January 8, 2023

Energy commodities presented substantial volatility during the last sessions, driven by the devastating political environment in the Middle East and the new EIA data.

Crude Oil

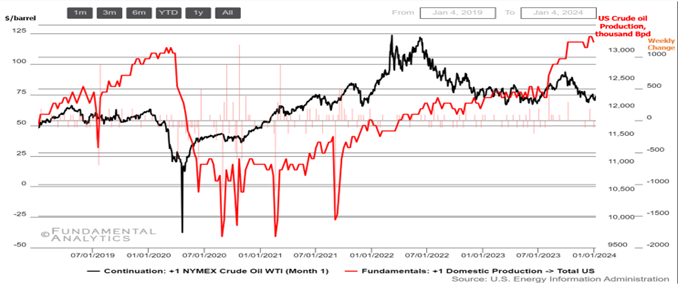

All-time production high squeezes WTI prices

- WTI crude futures surged by over 2% to $73 per barrel on Friday’s session amid escalating tensions in the Middle East. U.S. Secretary of State Antony Blinken is preparing to visit the region with the goal of preventing the further spread of conflict.

- Crude oil prices received additional support from a significant decline in US Crude stocks by 7.42M barrels, surpassing the market consensus of a 2.97M barrel decrease.

- Traders continued to monitor developments in Libya where protests halted production from the Sharara and El-Feel fields, which jointly contribute around 365k Bpd.

- In a bid to seek higher prices for their crude oil exports to China, Iran is allegedly suspending shipments to the world’s largest oil importer until China agrees to pay higher prices for Iranian barrels.

Gasoline

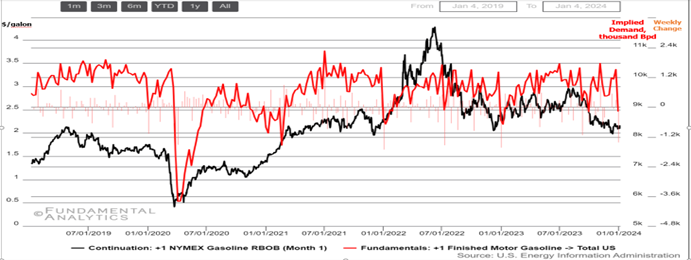

Gasoline prices remain muted as demand has fallen

- US gasoline futures held close to the $2.1 per gallon mark since the start of January as evidence of weak demand in the US offset risks to crude oil supply from elsewhere.

- The latest data from the EIA showed that product supplied fell by more than 1.2 million barrels in the last week of the year.

- The sharp drop in gasoline bidding, in addition to robust production domestically, drove US gasoline inventories to surge by 10.8 million barrels in the period, the sharpest weekly gain since 1993.

- Still, the developments weighed against recent threats to crude oil supply from outside the US.

- Protests in Libya shut down key oil fields, while repeated attacks targeted at ships by Yemeni Houthis in the Red Sea halted tanker activity through the Suez Canal and the straight of Bad al-Mandab.

Natural Gas

LNG prices spike in latest sessions despite strong storage

- US natural gas futures dipped to $2.76/MMBtu on Friday, still marking a 10% weekly increase due to soaring seasonal demand.

- The Midwest is expected to encounter wintry conditions and snowfall between January 8-12. However, moving forward, the Northern Hemisphere will experience above-average temperatures due to the persistent El Nino pattern.

- Additionally, record-high domestic production has allowed utilities to build reserves, with inventories currently 13% higher than average.

- The latest EIA report showed a smaller-than-expected storage draw last week because milder-than-normal weather kept heating demand low.