August 22, 2023

Crude oil, natural gas, and gasoline inventory levels are significantly impacting the underlying futures.

Crude Oil

Crude oil inventory hits current-year low

Crude Oil stocks lowered last week to a yearly low of 439.6 million barrels, according to EIA data for the week ending Aug. 11, 2023.

Crude Oil stocks lowered last week to a yearly low of 439.6 million barrels, according to EIA data for the week ending Aug. 11, 2023.

- The weekly change of -5.9m barrels is above the consensus -2.3m barrels, indicating more robust demand and fueling hopes that the economy could avoid a recession.

- The forecast for Crude Oil Inventories for the week ending Aug. 18, 2023, will be published this Wednesday and the consensus is -2.3m barrels.

- China’s Central Bank urged commercial banks to increase lending in a bid to shore up the economy while lowering its one-year loan prime rate by 10 basis points to a record low of 3.45% and keeping its five-year loan prime rate unchanged at 4.2%. This could be a clear signal of a future uptick in demand for oil imports for the world’s 2nd biggest economy.\

- The continuation of output cuts from OPEC+ majors Saudi Arabia and Russia puts more pressure on crude oil prices to edge higher by the end of the year. The scenario of $100/barrel for WTI is still in the play and even more amplified.

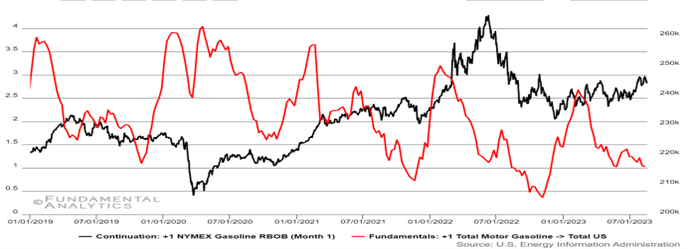

Gasoline

Gasoline stocks continue to drop

- Total Motor Gasoline Inventory has lowered by -23.4 million barrels compared to the start of 2023, indicating a -9.8% YTD drop. On the other hand, gasoline futures have soared to a 21.6% YTD increase.

- Gasoline futures in the US remain under the $2.9/gallon mark, well below the one-year high of $3/gallon touched on August 11th, and track the decline in energy commodities as demand concerns offset the evidence of tight supply.

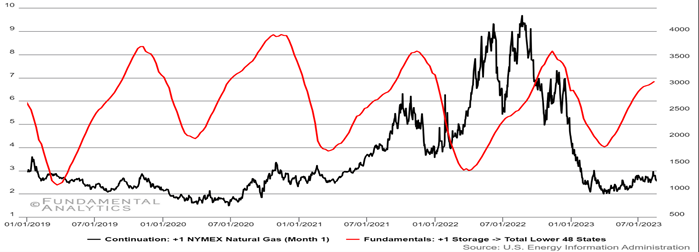

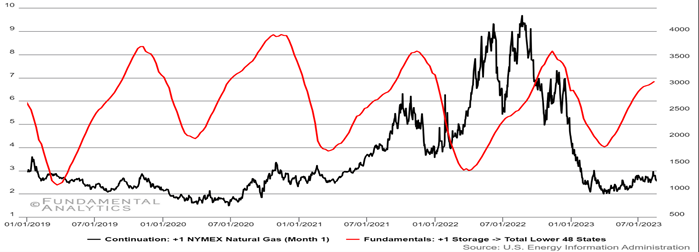

Natural Gas

Natural gas storage follows 2017 levels

- Natural Gas storage from early July is at the same level as 2017, standing at 3,065 Bcf, while the seasonal building that starts in April has steepened compared to previous years. This could be an indicator that storage has been built up earlier than expected, supporting more reasonable natural gas prices in the winter.

- US natural gas futures traded below the $2.6/MMBtu mark following a -8% loss in the previous week, driven by lower short-term demand and stronger production.

- Gas flows to US LNG export plants have fallen so far in August, mainly due to reductions at Venture Global LNG’s Calcasieu facility in Louisiana.

- From the supply side, output so far in August is nearly unchanged from last month and not far from the monthly record of 102.2 Bcf per day in May.