Commodity Market Update December 19, 2018

Energy

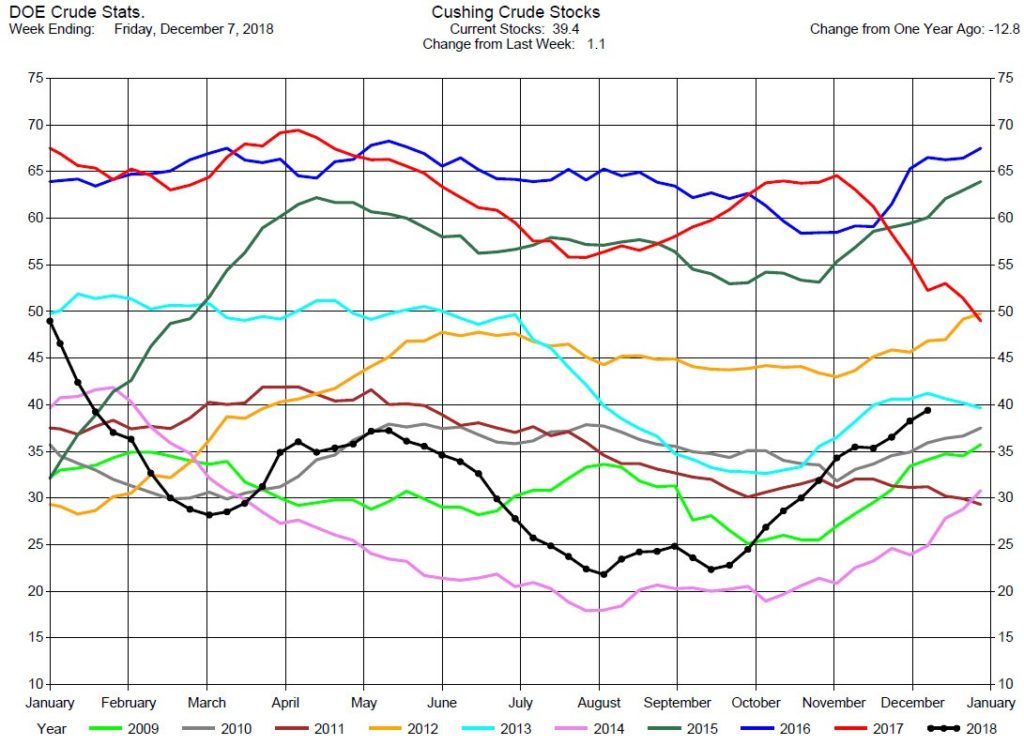

Crude oil prices are under pressure after stocks at the storage hub of Cushing, Oklahoma increased by more than 1 million barrels during the week ending December 14, according to the oil research firm Genscape. This increase is expected to be reported by the DOE on Wednesday. Current DOE Cushing data is through December 7 (Chart 1) and we anticipate the DOE to report over 40 million barrels for the week ending December 14. Cushing is the delivery point for the NYMEX WTI futures contract and prices there impact national crude oil prices.

Prices have remained low as traders are concerned that planned supply cuts by OPEC with Russia will not be enough to rebalance markets. The agreement is to reduce output by 1.2 million barrels per day starting in January for six months. However, US shale oil output is growing, taking market share from the big Middle East oil producers in OPEC.

Chart 1

Grains

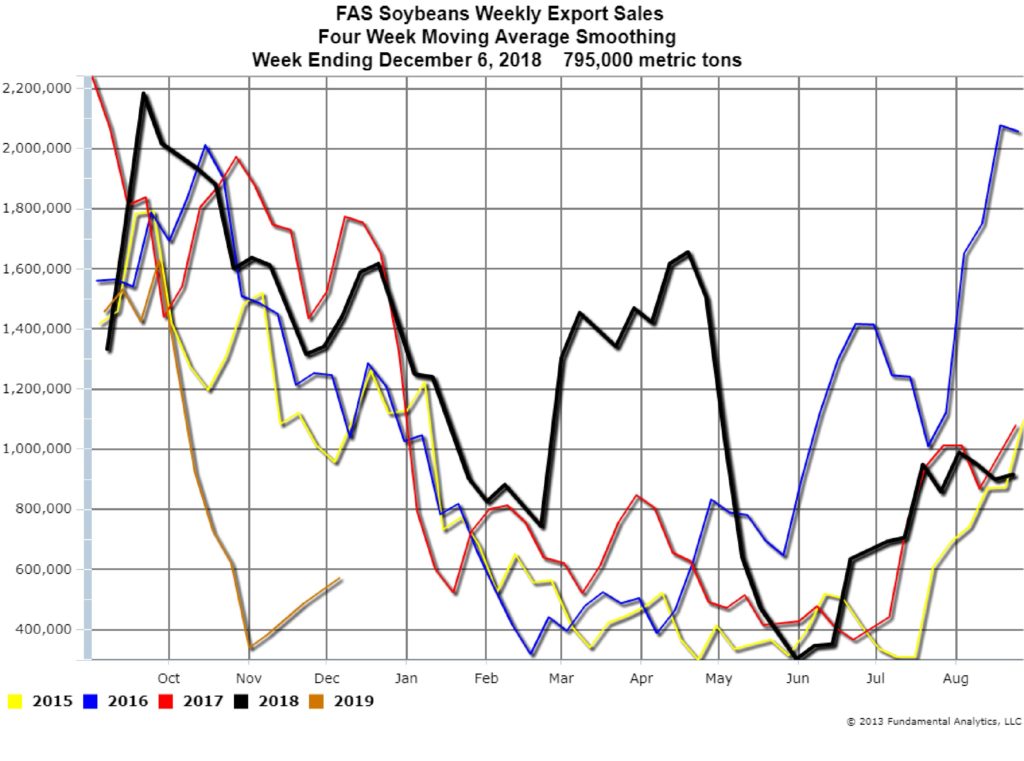

Weekly Export Sales for the week ending December 6, 2018 had soybean sales at 795,000 metric tons, within estimates of 700,000 to 1,000,000 (Chart 2, orange line). Exports continue to be substantially lower than previous years due to the lack of exports to China. The 90-day suspension of Chinese tariffs has allowed Chinese buyers back in US markets, but the initial orders were smaller than expected and prices dropped more than 20 cents last Thursday and Friday. Unless exports to China increase substantially, the downward pressure on US prices will continue.

Chart 2

For more information contact [email protected]