February 20, 2024

The main energy commodities are giving mixed signals as geopolitical risk intensifies.

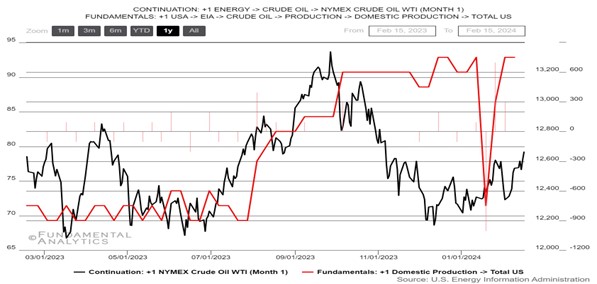

Crude Oil

Production is strong but risk remains

- Production remains at all-time high levels, alleviating supply concerns.

- Investors also continued to assess demand conditions in top crude importer China as the country returns from the week-long Lunar New Year holiday.

- Last week, oil prices gained more than 2% as geopolitical tensions in the Middle East and efforts by OPEC+ to restrict oil supply supported the market.

- However, the IEA cautioned in its monthly report that global oil demand is losing steam, citing a significant decline in Chinese demand.

- Stronger-than-expected US inflation data and hawkish rhetoric from central bank officials also dashed hopes for early interest rate cuts from the Fed, adding to bearish sentiment in oil markets.

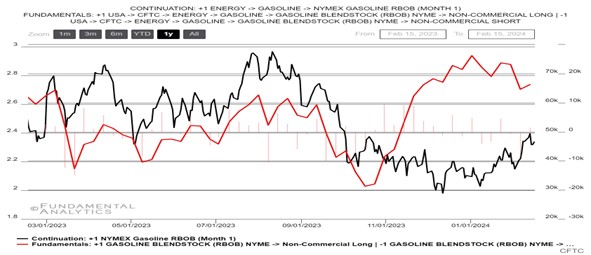

Gasoline

Gasoline prices struggle to gain direction

- Gasoline futures in the United States fell to $2.31 per gallon, easing from the over-four-month-high of $2.4 touched on February 13th amid a drawback in demand and cheaper prices for crude oil inputs.

- Data from the EIA showed that crude oil inventories in the US surged by over 12m barrels in the week ending February 9th, well above estimates of 2.6m barrels to record the sharpest increase in three months.

- While the report pointed to a sharper-than-expected drop in gasoline inventories, a fresh drop in gasoline product supplied tempered the demand outlook in the US.

- Still, continuing concerns over geopolitical tensions in the Middle East and their impact in supply and longer shipping routes kept the decline in check.

- Additionally, Ukrainian attacks on Russian refineries hampered the export capacity for Russia, adding to woes for the major seller.

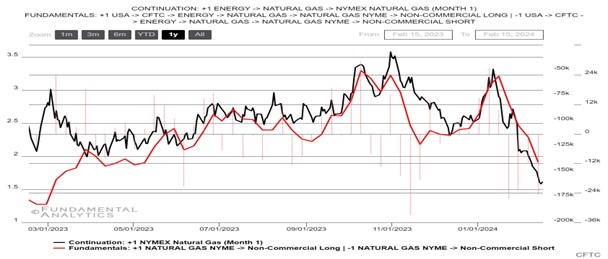

Natural Gas

LNG futures reached historical low level

- US natural gas futures fell to $1.55/MMBtu, the lowest since June 2020, driven by near-record production, abundant fuel storage, and above-average temperatures.

- Additionally, technical issues at Freeport LNG’s export facility have limited gas flow to LNG export terminals, and record levels are not expected until the plant returns to full power.

- This winter’s mild temperatures have enabled utilities to increase gas storage, with inventories currently 15.9% above normal levels.

- Gas output in February increased to an average of 105.8 billion cubic feet per day (bcfd) compared to 102.1 bcfd in January.

- Looking ahead, analysts expect producers to reduce output in 2024, following the sharp decline in prices.