October 10, 2023

Unexpected increase in gasoline stockpiles increased uncertainty in energy markets with crude oil falling, but LNG supported by exogenous factors.

Crude Oil

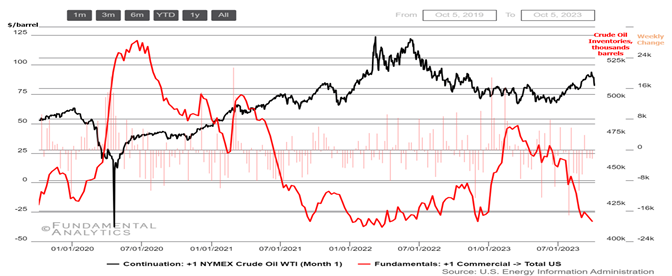

Crude oil inventories are back to pre-Covid levels, but uncertainty remains

- WTI crude futures remained stable below $83 per barrel on Friday’s close (10/06/2023) but were poised for a weekly loss of around 9% primarily due to concerns about weakening global demand, despite tight supply worries.

- The Joint Ministerial Monitoring Committee of OPEC+ reaffirmed the group’s restrictive supply policy last week, spurring the expectations for the global crude market to be finely balanced over the next year, which should sustain high oil prices throughout 2024.

- Furthermore, the spread between the front-month price and the two-month-ahead price is still positive, hinting at lingering supply constraints.

- The seasonal Brent-WTI spread is now below 2016 level and far below the historical lower bound average $4, creating opportunities for bullish movement in the short term for the Brent.

Gasoline

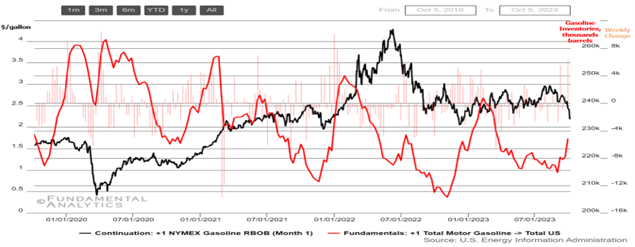

Gasoline prices in a downturn

- US gasoline futures plunged to $2.19 per gallon on 10/05/2023, the lowest since December 2022, and marking a near 10% decline since the start of the month as compounding signs of low demand offset tight supply.

- Data from the EIA showed that gasoline demand significantly decreased, as stockpiles surged by 6.5m barrels on the week ending September 29th, reporting the highest weekly increase since 12/31/2022, due mainly to heavy rains on the East Coast that limited commutes while summer season travel waned.

- The developments coincided with concerns about low energy demand among the world’s major consumers, as the hawkish outlook for the Federal Reserve added to risks of financial contagion from debt-ridden property developers in China

- Still, mounting scheduled maintenance in key US refineries limited an even greater downturn in gasoline prices.

Natural Gas

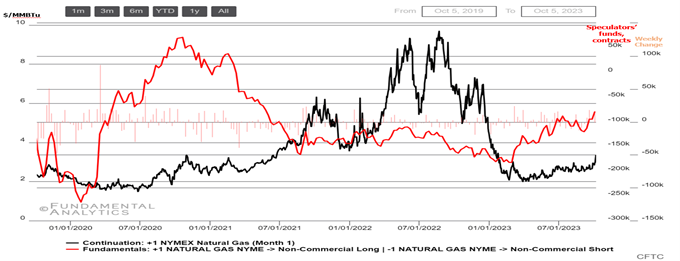

Speculators’ bets indicate bullish LNG

- US natural gas futures rose toward $3.3/MMBtu, closing in on their highest level since January, leading money-managed funds (speculators) to reach highest level since 05/25/2021.

- Main drivers include reduced domestic gas production along with increased exports, especially in Mexico.

- October’s gas output declined to 102.1 billion cubic feet/day (bcfd) from 102.9 bcfd in September and a record 103.1 bcfd in August.

- Additionally, exports are expected to support output more when the New Fortress Energy’s plant starts exporting LNG.

- The total volume of natural gas supplied to the seven major US LNG export plants edged up to 12.8 bcfd in October, but it still falls short of the record levels of 14 bcfd observed in April.

- Cove Point, which halted operations around September 20, is expected to resume production within the next week or so. Elsewhere, workers at US energy firm Chevron’s two LNG export plants in Western Australia voted to restart strikes.