Mid-Week, Weekly Review of Gold, Silver, and Palladium

November 4, 2020

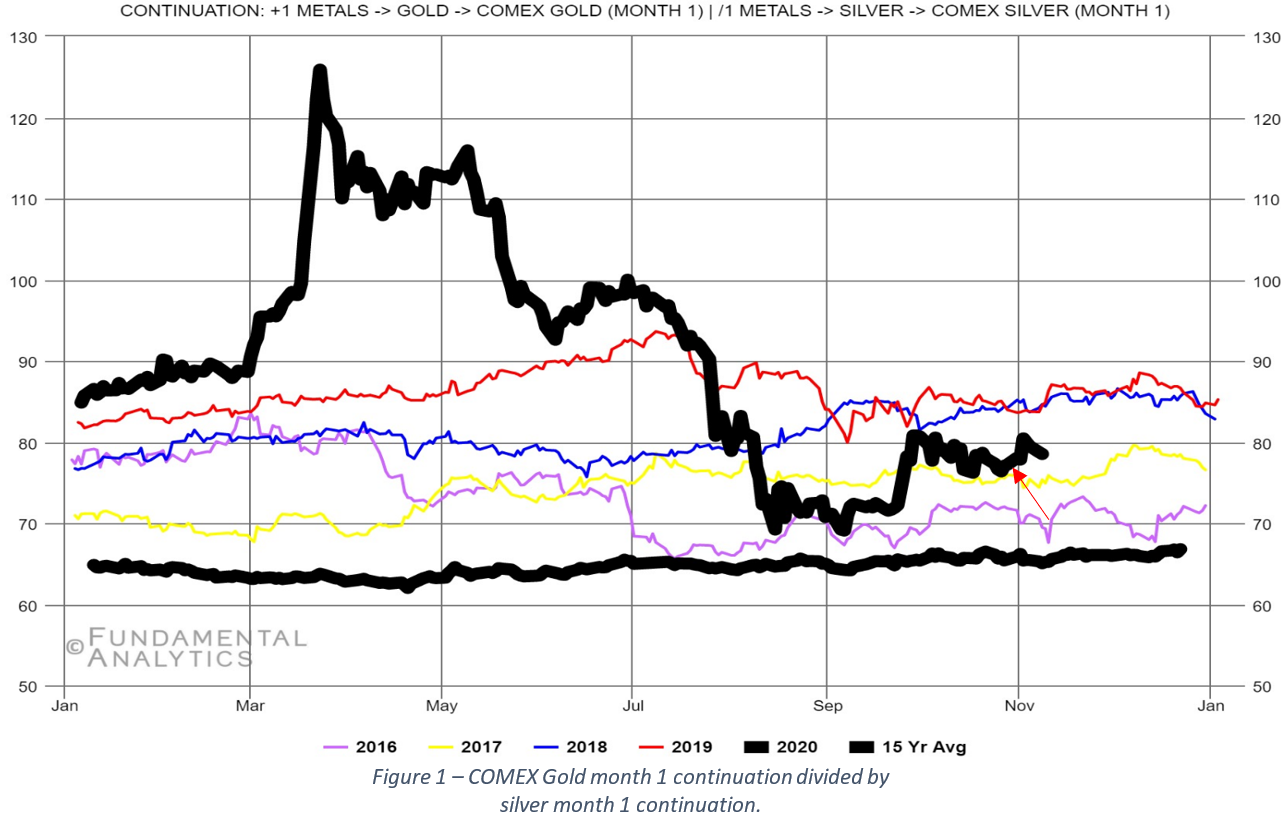

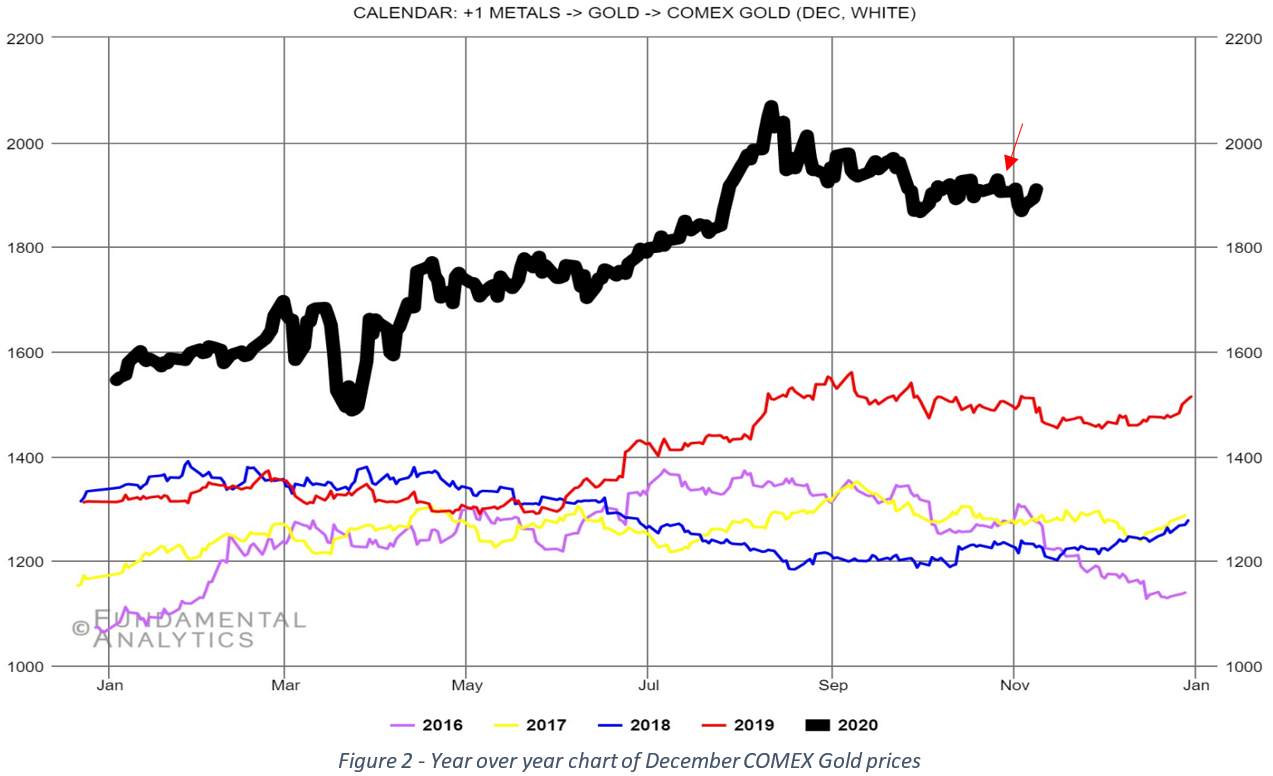

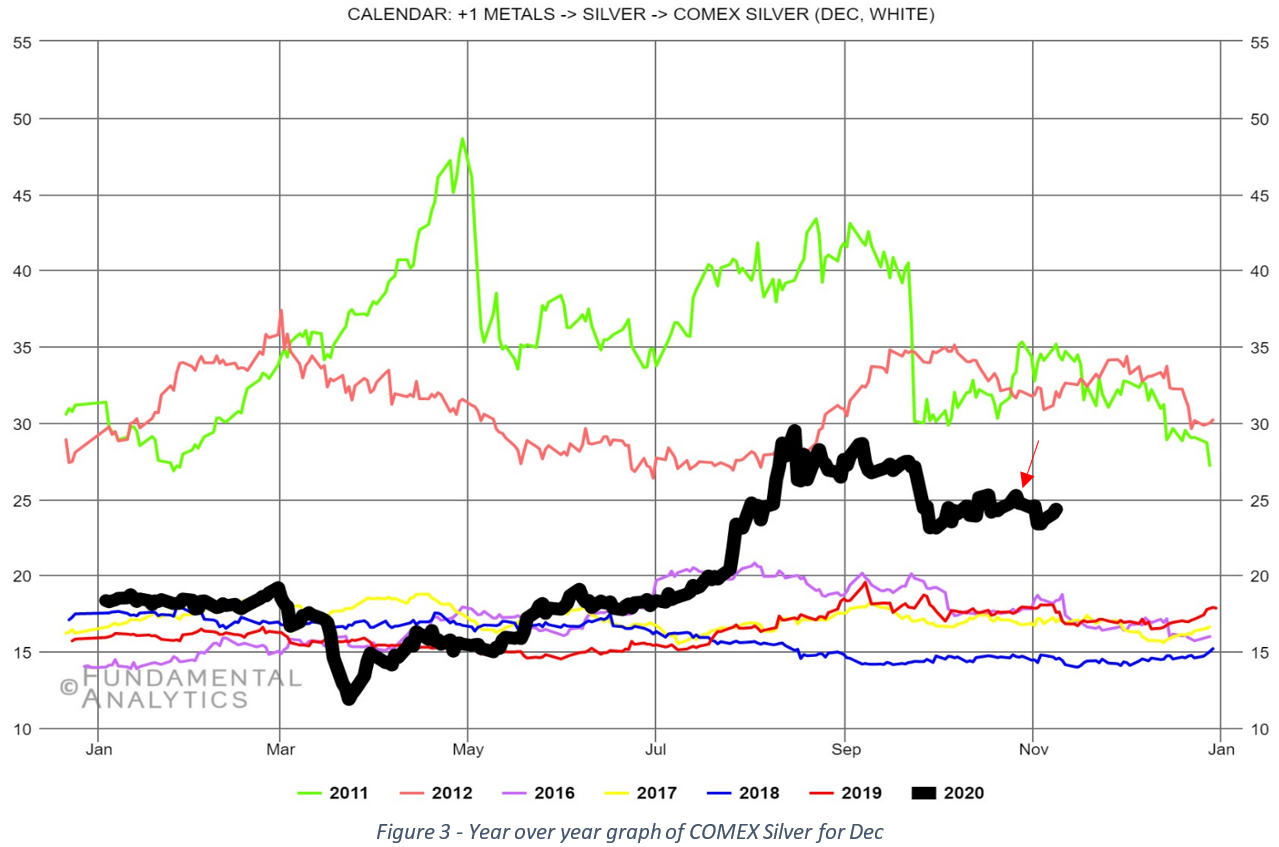

Prices for precious metals are volatile today as there is currently no clear winner after the US presidential election yesterday. As estimates stand at the time of this writing, Biden will have between 270-306 electoral votes and will win the presidency. A scenario of market reflation may take place in that case, which could be positive for precious metals, assuming that if any strengthening of the dollar takes place along with that scenario, such dollar strengthening will not offset the gains due to market reflation. This uncertainty along with continued pressures from COVID may continue to result in some volatility for the foreseeable future. The front month contract for gold was almost unchanged and silver was down at the close of trading yesterday, with respect to the close on October 27, 2020. Gold and silver were down 0.02% and 0.9%, respectively (red arrow identifies close on the 27th). The ratio of the month 1 Gold contract to the month 1 Silver contract (Figure 1) is up 0.89% compared to the close on the 27th. Through last week, the gold/silver ratio was descending since the end of September, a positive for gold. However, with the moves over the last week, the ratio is now moving sideways. With the front month gold and silver contracts closing yesterday at $1908.50 and $24.31, respectively, the gold/silver ratio is now 78.52, 20.7% higher than the corresponding 15-year average.

December gold (Figure 2) closed yesterday at $1910.40, down 0.08% and December silver (Figure 3) closed at $24.33, down 0.96% from the close on October 27th. From an open interest perspective, gold’s total open interest is slowly trending down in sync with the price of gold. The 50-day SMA for futures and options volume continue to decline since the end of September. The latest CFTC report for gold (10/27) for non-commercial net position of funds show both long and short positions were reduced with the net long positions falling 1.8% since the previous week’s report. But the net positions are little changed since the end of September. As mentioned last week the non-commercial funds continue to build their short positions, resulting in a gradual reduction in the number of net-long positions. Now onto silver… Silver total open fell 4.3% since last week Tuesday, which is a significant change compared to increasing open interest seen since the end of September. Due to the delay in reporting CFTC data, we will not know if the October 27 report will show similar action, until this weekend. As mentioned last week, since the August 11th CFTC report, the non-commercial funds have increased their net long positions by 12% at the same time reducing their short positions by 23%. The 50-day SMA of total futures and options volume has fallen in the last month to levels more consistent with early to mid-2019. The Silver Institute posted their October 2020 newsletter on Monday, found here, stating global silver Exchange Traded Product (ETP) holdings growth nearly tripled growth on year over year through the first three quarters of 2020. It grew 297M oz, where the Silver Institute had projected a growth of 120M oz in their World Silver Survey for 2020, published near the end of 2019. Recent indications of a partial recovery of industrial silver usage may again be muted due to new COVID lockdowns being instituted worldwide.

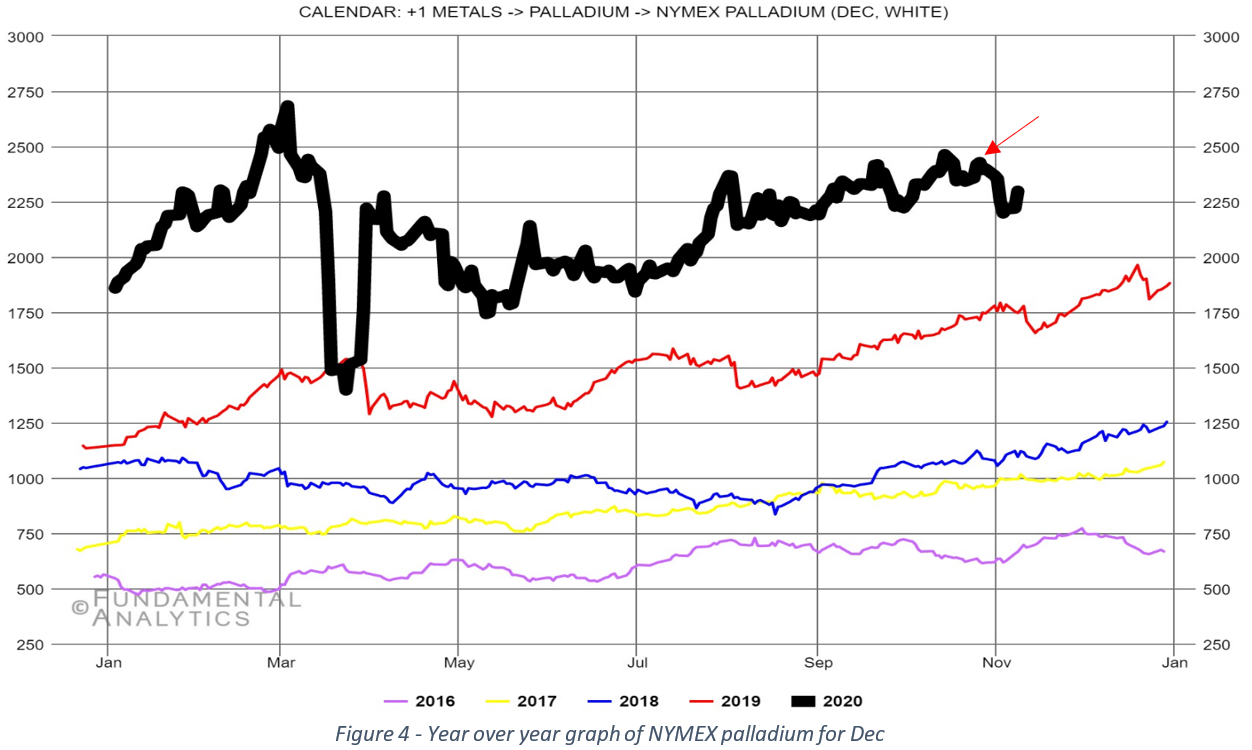

Now for Palladium. December Palladium closed at $2297.80 yesterday, down 2.38% from the close last week Tuesday. Total open interest fell 4.5% from Tuesday last week and is essentially unchanged from open interest two weeks ago. Total palladium volume remains low and, in a range, like volumes prior to 2008. The Oct 27th CFTC report shows an increase of 1.5% in non-commercial net fund positions. We expect an increasing number of COVID cases, resulting in additional lockdowns may slow the recovery in palladium demand. Rhodium prices seem also to indicate this as it fell on October 28th but has recovered some of its reduction.

The final thought I leave with you today is a recommendation to listen to The Incrementum Inflation Diversifier – Advisory Board Call – Q4 2020, found here. The group does an excellent job outlining the current market with respect to deflation/inflation and explain their positions at length. Over the last few months, we discussed negative interest rates and the price of gold being negatively correlated resulting in rising gold prices as real rates drop. With rates near zero and the Federal Reserve stating they do not plan on using negative rates, is there still an upside to gold? In their discussion they stated yes because there are ways to achieve negative rates through the market. Doing so would be positive for gold.

If you would like access to the great insights and analysis provided by the Fundamental Analytics platform, sign up for a 15-day free trial and demonstration!

If you have any questions, please contact our Technology Manager, Mike Secen at [email protected]

We also invite you to read our other articles and follow us on social media!

Best Regards,

The Fundamental Analytics Team

The information provided here is for general informational purposes only and should not be considered individualized investment advice. All expressions of opinion are subject to change without notice in reaction to shifting market conditions.