Dr. Ken Rietz

December 21, 2023

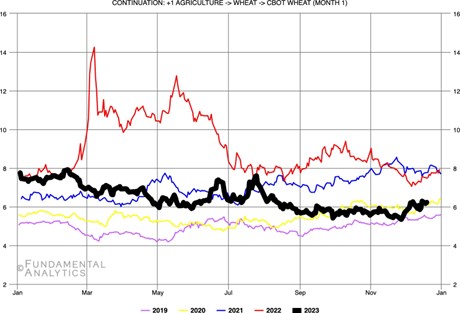

Everybody knows that weather is one of the largest external factors in agricultural markets. And one of the earliest lessons people learn about commodities is that prices are heavily affected by international markets. That is why traders pay close attention to global weather. Right now, we have an La Niña event in the Pacific Ocean that is having a major impact on South American wheat. That is what we will look at today. We start with a graph of the NYMEX wheat futures.

Figure 1: The front month price of a futures contract on NYMEX wheat

The graph makes clear the effect of international markets; the price of wheat spiked right after Russia invaded Ukraine, a major wheat producer, and it has taken years for the price to settle down to what was a normal level.

Two countries dominate South American wheat production: Brazil and Argentina. Brazil has historically been a net importer of wheat and has not yet become a major exporter. That leaves Argentina. Two factors have emerged that affect its wheat prices. The first, of course, is the weather. We will return to that momentarily. The other the fact that Javier Milei, the newly- elected president of Argentina, has devalued their currency by 60%. This provides an immediate advantage to Argentinian wheat exports, which are suddenly much cheaper.

International markets are still a bit hesitant to fully incorporate that price reduction for several reasons. The biggest ones are that it is still early in the growing season and the weather is uncertain. The planting of wheat was delayed due to a lack of rain to help seeds germinate. The next two months will be critical in projecting how large the crop will be. The short-term forecast is not encouraging: little rain and triple-digit (Fahrenheit) temperatures.

It is those competing factors of devaluation and drought that make it difficult to predict the effect on wheat futures in the US. The market right now is holding steady and watching carefully. The devaluation is a fact; the weather is harder to predict. The more likely scenario, then, is for Argentine wheat to sell cheaply, forcing other countries to reduce prices.