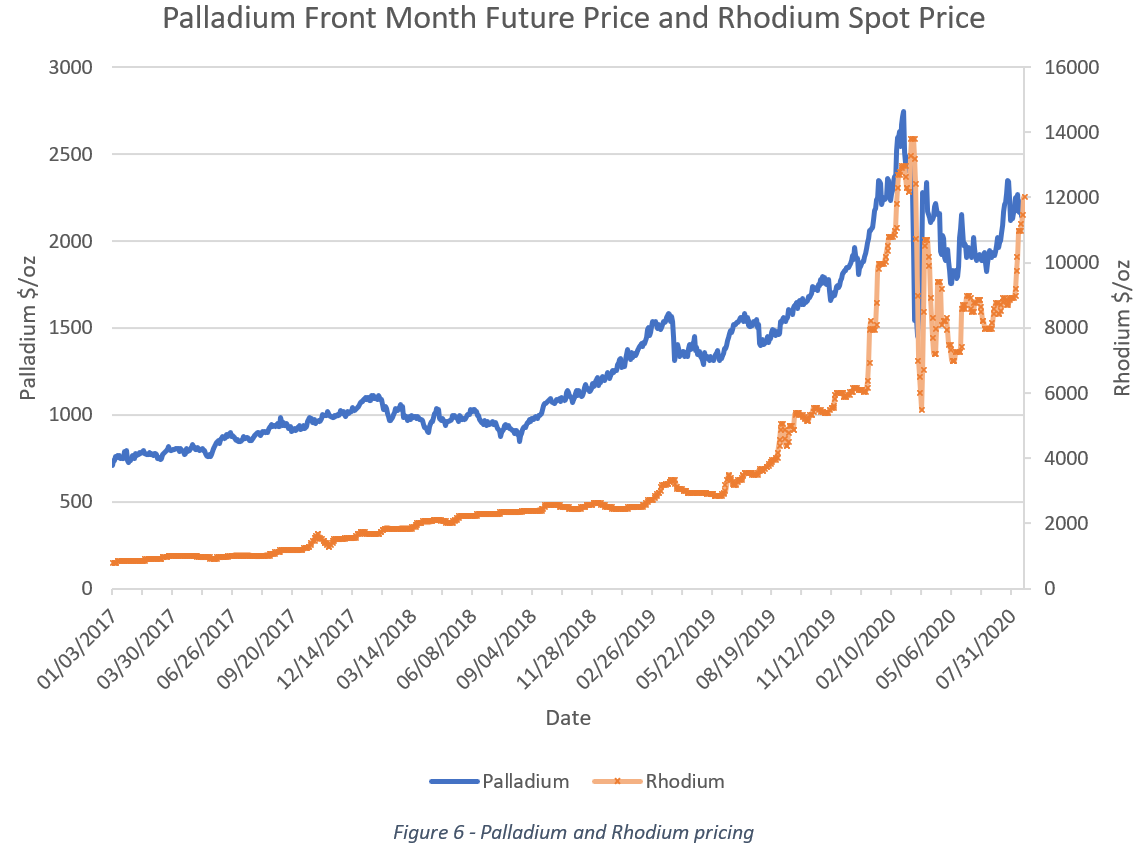

The final thoughts I leave with you today are regarding the price of palladium. Russia’s Nornickel, the world’s largest high-grade nickel and palladium producer released their latest earnings and business outlook on Aug 11. For those who are interested you can find the report here. Nornickel has a neutral outlook on palladium as they expect to see a balance year with respect to supply and demand. This is a shift in expectations as until recently demand was expected to exceed supply. However, the price of rhodium has increased 34% since August 5, 2020. As rhodium often is a good indicator of future trends in palladium, this increase should be monitored (Figure 6). If there is a shortage of rhodium, auto makers are forced to increase their palladium loadings substantially, per the Nornickel report and this could drive up the price of palladium as happened in 2019 and 2020.

If you would like access to the great insights and analysis provided by the Fundamental Analytics platform, sign up for a 15-day free trial and demonstration!

If you have any questions, please contact our Technology Manager, Mike Secen at [email protected]

We also invite you to read our other articles and follow us on social media!

Best Regards,

The Fundamental Analytics Team

The information provided here is for general informational purposes only and should not be considered individualized investment advice. All expressions of opinion are subject to change without notice in reaction to shifting market conditions.