Crude Oil

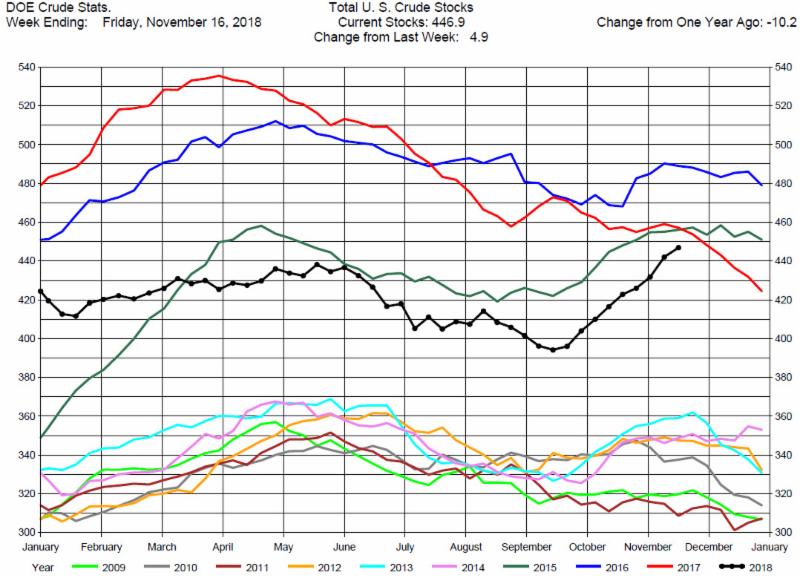

Crude Oil Stocks Build, Greater than Expectations

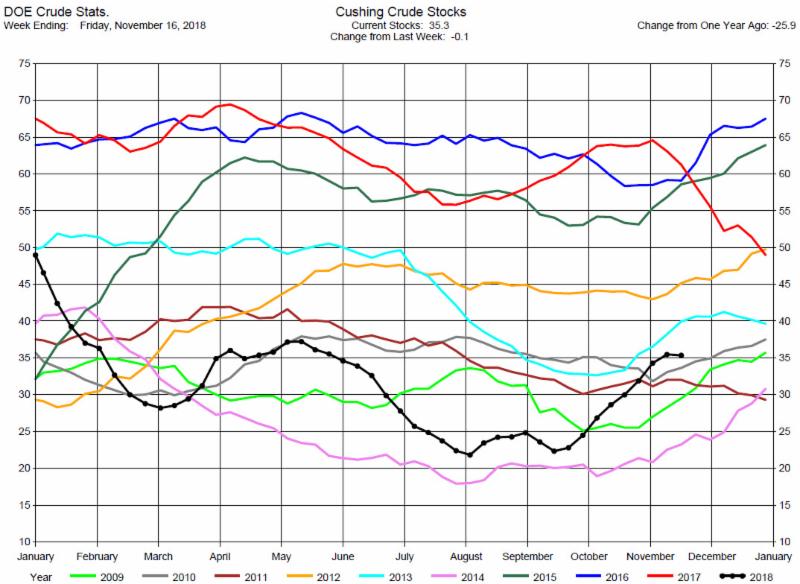

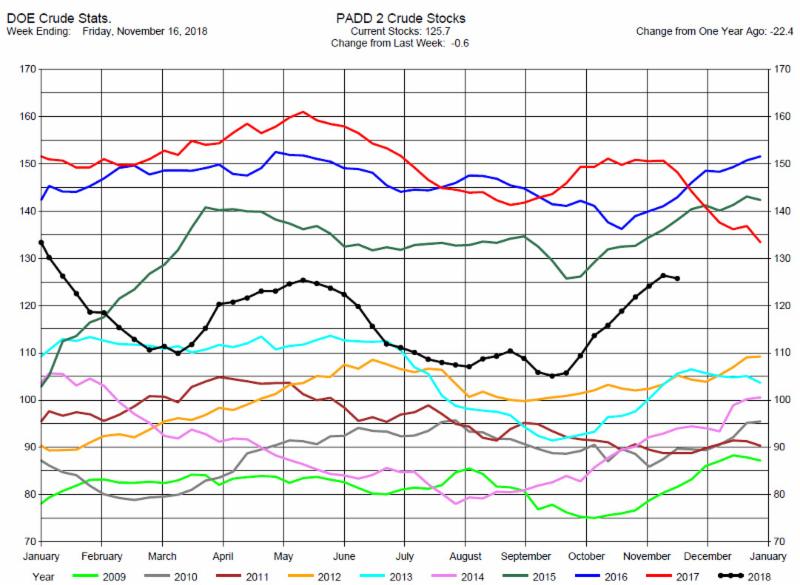

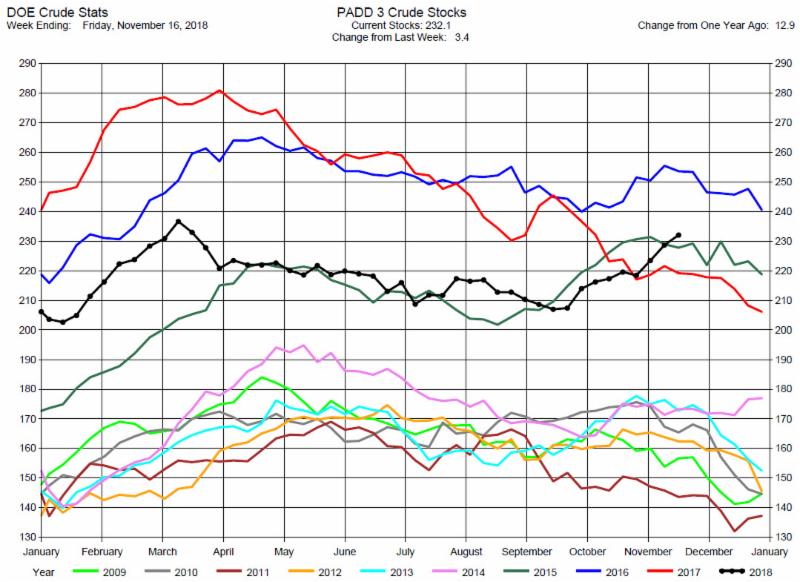

The DOE reported Total Crude Oil Inventories increased by 4.9 million barrels to 446.9 million barrels for the week ending November 16, 2018, while expectations average was for a 2.9 million barrel increase.

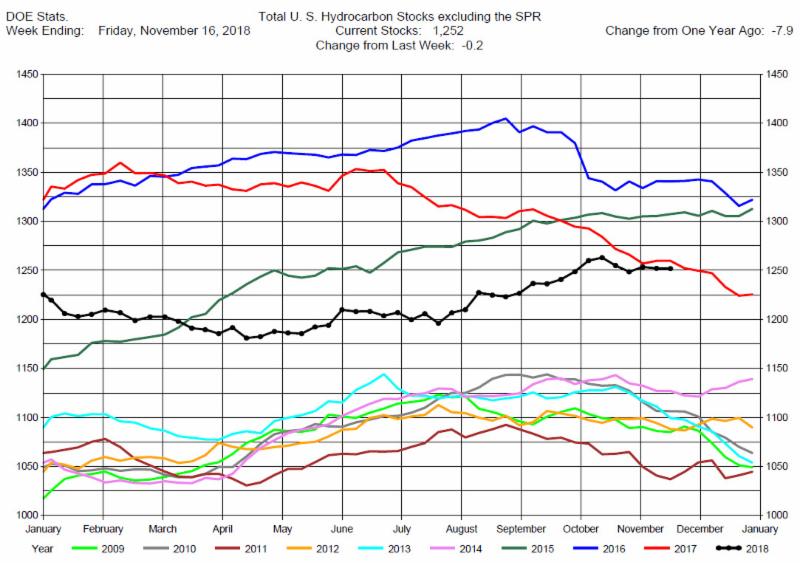

Overall hydrocarbon supplies decreased by 200,000 barrels to 1,252 million barrels.

Crude Oil Production was unchanged at 11.7 million barrels per day.

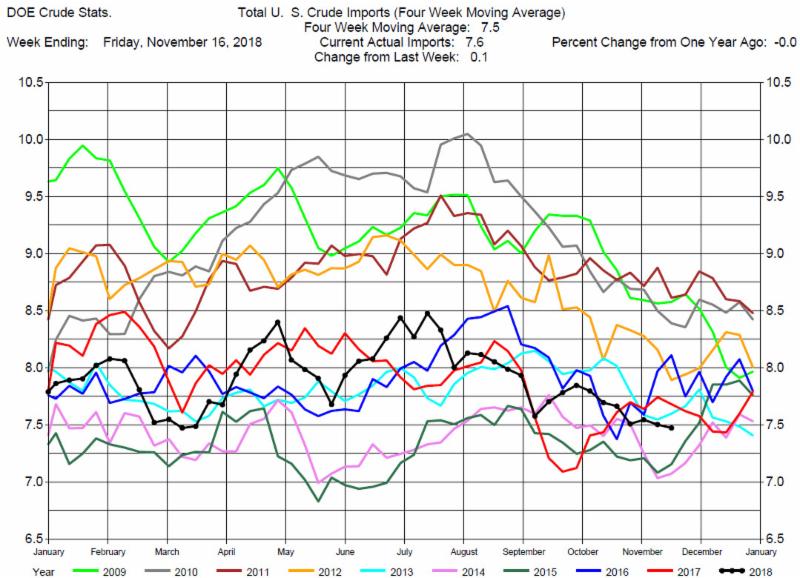

Total Crude Imports were up by 100,000 barrels per day to 7.6 million barrels per day.

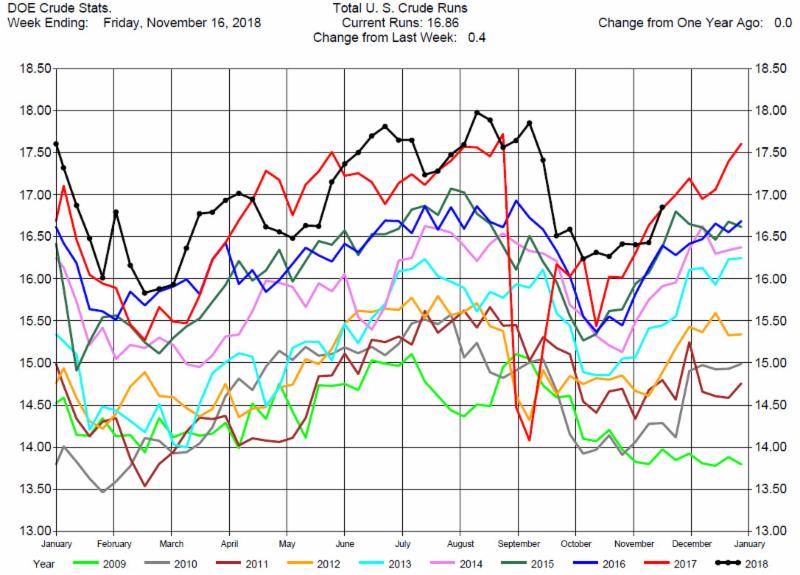

Total Refinery Crude Runs were by 400,000 barrels per day to 16.86 million barrels per day.

Despite the bearish DOE report crude oil prices rallied with the release of the report. After several weeks of dramatic decline in crude oil prices we believe the price rally has more to do with the covering of short positions than any fundamental development.

This is a bear market for crude oil. More than sufficient crude oil supply, but, more important, the concern about the slowing growth in crude oil demand have created the bear market.

With the increased volatility in the market we recommend being on the sidelines.

We would be happy to discuss this commentary with you and provide additional market insights.

Feel free to call us at 312-348-7518 or email us at [email protected].

Gasoline

Gasoline Stocks Draw, Greater Than Expectations.

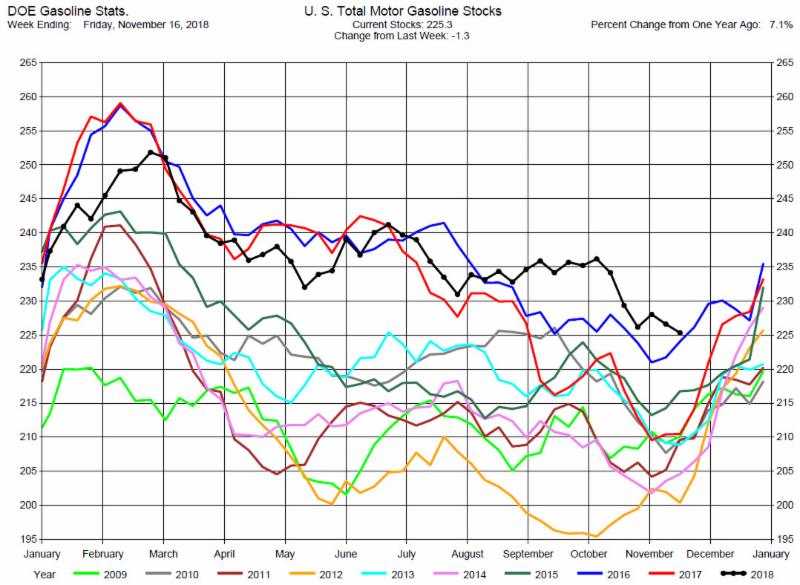

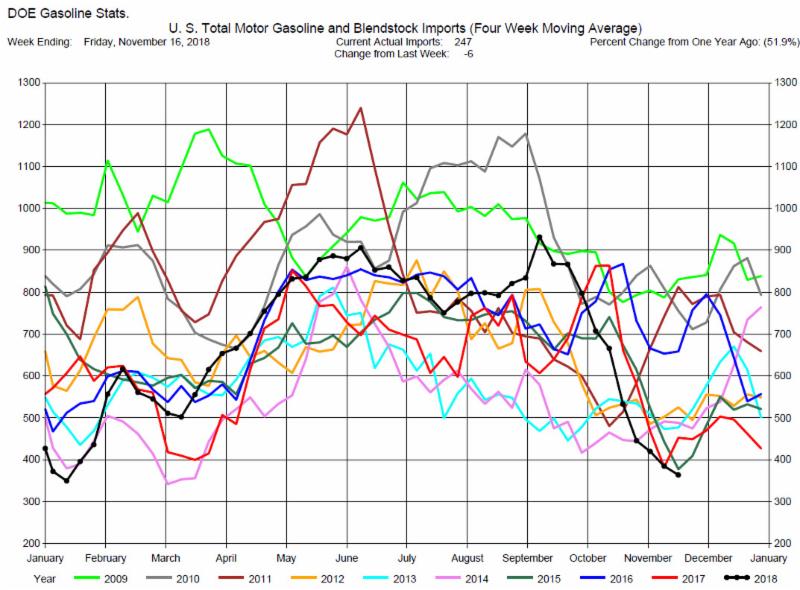

Total MotorGasoline Inventories decreased by 1.3 million barrels to 225.3 million barrels for the week ending November 16, 2018, greater than the expectations average of a 200,000 barrel decrease.

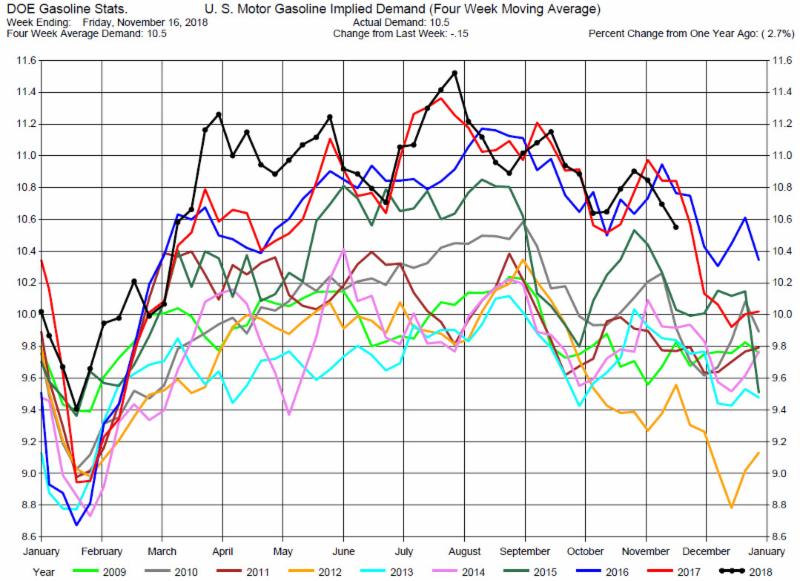

Implied Demand was down by 150,000 barrels per day to 10.5 million barrels per day.

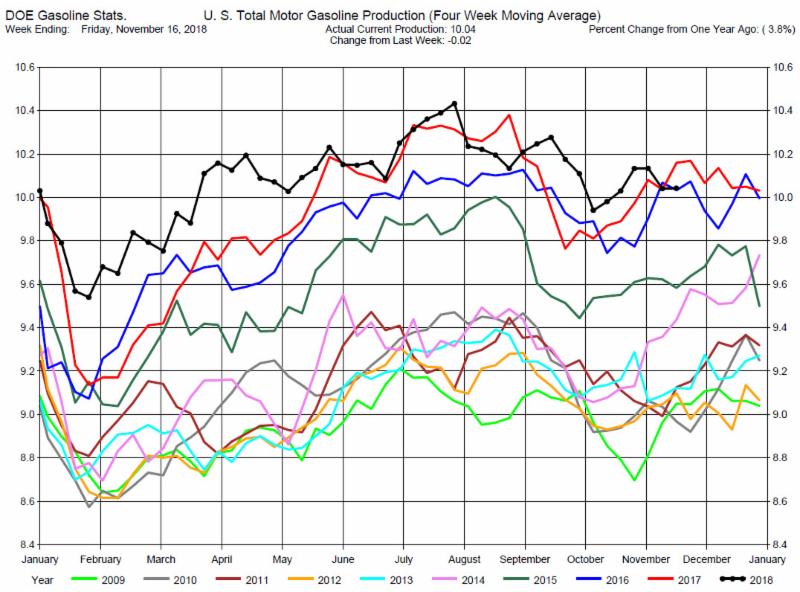

Gasoline Production was down by 20,000 barrels per day to 10.04 million barrels per day.

Gasoline price behavior was in tandem with crude oil prices, but at a smaller magnitude. The gasoline cracks weakened again.

Gasoline stocks are plentiful for this time of the year and demand is decreasing so we still recommend consideration of short positions, especially in the cracks.

Distillates

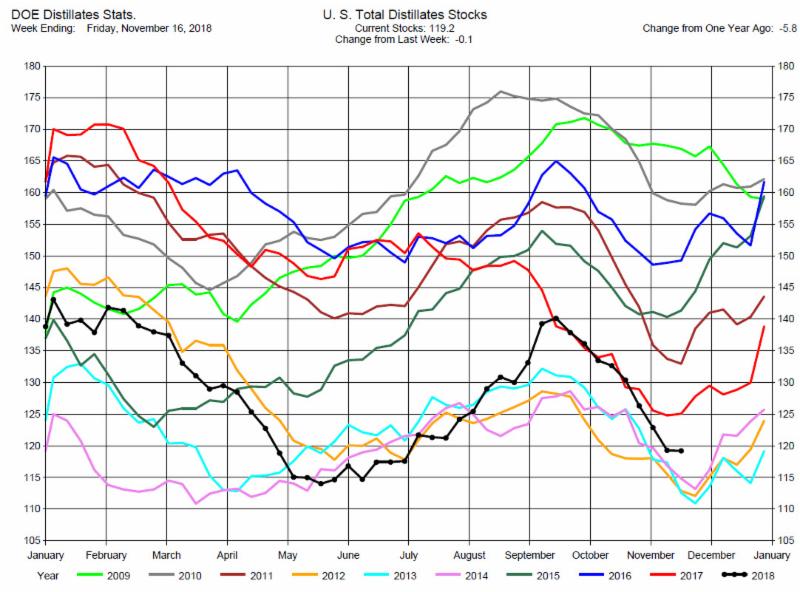

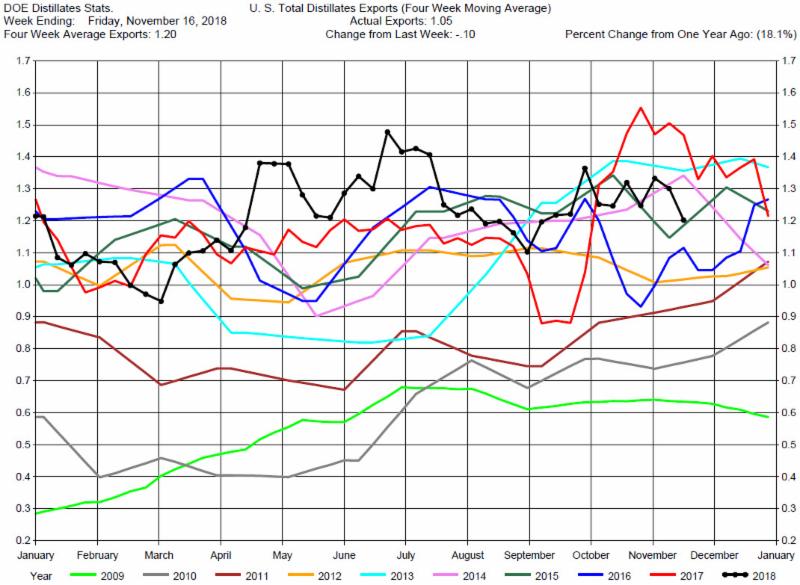

Distillates Stocks Draw, Less than Expectations.

Total Distillates Stocks decreased by 100,000 barrels to 119.2 million barrels for the week ending November 16, 2018, while expectations average was for a 2.8 million barrel draw.

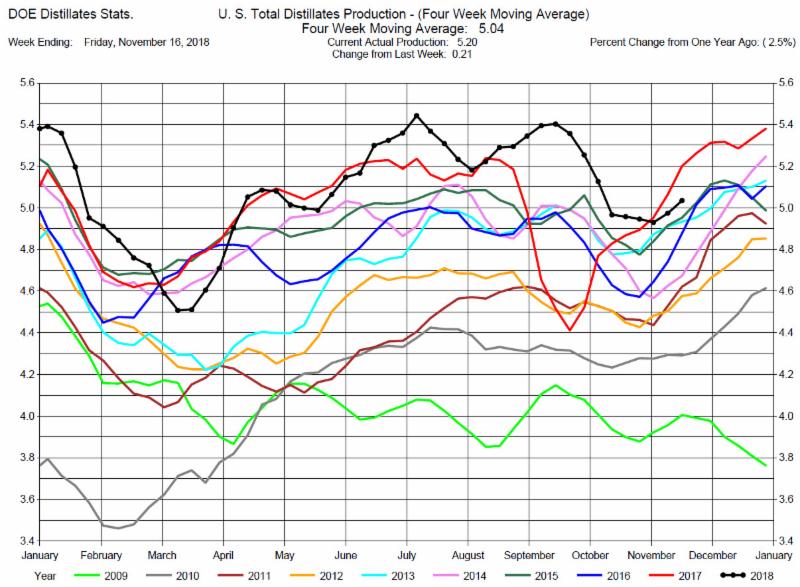

Total Distillates Production was up 210,000 barrels per day to 5.20 million barrels per day.

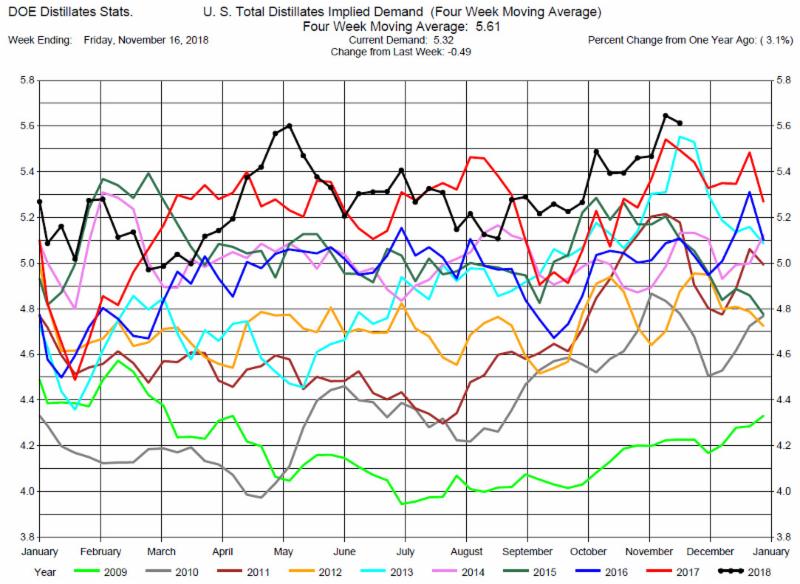

Total Distillates Implied Demand was down 490,00 barrels per day at 5.32 million barrels per day.

Heating Oil prices ended basically unchanged for the trading day, the cracks weakened. Distillates stocks are low and demand is a record levels so we maintain our suggestion of consideration of long positions in the Heating Oil Cracks.

| For further information contact [email protected] |