Dr. Ken Rietz

November 9, 2023

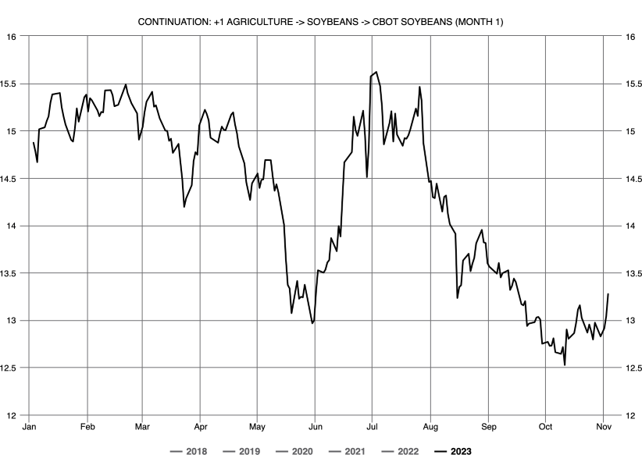

The US soybean harvest is finishing up, and despite the weather, the resulting size of the harvest is projected to be higher than usual. As expected, the price of soybean futures dropped as the harvest predictions came in, at least until mid-October (see the first graph below). But then, soybean futures started going up, even as harvest predictions have been going up quite aggressively, lately. This is a bit perplexing, and due to several factors. We want to go over those factors this week.

First, there are two graphs that are relevant. The first is the price of soybean futures. The second graph below is the graph of the ratio of the Brazilian Real to the US Dollar.

Figure 1: Price of front month soybean contracts, in USD per bushel

Figure 2: Ratio of Brazilian Real to US Dollar

The second graph gives away, partially, both of the factors. But why Brazil? It turns out that the global soybean export market is dominated by Brazil and the US. In 2022, Brazil accounted for 50% of all soybean exports, while the US accounted for 37%. No other country was close. The third place was held by Argentina at less than 4%. Any problems with the Brazilian or US harvests will have a large effect on the price of soybeans.

The second graph illustrates that the USD has been growing weaker relative to the Real (If that is not clear, look at what 5 reais—the plural of real—converts to. When the graph is below 0.2, then 5 reais are worth less than 1 USD; when the graph is above 0.2, 5 reais are worth more than 1 USD. When 5 reais moves from being worth less than 1 USD to being worth more than 1 USD, the USD is getting weaker relative to the Real). What this means is that in order to pay for a fixed amount of soybeans, you pay fewer dollars than before or more reais. The result, predictably, is that more orders for soybeans would be sent to the US instead of Brazil, and the increased demand in the US would cause prices here to increase. However, this effect is not sufficient to explain the size of the increase in the price of soybean futures. There must be another factor involved.

It turns out that the weather in Brazil has been a bit chaotic for the past several years, as it has endured both El Niño and La Niña weather events. The difficulty is that Brazil is so large that the effects of the two depend on the location. Mato Grosso, a western state centered between the north and the south of Brazil, produces much of Brazil’s soybeans. La Niña has the effect there of causing hot and dry conditions. La Niña was the controlling factor for about three years until early 2023, with drought covering Mato Grosso down to northern Argentina. Thus, the soybean harvests were not very good. On the other hand, La Niña has the opposite effect in northern Brazil, which is fully tropical, with cooler and rainier weather. Things flip around with El Niño, which followed right on the heels of La Niña, bringing cooler, rainier weather to Mato Grosso, and near drought to northern Brazil. Mato Grosso thus has to cope with planting and harvesting in wet conditions now.

Between the northern and southern regions of Brazil, there is usually some good weather for soybean crops. The effects of El El Niño in Mato Grosso this year have been somewhat drier than the usual overly wet conditions, but even then, there has been plenty of rain for a good start for soybeans. But this is only the start of their soybean crop; El Niño could easily cause serious problems, which has attracted the markets’ interest. If the weather turns as nasty as it might, then the soybean production in Brazil will drop, reducing supply and causing prices to increase.