January 3, 2023

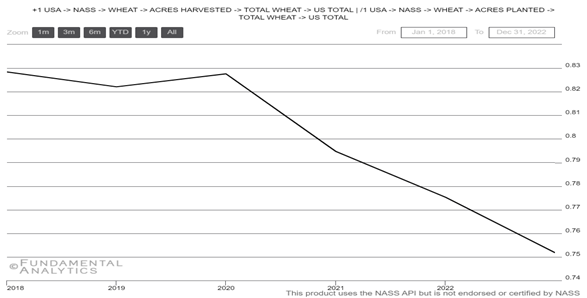

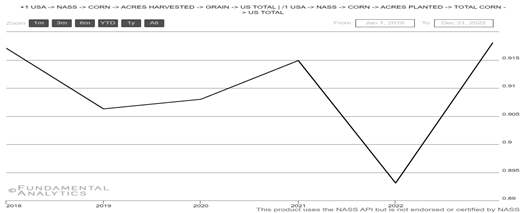

The harvested/planted ratio has been a significant driver of agricultural exports.

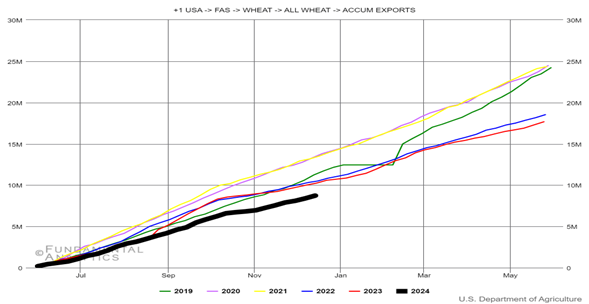

Wheat

Total wheat exports are at historically low levels

- Wheat futures were near $6.3 per bushel at the turn of the year, slumping 15% in the last 12 months as ample supplies from key producers offset supply risks from the second year of war in Ukraine.

- Accumulated wheat exports have fallen nearly -40% from 2019 level, as harvested/planted ratio decreased from 82.2% to 75.2%

- The latest forecasts from the USDA showed that a bumper harvest from Russia is expected to yield 90 million tons in the 2023/24 marketing year, close to the record-high 92 million from the earlier period.

- Robust crops in South America also added to global supply, magnifying the decline in wheat futures to a three-year low in September.

Corn

Corn exports fell over 2023

- Chicago corn futures traded around $4.8 per bushel, not far from the near 3-year low hit on November 23rd, pressured by decreased oil cost, which dampened the demand for biofuel alternatives, and improved weather conditions in top producers Brazil and Argentina.

- Both countries have witnessed rainfalls after the prolonged period of drought

- Over the course of 2023, corn prices have plunged by 30% due to alleviated Black Sea bottlenecks, muted global demand, and bumper harvests by the US and Brazil.

- Additionally, the start of trade between China and Brazil eased bidding competition on other export markets.

- Still, support for the commodity came from weaker dollar and hopes for monetary easing from major central banks in 2024.

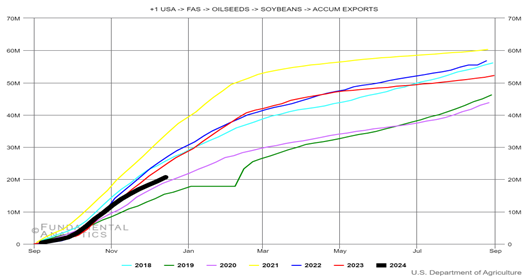

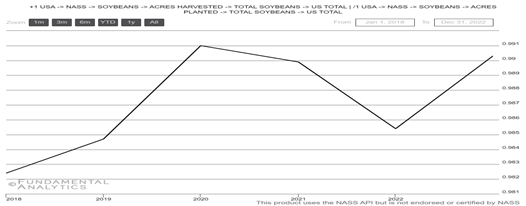

Soybeans

Accumulated soybean exports remained muted

- Soybean futures fell below $12.7 per bushel in early 2024, the lowest in almost three months and following a 15.1% loss in 2023 mainly due to Brazil, which is expected to achieve record-breaking production despite weather adversities.

- During the last 5-year (2019-2023), the average Accumulated exports is 21 million Mt, while the corresponding average harvested/planted ratio is below 80% mark.

- Moreover, Argentina is expected to potentially double its soybean output, with Paraguay and Uruguay also showing increases .

- On the demand side, China’s strong soybean purchases suggest a possibility of setting a new import record in 2023.