September 5, 2023

The decreased number of means of drilling may affect EIA projections for the average crude oil output of current year, leading to additional energy disruptions.

Crude Oil

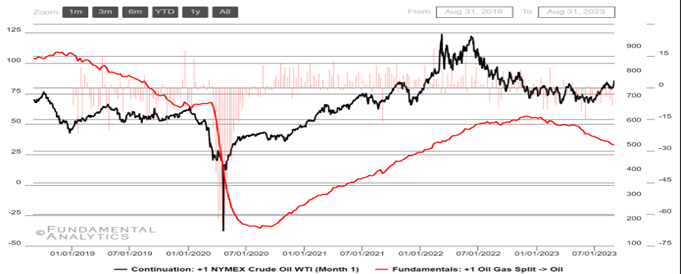

Oil Rig count has decreased from the start of 2023, while WTI prices have experienced increased volatility

- U.S. energy firms have significantly cut the number of oil rigs operating, with the latest data from Baker Hughes Co. reporting 512. This is the lowest point since early November of 2022 (11/02/2022). On a YTD basis, the oil rig count is down by 106 rigs.

- Drilling has slowed since the beginning of the year due to weaker WTI crude oil prices compared to the previous lucrative year, alongside higher costs. Since energy companies want to satisfy their shareholders via increased dividends, the budget for CAPEX has been reduced.

- According to the Dallas Federal Reserve survey (published late June), most small firms expect drilling and completion costs per well to be higher at the end of 2023 than they were in 2022, whereas large firms expect these costs to decline. This could create a field of acquisition opportunities for larger companies.

- Increased drilling costs could lead EIA to revise its forecast lower for average 12.76m bpd crude oil production for 2023 as we proceed to Q3.

- Despite the lower oil rig count, production is strong, with 12.8m bpd (EIA data August 25th 2023) outperforming 2019 production of the same period by 0.3m bpd.