|

Dr. Ken Rietz It’s that time of year when the eyes of the agricultural world turn to South America, and Brazil in particular, for two reasons. Much of the world looks to Brazil for exports of various foods, particularly corn and soybeans. The size of the crops is a fundamental number determining the price of the exports. Another important group looking to Brazil is the US farmers, trying to decide the kinds of crops they will be planting, and how to allocate their acres to different crops. Those decisions are literally wealth or poverty for the farmers as well as for the people who trade those commodities. This week we will try to untangle some oddly contradictory information and give a sense of the direction of the markets in the near future. But first, here is the past several years of the corn futures market, front month values. |

|

|

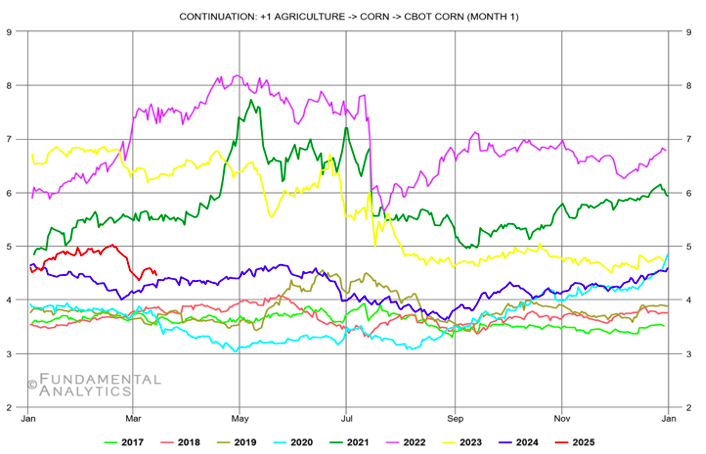

Figure 1. CBOT Corn futures, front month values The price levels for corn were very consistent around 4 before 2020 (COVID), and then began moving up slowly, and stayed between 5 and 8 for 2021 to 2023, and has been staying between 4 and 5 for most of 2024, and is staying below 5 so far in 2025. There is not much that can be said from the charts about future price movement beyond the observation that the price is moving slowly downward in the very short term. The single factor that affects crops the most is the weather, and there is plenty to discuss about precipitation in Brazil and Argentina. The weather forecast says it all: south and southeast of Bolivia, there is a significant threat of drought, while north of that line, there is too much rain. Either one of these is a problem for the crops we are looking at. Argentina has to deal with a lack of rain, while its neighbor Brazil has to deal with too much rain. The governmental outlooks for both countries expect that the weather will moderate enough to produce more crop this year than last. However, this month, Argentinian farmers were pessimistic about enough rain returning to bring out a decent harvest. But, soon after that report, there was some rain in the wheat-growing region of Argentina, as seen in this map from the USDA FAS. (The most wheat is grown in the bulge of Argentina southwest of the Rio de Janeiro river, which is the major river cutting into the Argentine coast.) |

|

|

There is the usual disagreement between the USDA and CONAB (Brazilian counterpart to USDA) estimates for Brazilian crops, but both of them are projecting near-record levels for both corn and soybeans. CONAB estimates 167.37 million tons of soybeans this marketing year (MY), and 122.76 million tons of first-crop corn and 95.52 million tons of second-crop corn. That is greater than last year’s corn crop total. The USDA estimates 169 million tons of soybeans, and 126 million tons of first-crop corn, more optimistic than Brazil. Both agencies assume that the less-than-favorable weather turns around and provides good weather for the rest of the crop season.

So, what does all this say about the corn and soybean futures here in the US? Crop yields that high in Brazil will tend to hold down the futures prices, which is a potential reason for the recent dip seen in the chart above. All of this suggests that corn and soybean futures are not going as high as they have in previous years. |