DOE INSIGHTS November 15, 2018

CRUDE OIL

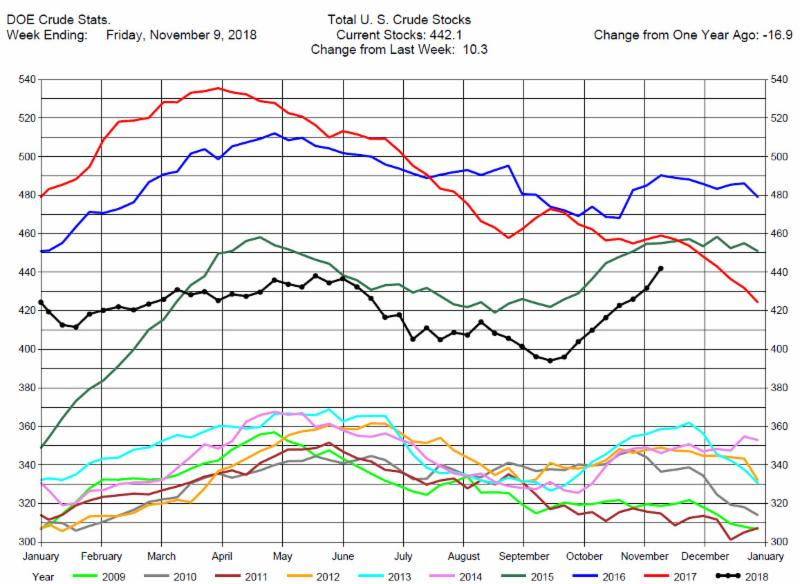

Crude Oil Stocks Build, Much Greater than Expectations

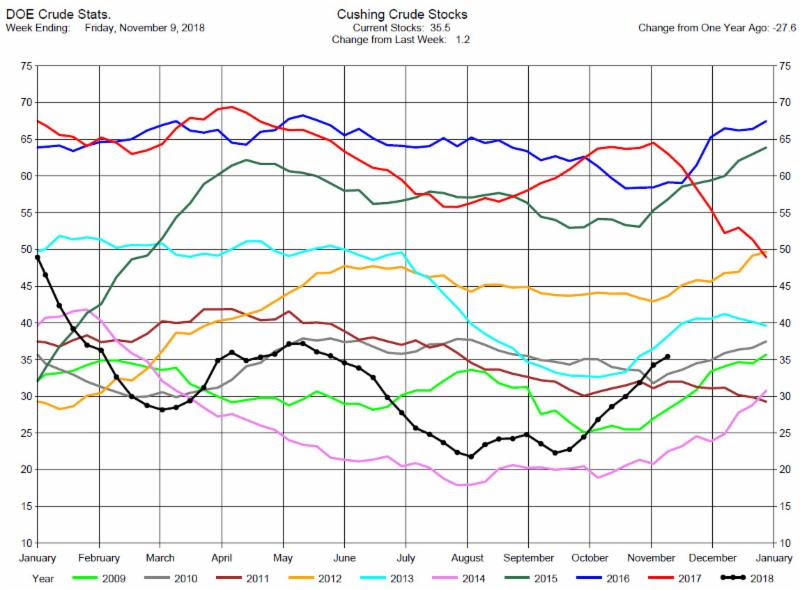

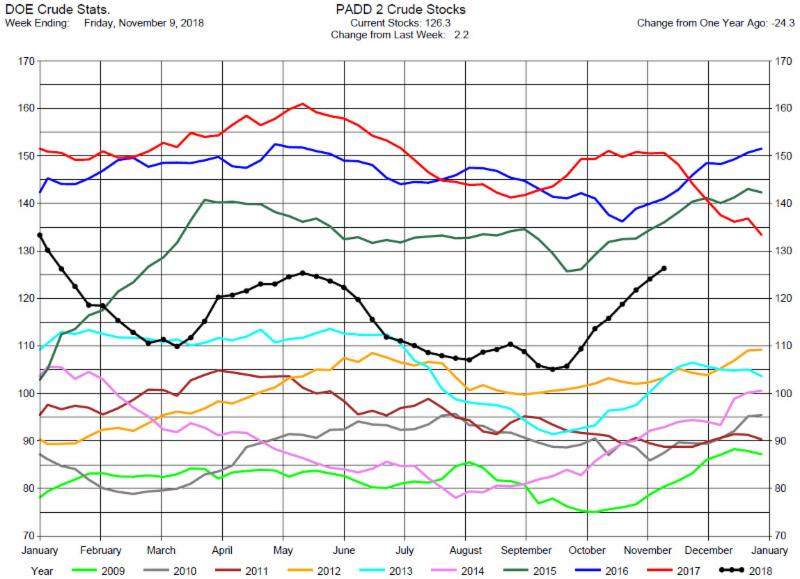

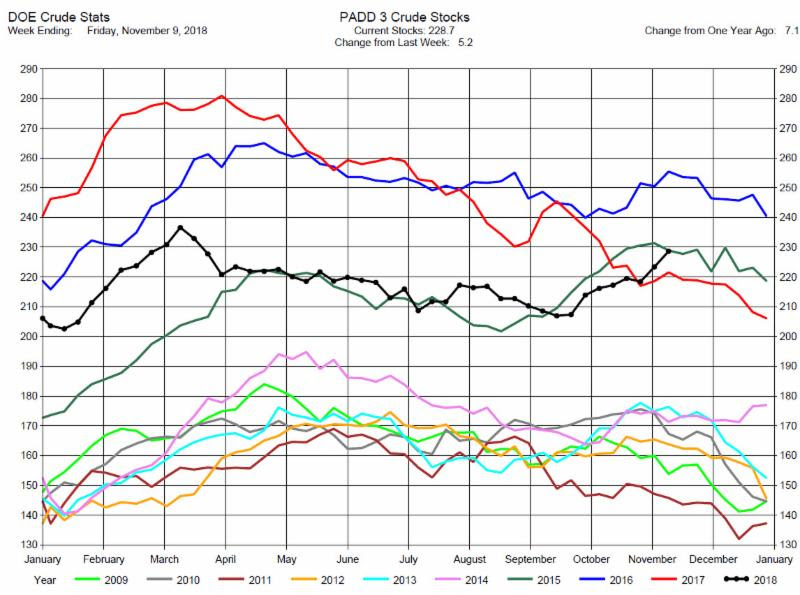

The DOE reported Total Crude Oil Inventories increased by 10.3 million barrels (1.9 million barrels of that build was from the SPR) to 442.1 million barrels for the week ending November 9, 2018, while expectations average was for a 3.0 million barrel increase.

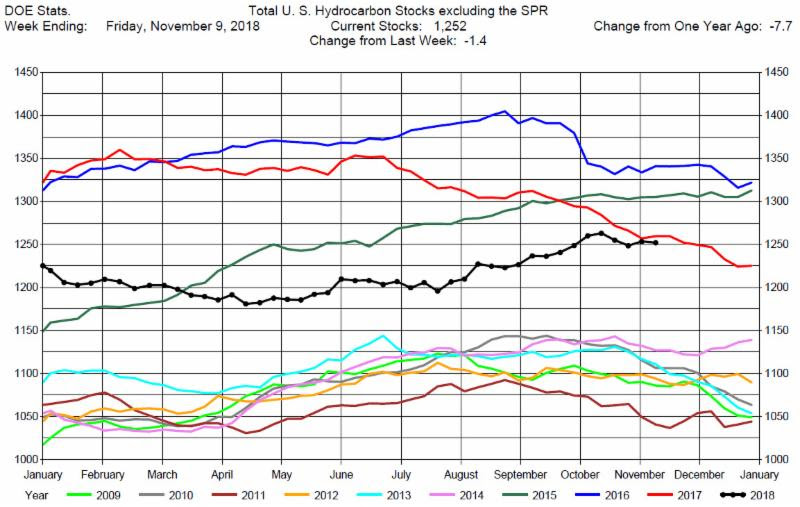

Overall hydrocarbon supplies decreased by 1.4 million barrels to 1,252 million barrels.

Crude Oil Production increased by 100,000 barrels per day to a new record 11.7 million barrels per day.

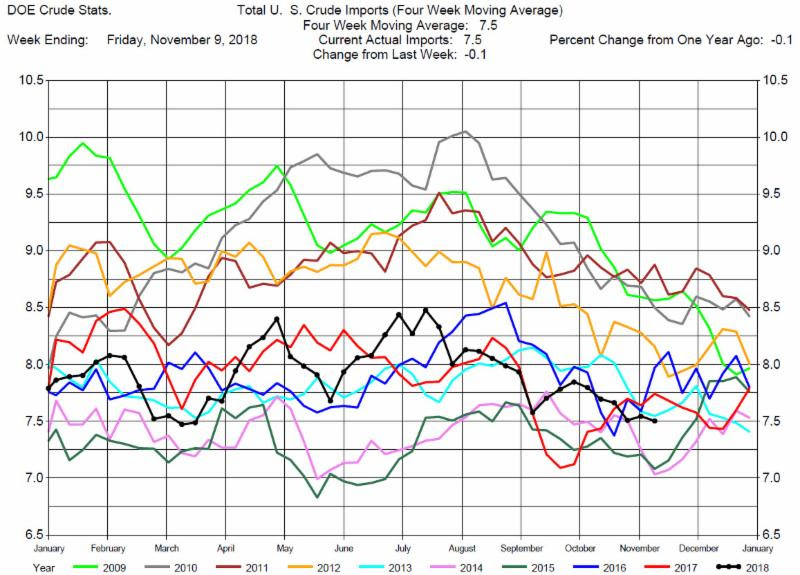

Total Crude Imports were down by 100,000 barrels per day to 7.4 million barrels per day.

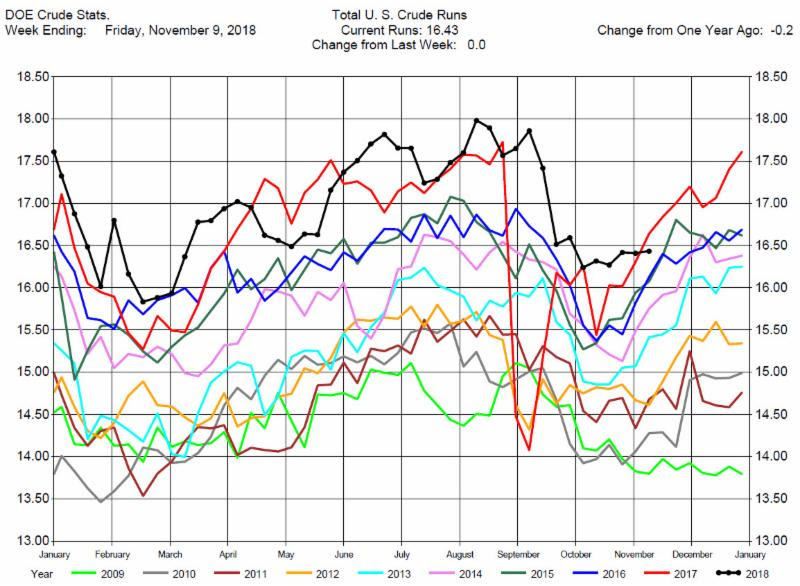

Total Refinery Crude Runs were unchanged at 16.43 million barrels per day.

Despite the bearish DOE report crude oil prices rallied with the release of the report. At one point prices were up nearly $1, but prices fell back ending up only 30 cents for the day. With the major decline in crude prices in the last several days, today’s up move may have been short covering.

This is a bear market for crude oil. More than sufficient crude oil supply, but, more important, the concern about the slowing growth in crude oil demand has created the bear market. With the increased volatility in the market we recommend being on the sidelines.

We would be happy to discuss this commentary with you and provide additional market insights.

Feel free to call us at 312-348-7518 or email us at joel.fingerman@

Gasoline

Gasoline Stocks Draw At Expectations

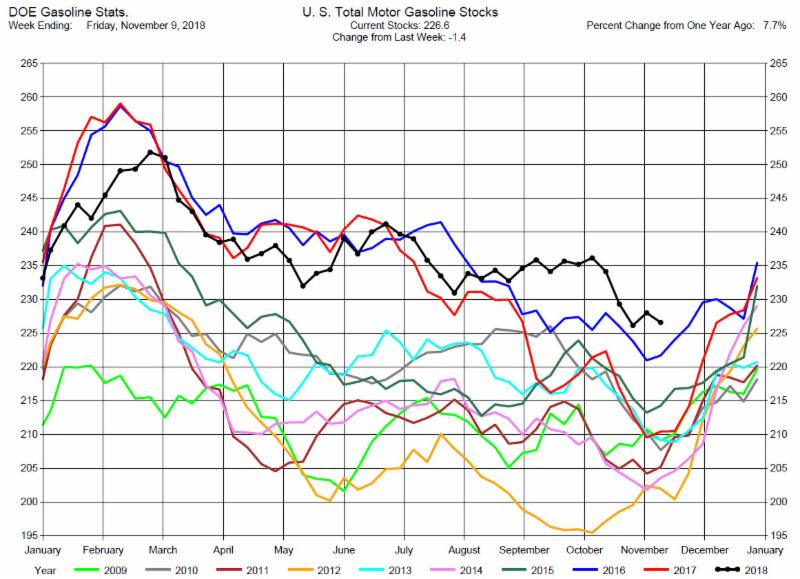

Total MotorGasoline Inventories decreased by 1.4 million barrels to 226.6 million barrels for the week ending November 9, 2018, at the expectations average of 1.4 million barrel decrease.

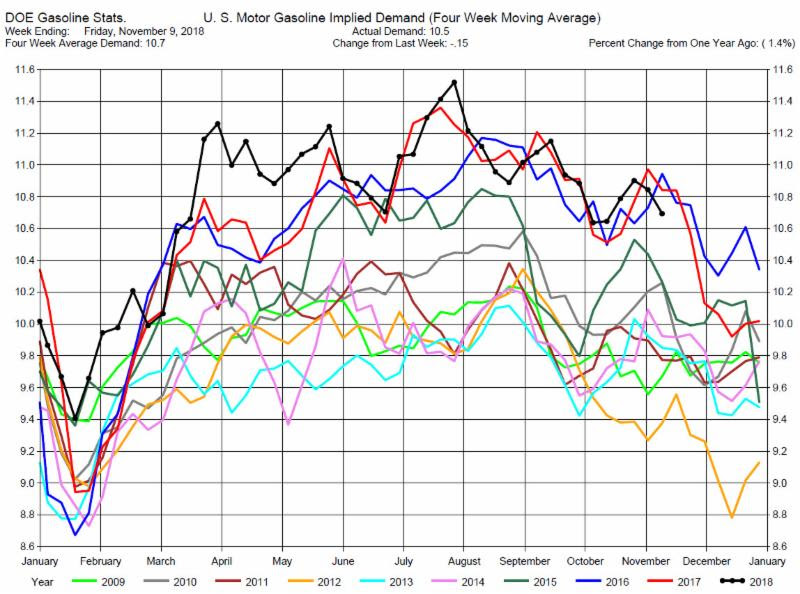

Implied Demand was down by 150,000 barrels per day to 10.5 million barrels per day.

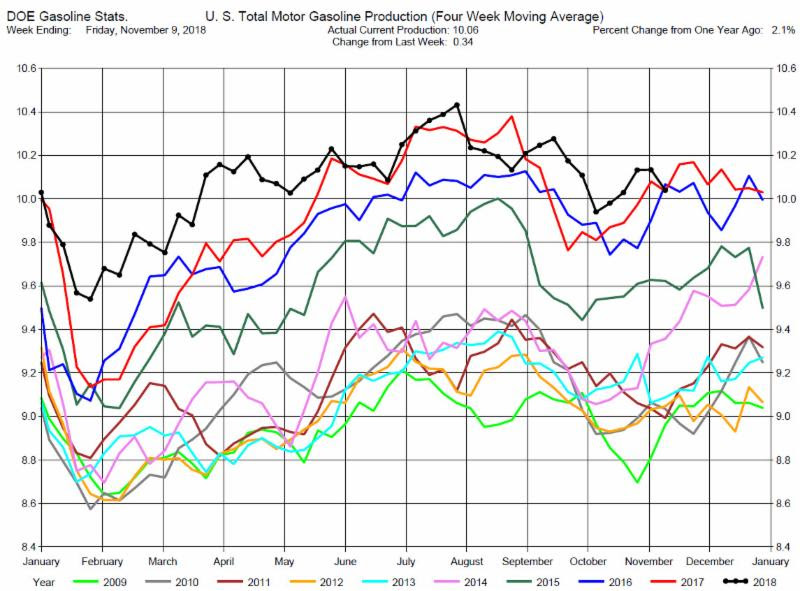

Gasoline Production was up by 340,000 barrels per day to 10.1 million barrels per day.

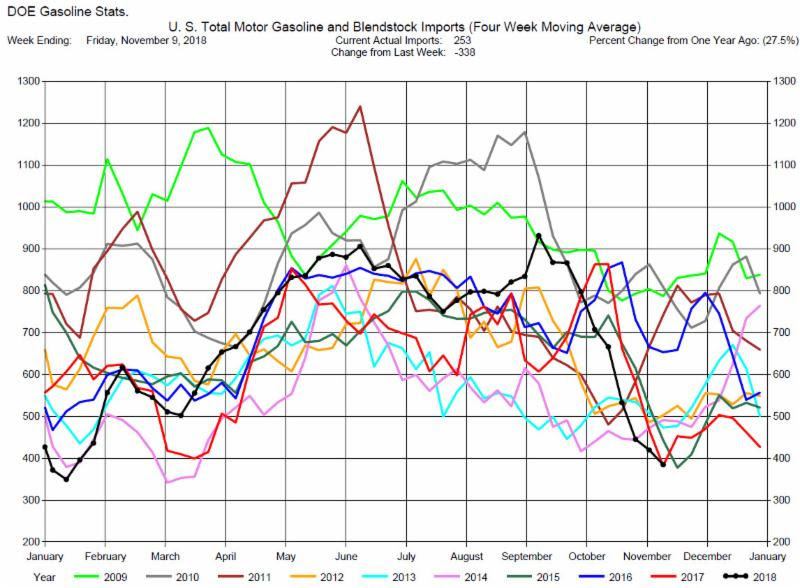

Gasoline price behavior was in tandem with crude oil prices. However, gasoline prices ended the day basically unchanged and with crude prices up the gasoline cracks weakened again. Gasoline stocks are plentiful for this time of the year and demand is decreasing so we still recommend consideration of short positions, especially in the cracks.

Distillates

Distillates Stocks Draw, Greater than Expectations

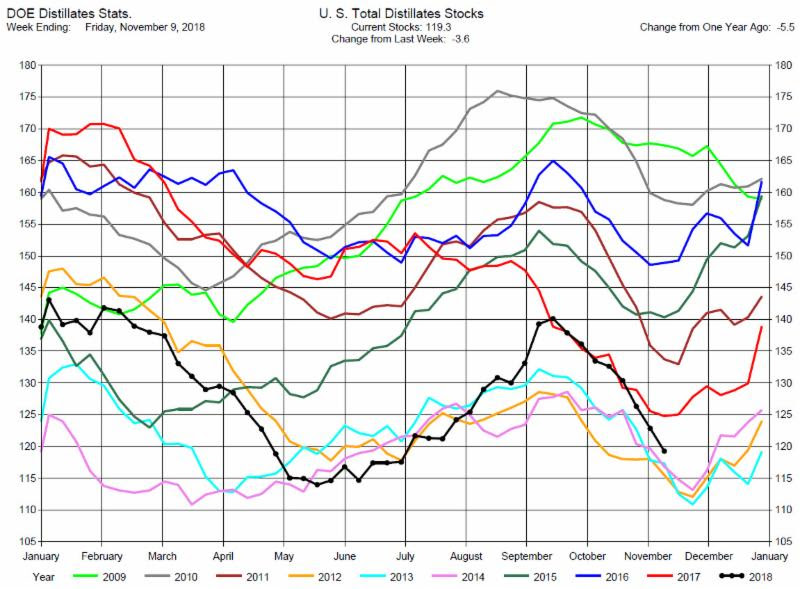

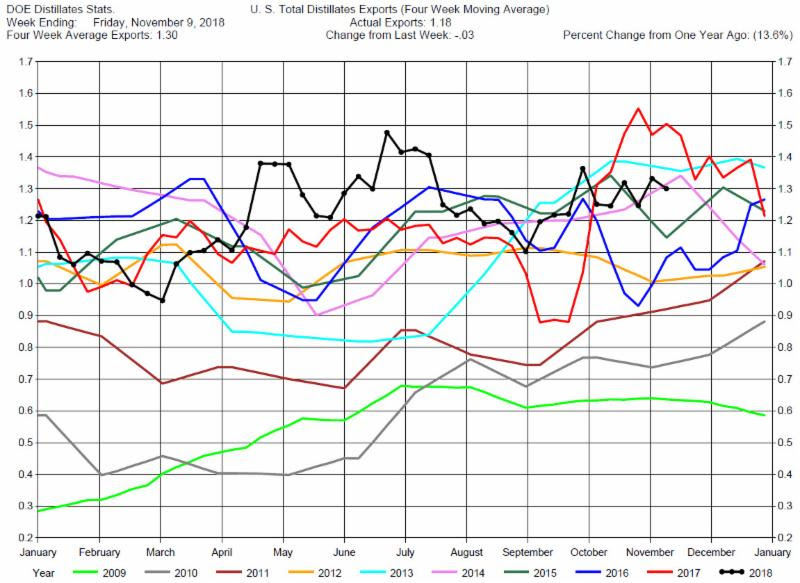

Total Distillates Stocks decreased by 3.6 million barrels to 119.3 million barrels for the week ending November 9, 2018, while expectations average was for a 1.6 million barrel draw.

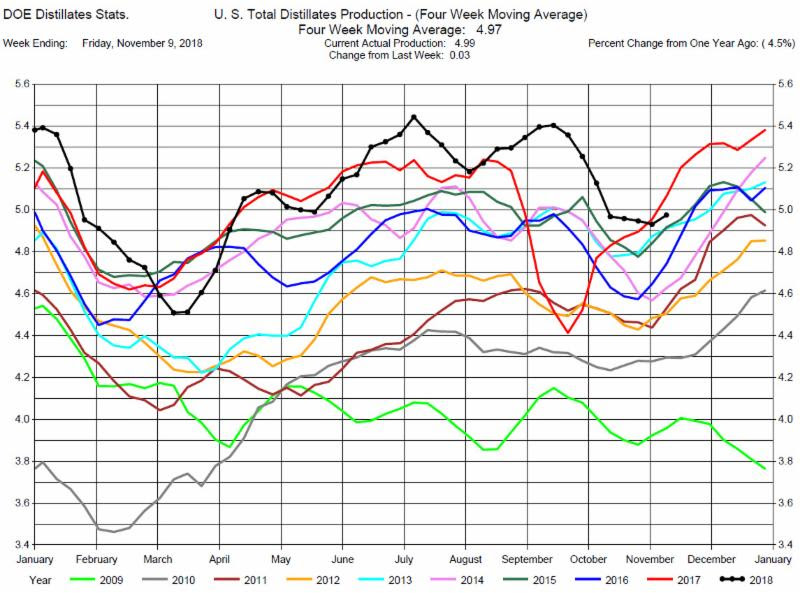

Total Distillates Production was up 30,000 barrels per day to 4.99 million barrels per day.

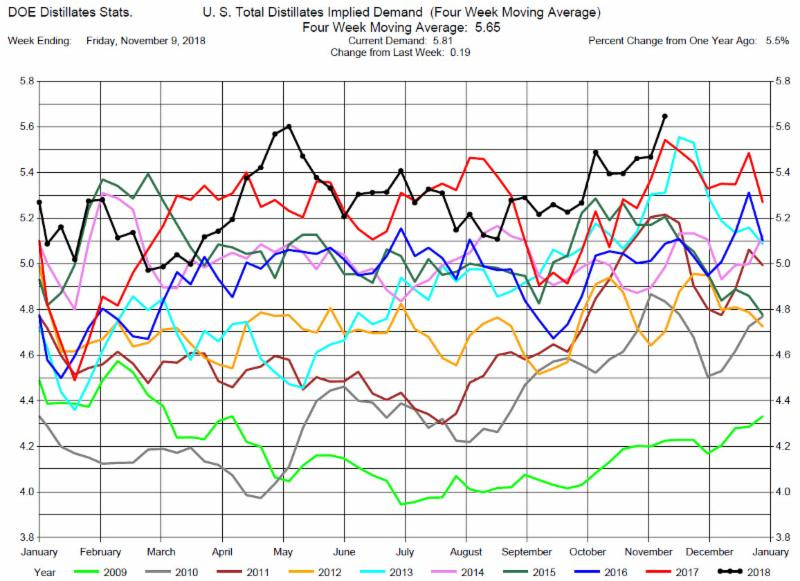

Total Distillates Implied Demand was up 190,00 barrels per day at 5.81 million barrels per day.

Heating Oil prices ended basically unchanged for the trading day, the cracks weakened. Distillates stocks are low and demand is a record levels so we maintain our suggestion of consideration of long positions in the Heating Oil Cracks.

For further information contact joel.fingerman@