Dr. Ken Rietz

The prices of natural gas futures have acted very strangely, increasing until the recent frigid temperatures hit the US, and then dropping until after the temperatures recovered. Since 60% of the houses in the US are heated using natural gas, a drop in natural gas reserves would be expected, and the prices would accordingly increase. Neither of those happened. There are several reasons, which we will look at in this commentary. First, here is a chart of natural gas front month futures, from January 2023 to the present.

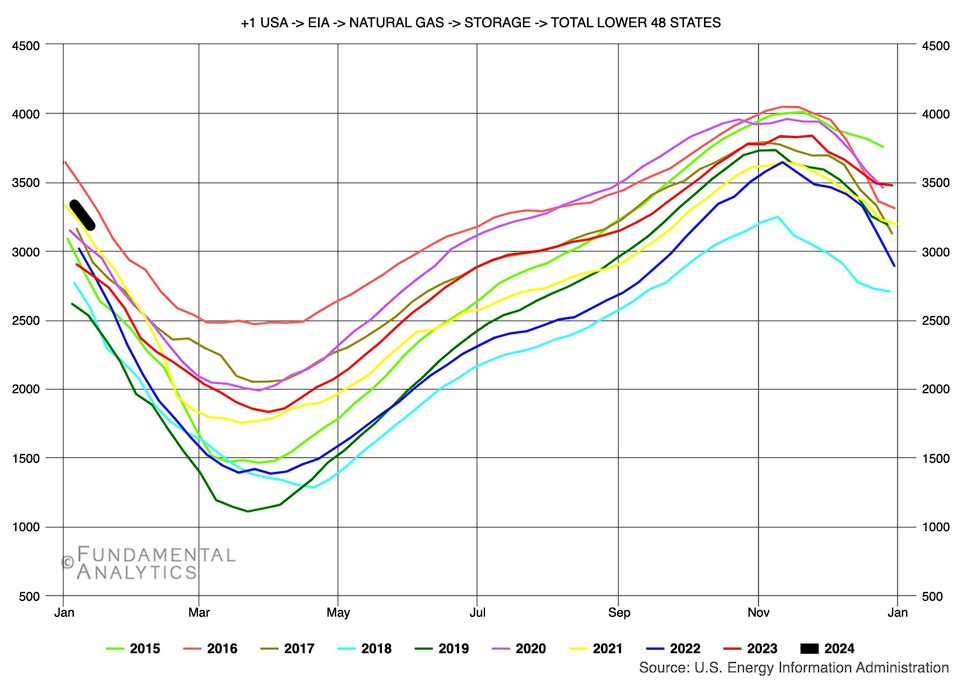

The increase in the price of natural gas futures since January 22 should be looked at as an expected recovery from the rapid drop in price that preceded it, rather than a reaction to the very cold temperatures. It should also be mentioned that the EIA reported that the natural gas reserves did drop last week, but entirely in line with the normal drop in reserves observed during these dates over the past nine years, as will be shown later.

Now, let’s dig into why this happened. We begin with the less obvious reason. This arctic blast was actually not as cold as previous ones, even if it felt just as bad. During the past month, only two monthly record lows were set across the entire continental US, because previous storms were colder. (Monthly lows are a better measure than daily, since the storms are not courteous enough to occur over the exact same dates.) And why is that? The arctic storms are generally getting less frigid because the Arctic air, in common with the rest of the global air, is getting warmer. In support of that assertion, consider the number of record daily high temperatures versus the number of record daily low temperatures during the past 365 days (as of Tuesday, 30 January), according to NOAA. In a stable temperature environment, you would expect those two numbers to be roughly equal; they are not. There have been 32,590 record highs and 15,175 record lows, indicating a bias toward warmer temperatures. An interesting and curious fact: The record low temperature over the continental states for the afternoon of Wednesday, January 17, 2024, was −22◦ F, set at Monticello, Kentucky. That is an indication that the atmosphere was highly chaotic.

The more obvious reason for the drop in natural gas prices is that the reserves of natural gas have behaved completely normally. Yes, they did drop during January, but the drop precisely mirrored the drop of the past nine years, as can be seen in the following graph.

This means that, despite the large amount of natural gas that would have been used for heating during the arctic weather, the amount of natural gas that was put into storage was enough to mimic the average decline in natural gas. Turning back to prices, the timing of the events indicate that the prices shown could not have been affected by Joe Biden’s decision to suspend approvals for applications to export LNG (liquid natural gas) pending review by the Department of Energy. It probably won’t have any effect, since the market knows that the Department of Energy has never given a negative review of a natural gas project.

The past few weeks do show an overall likelihood of a continual, slow fall in natural gas prices, accompanied by a slow increase in storage. The US has a gigantic amount of natural gas that is being tapped into now and can be retrieved rapidly if necessary.