Dr. Ken Rietz

October 12, 2023

This is the inaugural issue of what is planned to be a monthly issue devoted to spreads. The intention is to present spreads with a bit of commentary. Additionally, we are eager to publish any spreads that you are interested in seeing. In this issue, we are including only those spreads that are, arguably, the most important: petroleum crack spreads and the soybean crush spread. If there are other spreads you would like to see, please e-mail us at [email protected].

Briefly, a spread is the difference in price between two related items, or between two aspects of the same item. Read properly, a spread provides guidance not only for traders but for practitioners as well. Examples of this will occur this week and in successive weeks. If you want more information on the meaning or use of spreads, please click here to look at the extensive CME tutorials.

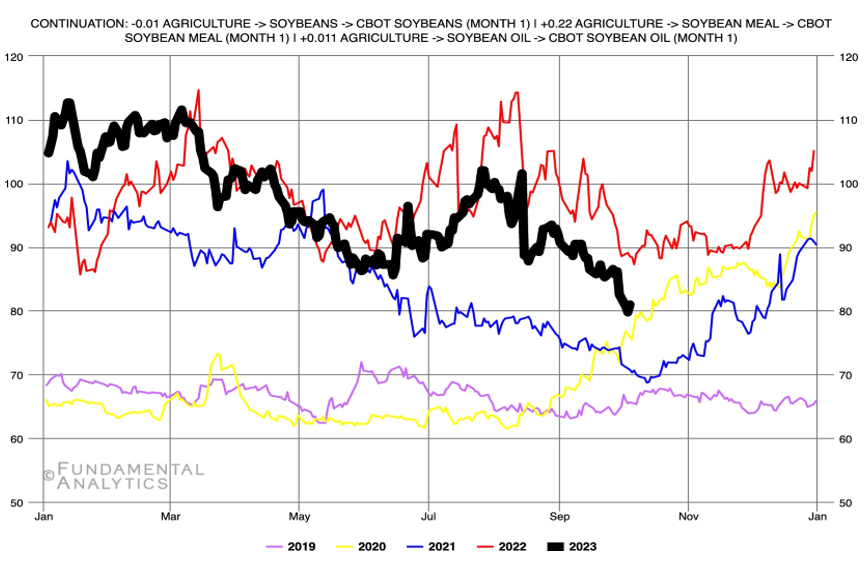

Soybeans are turned into soy meal and soy oil. The spread is the difference in price between the price of the beans and the total of the prices of the meal and the oil, using futures contracts. There is some complexity involved in this, however. Soybeans are traded in bushels, soybean meal is traded in tons, and soybean oil is traded in pounds. One bushel of soybeans produces about 44 pounds of meal and 11 pounds of oil. Putting that together gives this graph.

Figure 1: Soybean Crush Spread

While this information would be useful to farmers, traders are the ones more likely to use it. For that, knowing what factors affect the spread is essential. There are several. The most important ones are the acreage planted and harvested in soybeans (affecting the price of soybeans) and the quality of the crop (affecting the amount of the oil and meal). Both of those are given by the USDA, and traders follow those numbers carefully. These numbers are strongly affected by the weather and by international markets. Currently, the soybean November futures market is down 1.2%, and off from January prices by 19 cents per bushel. Soymeal futures are down $1.70 to $3.00 per ton, and soybean oil futures are similarly down 16 to 17 points. The net result is a decrease in the crush spread, as seen in the graph.

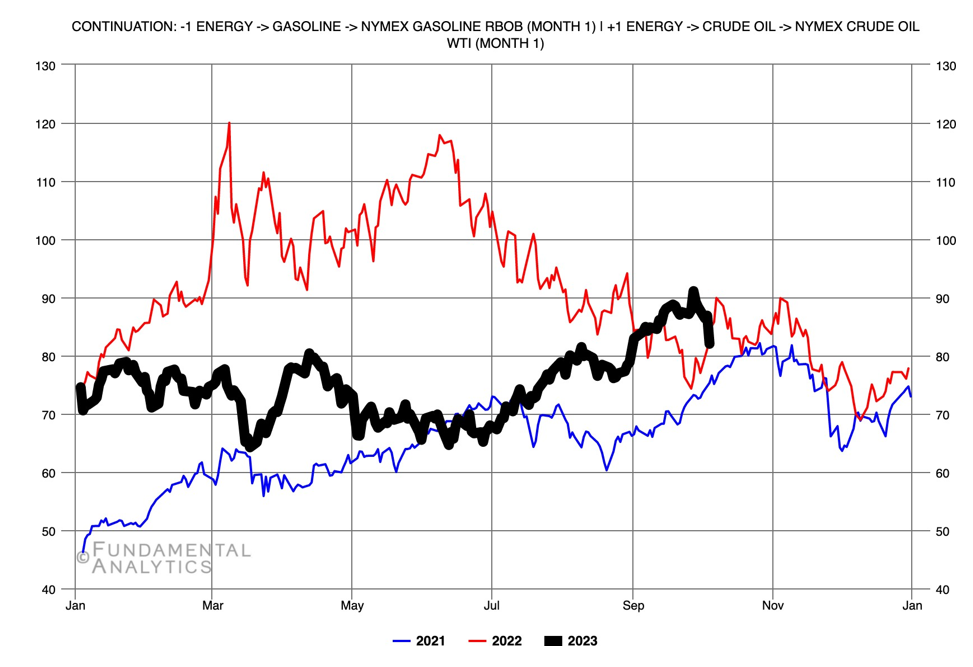

Next, we tackle the petroleum crack spread. Briefly, this is a graph of the difference in the price of crude oil and the wholesale prices of the gasoline and diesel produced. (In the interest of making this simple, we will ignore a raft of important technicalities. Please excuse this. We can try to dive into some of these in a later issue.) Since a single barrel of oil produces several different products with different prices, we use the industry standard ratio of 3:2:1. That ratio says that 3 barrels of crude oil produce roughly 2 barrels of gasoline and 1 barrel of distillates. Distillates are ultra-low sulfur oils and are sold as either diesel fuel or heating oil. This means that there is always a trade-off between the prices of gasoline and diesel, with the refinery adjusting the ratio of gasoline to diesel to maximize their profits.

Figure 2: Petroleum crack spread in dollars per gallon

What can we see from the crack spread? Clearly, the spread is dropping in the short term, which translates directly into decreasing revenue for the refineries. Their reaction is not simple to predict, since there are a few options open to them. But we can explain the overall movements in the crack spread shown in the graph. During 2021 until mid-May 2022, the spread was mainly affected by COVID-19, when refineries reduced production due to a drop in demand. The effect was a reduction in output and a corresponding increase in prices per gallon to maintain their profit margin. As supply chain issues began to resolve themselves, the crack spread returned to more typical prices by the end of 2022. Since then, the overall inflation has caused the average spread to climb slowly, a trend that is likely to continue. Finally, recent developments in the Middle East have prompted us to consider that a regional war could have an effect on the crack spread, but it is too early to tell.