September 12, 2023

Crude oil, gasoline, and natural gas futures have shown increasing volatility during the first eight months of 2023.

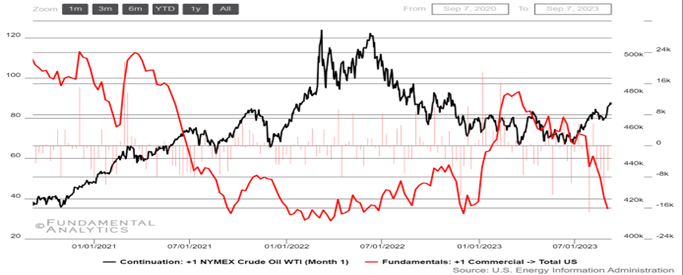

Crude Oil

Crude oil inventories signal bullish economy but external fears are still at play

- WTI crude oil futures soared +2.3% on a weekly basis for the week ending Sep 8th, supported by the announcements of Saudi Arabia and Russia that they plan to extend voluntary supply cuts of a combined 1.3 million bpd until the end of the year.

- US crude oil inventories reached the mid-December 2022 level after decreases for the fourth consecutive week were reported (data EIA, 09/01/2023). Lowered crude oil stocks could imply stronger demand for the US economy and better-than-expected growth for the world’s largest economy.

- During January-August of the current year, crude oil inventories diminished cumulatively by 22.9 million barrels, while WTI futures have gained more than +13.7%.

- Nevertheless, concerns about sluggish growth in China continue to grip commodity markets, as the world’s largest crude importer has yet to convince markets of an economic turnaround.

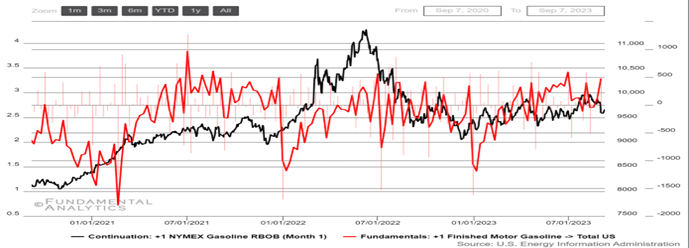

Gasoline

Stronger-than-expected demand supports falling gasoline prices

- Gasoline prices rebounded after the steep drop during the August 28th to Sep 1st period, gaining +2.41% on a weekly basis.

- Demand remains strong with EIA data showing an increase to 9.32 million b/d last week from 9.07 million b/d while gasoline inventories fell by 2.666 million barrels, the biggest decline in four months.

- Unplanned refinery outages have also pushed gasoline prices higher. The national average gasoline prices in the United States hit $3.811/gallon at the beginning of September, the second-highest level in records going back to 1994 from the American Automobile Association.

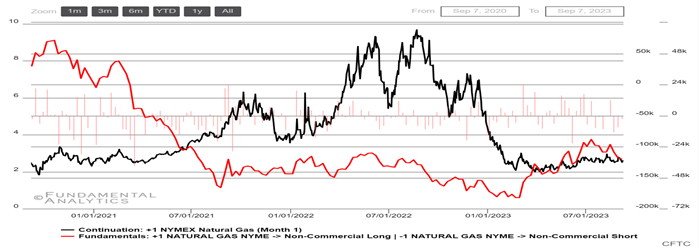

Natural Gas

Speculators bet on natural gas falling supported by expectations for warm weather

- Natural Gas futures slipped -5.79% on a weekly basis, standing at $2.605/MBtu and returning to late August levels. It’s notable that on a YTD basis, natural gas futures have lost more than 34.6%, showing increased volatility.

- Speculators expanded their net position to 119,997 short contracts for the third consecutive week, amid EIA data that showed stockpiles in the US rose by 33 Bcf, missing expectations of 43 Bcf build and remaining sharply below averages from the end of the second quarter.

- Seasonally cooler weather reduced the outlook on air-conditioning use and gas consumption in the short term, although meteorologists still forecast temperatures to remain mostly hotter than normal until mid-September.

- Furthermore, reduced operations at domestic LNG export facilities, including Cheniere Energy’s Sabine Pass and Corpus Christi, have prevented a greater supply draw from national territory.

- Workers at Chevron’s LNG projects in Australia went on strike last week after talks broke down, potentially disrupting output from facilities that account for over 5% of global supply. Additional rallies in European and US LNG prices are expected as the strike continues.