November 6, 2023

The supply of energy commodities remains at high levels, pushing prices for crude and gasoline lower, while LNG futures increase amid traders wanting to decrease their oil exposure.

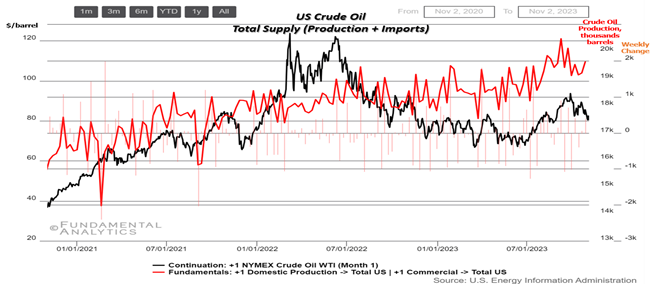

Crude Oil

Strong US supply, WTI return to two-week low

- WTI crude futures slipped -9.3% during the last two weeks.

- Oil prices are now back to levels before Hamas attacked Israel on October 7th, as concerns that the conflict in the Middle East would disrupt supply have eased.

- Demand outlook remains gloomy, with the ISM Services PMI for the US falling more than anticipated while in China, the biggest importer, manufacturing fell back into contraction and the services sector grew only slightly faster.

- Saudi Arabia is expected to reconfirm the extension of its voluntary oil output cut of 1 million barrels per day through December, in order to push oil prices to $100 barrel target.

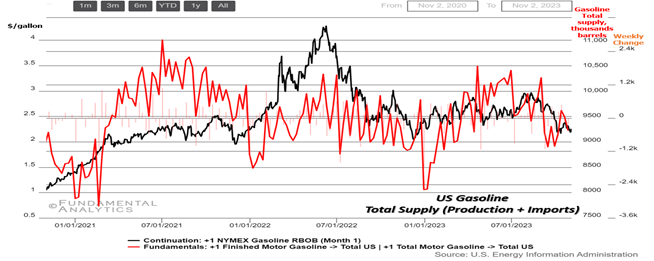

Gasoline

Lower gasoline supply, RBOB futures below $2.25 mark

- US gasoline futures remain $2.25/gallon, reporting -7.3% lower compared to two last weeks, tracking lower crude oil prices as concerns over supplies amid geopolitical conflicts in the Middle East have eased.

- Furthermore, higher inventories and lower demand for gasoline added extra downward pressure.

- Money-manage funds, speculators’ bets monitoring tool, were expanded to 41,504 long contracts reporting the biggest weekly change (+9,441 contracts long) from November 10th data, according to CFTC.

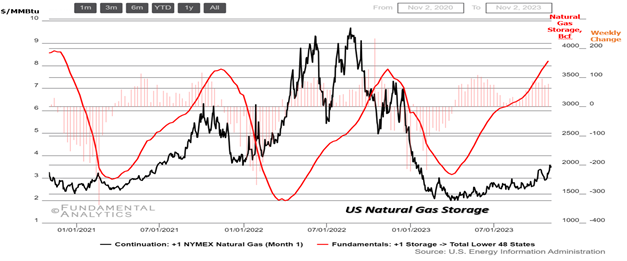

Natural Gas

US LNG storage higher than 2019 levels, LNG prices soar on investors alter preferences

- US Natural Gas soared +21.3% from October 20th, as investors seek to decrease their exposure to oil, weighing on LNG futures.

- The latest EIA report showed US utilities injected 79 bcf of gas into storage last week, broadly in line with expectations.

- During last week, prices expressed less volatility as investors balanced increased gas production and milder weather against record gas flows to LNG export facilities.

- Natural gas production rose to 106.1 bcf per day so far in November, surpassing a record high of 104.2 bcf per day in October. Looking ahead, meteorologists anticipate a shift to warmer-than-normal weather from November 4-17.

- Gas flows to US LNG export facilities rose to an average of 14.8 bcfd so far in November, up from 13.7 bcfd in October and a record 14.0 bcfd in April

- Exports to Mexico have been falling from September’s record, although there are expectations of an increase when New Fortress Energy’s plant starts exporting LNG.