Global production of agricultural commodities is expected to surpass historically high levels amid increased geopolitical tension, raising concerns for lower prices during 2024.

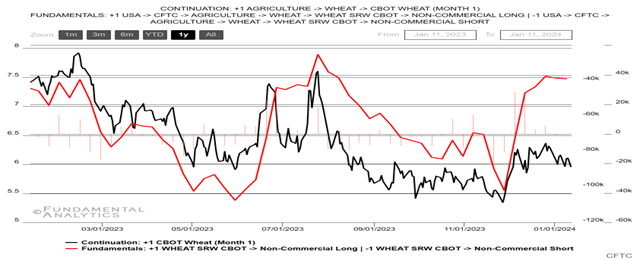

Wheat

Speculators weigh their positions on higher demand

- Wheat futures fell to below $5.95 per bushel in January, the lowest in over one month, amid persistent expectations of strong global supply.

- The USDA upwardly revised its forecasts on global wheat supply for the current marketing year due to higher production and beginning stocks.

- A revised count pointed to more ample stocks of grain in Ukrainian silos, raising the expectations of exports from the European breadbasket.

- Additionally, production out of Russia was revised higher to 91 million tons, only 1 million away from the record-high posted last year.

- Furthermore, strong harvests in Canada and Australia also lifted export forecasts from the key producers. Limiting the decline, global consumption was revised higher amid increased feed and residual use in India and the EU.

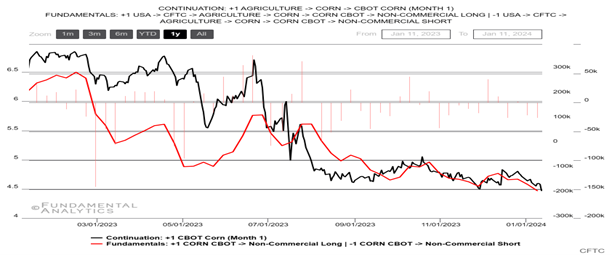

Corn

US corn futures plummet as competitors increase supply

- Chicago corn futures traded around $4.5 per bushel, close to the 3-year lows hit on January 2nd, pressured by improved weather conditions in top producers Brazil and Argentina. Both countries have witnessed rainfalls after the prolonged period of drought.

- Weighing on the commodity further, USDA’s weekly data showed a decline in exports, with 569.7k MT of corn shipped on the week ending December 28th, down from the 1.23 MMT in the prior week and below 683k MT in the same period last year.

- For 2024, the trend in corn prices is projected to remain bearish amid a recovery in output from Argentina and strong supply from USA and Brazil.

- Still, the underlying risks include El Nino-related weather effects, which could damage the crops.

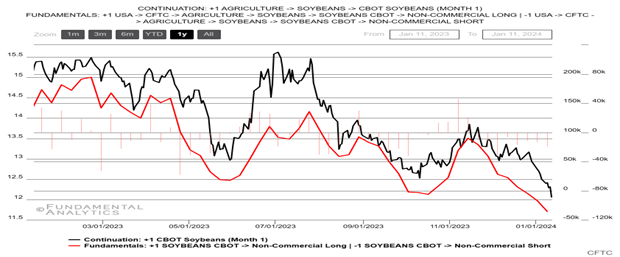

Soybeans

Soybeans close to $12 historic low benchmark

- Soybeans futures fell below $12.1 per bushel, hitting the lowest since November 2021, after the USDA report indicated supply of grains remains strong.

- Soybean stocks stood at 3 billion bushels, surpassing market expectations.

- On-farm soybean stocks were 1.453 billion bushels, down 1.6% from a year ago, while off-farm stocks were slightly above last year at 1.547 billion bushels.

- The soybean market faces pressure from an excess supply of old-crop soybeans and favorable weather conditions in Brazil, the largest soybean exporter.

- Adding to downward pressure, rains in Brazil are set to boost crop yields leading to projections of a significant rise in soybean exports to 1.3 million metric tons in January compared to 940k tons the previous year.