December 18, 2023

Money-managed funds indicator experienced mixed variations for the main energy commodities, amid fundamental changes and analysts’ short-term forecasts.

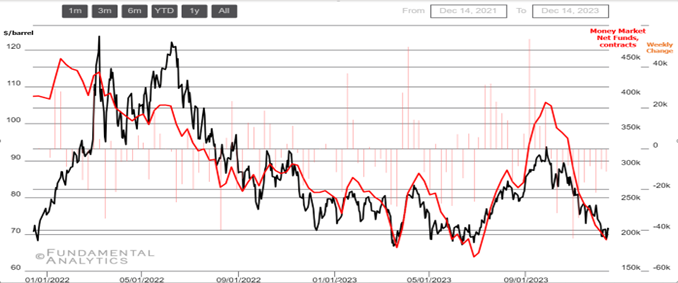

Crude Oil

Crude oil speculators expect ongoing bearish movement

- WTI crude futures erased earlier gains and hovered flat at the $71 per barrel mark, hitting a 7-month low level, amid outlook of ample supplies continued to outpace hopes of stronger demand.

- Money-managed funds have plummeted from 390k long contracts high from late September to 195k long contracts, hit 4-month low. This was the 11th consecutive weekly decrease. During the same period, WTI crude fell -21%.

- NY Fed President pushed back against market bets of multiple rate cuts by the central bank next year, driving oil benchmarks to give back gains that were fueled by a dovish Fed outlook.

- IEA upwardly revised next year’s consumption forecasts by 130k barrels per day to 1.1 million.

- OPEC has announced additional supply constraints through Q1 of 2024, but energy traders remain skeptical that OPEC can successfully choke down oil production to meet waffling demand.

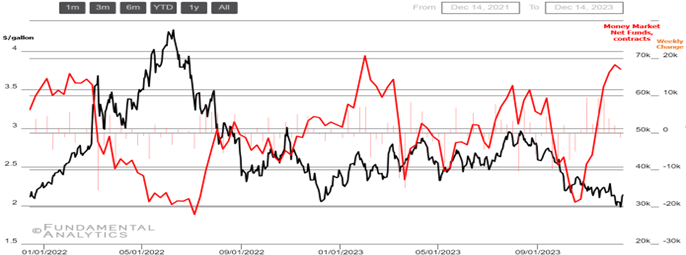

Gasoline

Money-managed funds fell after a strong soar

- US gasoline futures gained almost 4.4%, from the previous week, staying above $2.13/gallon after a dovish Fed and a fall in US crude inventories sent oil prices slightly higher.

- Speculators’ funds lowered for the first time after 7 consecutive week gains, driven by continuing inventory build and forecasts for next year’s demand.

- Early in the week, gasoline futures touched low levels not seen since November 2021, amid weak demand and increased supply as refiners resumed operations after seasonal maintenance.

- EIA reported another increase in domestic gasoline stocks by 0.408 million barrels in the week ending December 8th, a fourth consecutive rise although below expectations of 1.93 million.

- Also, gasoline production increased last week, averaging 8.9 million bpd, adding 0.39 million bpd compared to the previous week, while surpassing the 5-year average 8.6 million bpd.

- The EIA forecasts a 1% decline in US gasoline consumption by 2024, reaching the lowest per capita level in two decades.

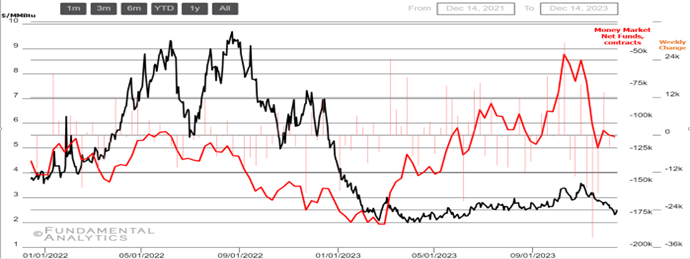

Natural Gas

Natural gas prices strengthened, driven by weather forecasts

- US natural gas futures climbed toward the $2.5/MMBtu level, recovering from the mid-June low observed on December 12th, driven by heightened demand forecasts and increased gas flow to liquefied natural gas export plants.

- Speculators expanded their net short position for 2nd consecutive week, adding 1,122 short contracts extra .

- Despite record output and projections of mild weather reducing heating demand in the upcoming week, leading to decreased gas withdrawals from storage, prices experienced a modest increase.

- Analysts suggest that prices likely peaked in November for this winter, coinciding with a decline in US gas demand.

- Looking ahead, prices are expected to rebound in the short term due to increasing gas demand driven by new US LNG export plants in the US, Canada, and Mexico, despite adjusted forecasts for reduced US demand