Andreas Anastasiadis

March 22, 2024

As uncertainty intensifies, the major names in commodities trading become more and more popular with investors seeking to find not only opportunities but also ways to hedge against possible turmoil. Crude and gold futures have appreciated 20.8% and 11.4% on a yearly basis, respectively, and have raised concerns among investors about the bullish cycle’s endurance.

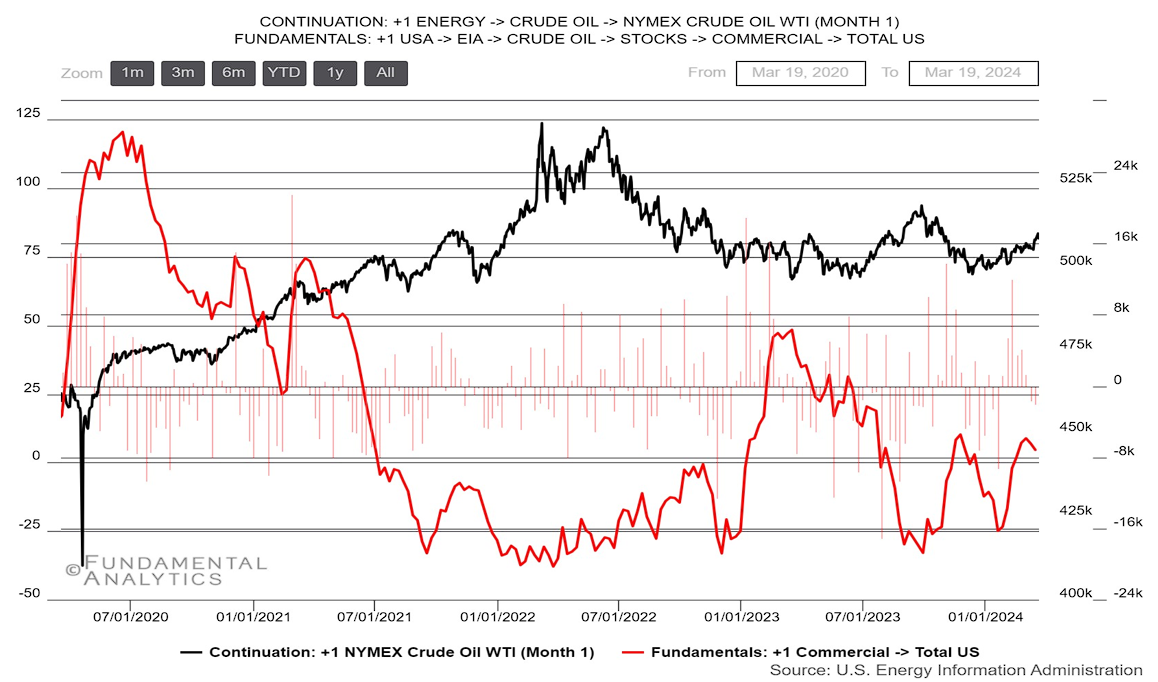

WTI crude futures cut early gains to trade around $81 a barrel on Thursday, following a 1.7% decline the day before, as traders assess the demand and supply outlook. The Fed kept interest rates steady and continued to signal three rate cuts this year, providing some support for demand. Meanwhile, Ukrainian drone strikes on Russian refineries continued to stoke supply concerns. The attacks have shut down about 10% of Russian refining capacity, adding to market tightness alongside OPEC+ production cuts. Still, a rise in supply from outside of OPEC, including the US and Brazil, has been offsetting some of the impact. Fresh EIA data showed crude inventories in the US unexpectedly declined by 1.95 million last week, the most in two months, as exports went up and refiners continued to increase activity. Current EIA inventories of 445 million barrels (Figure 1) are lower than the 5-year average of 459 million barrels.

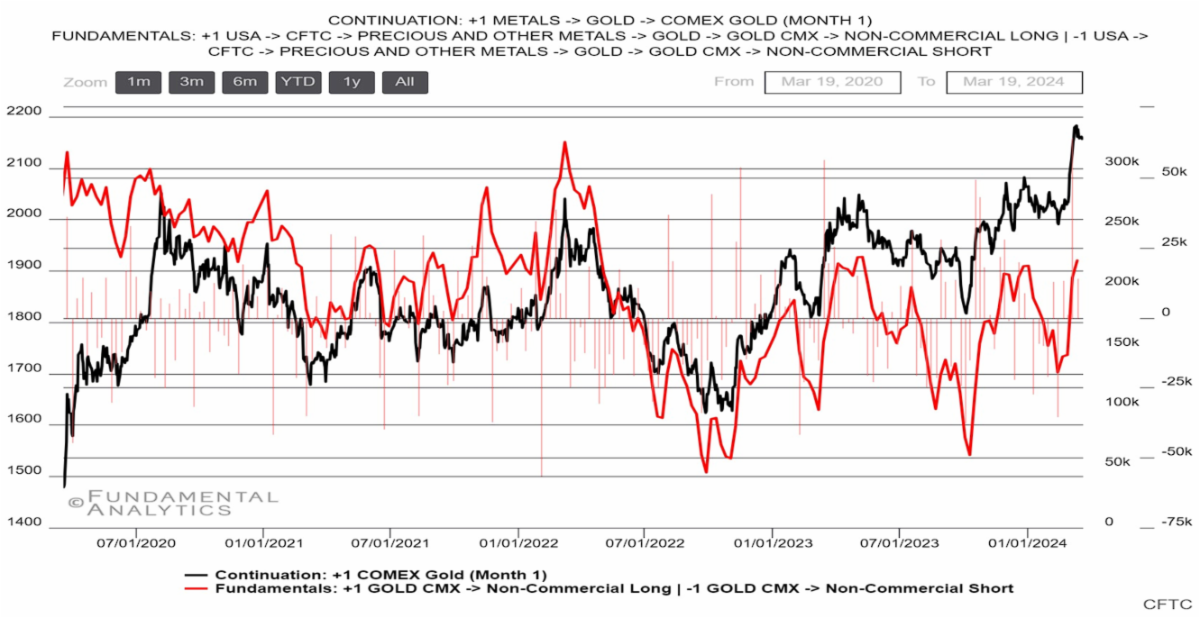

Gold prices rose above $2,200 an ounce on Thursday, hitting record highs as investors are becoming increasingly convinced that major central banks will likely ease their monetary policies soon. As mentioned above, the Federal Reserve kept rates unchanged, as widely anticipated, and continued to signal three rate cuts in 2024. According to CME FedWatch Tools, traders anticipate a 68% probability that the first rate cut will occur in June. From a historical perspective, traders often increase their net long bets after the first rate cut in the interest rate hiking cycle. Currently, the money-managed funds (speculators’ bets) are 222,539 contracts net long, the highest in one year (Figure 2), and are strengthening for a 4th consecutive week. Furthermore, the Bank of England’s two remaining supporters of rate hikes have voted to keep the rates steady, while one member voted for the rate cut. Additionally, the Swiss National Bank unexpectedly lowered its key benchmark rate by 25 bps, becoming the first major lender to initiate an easing cycle.