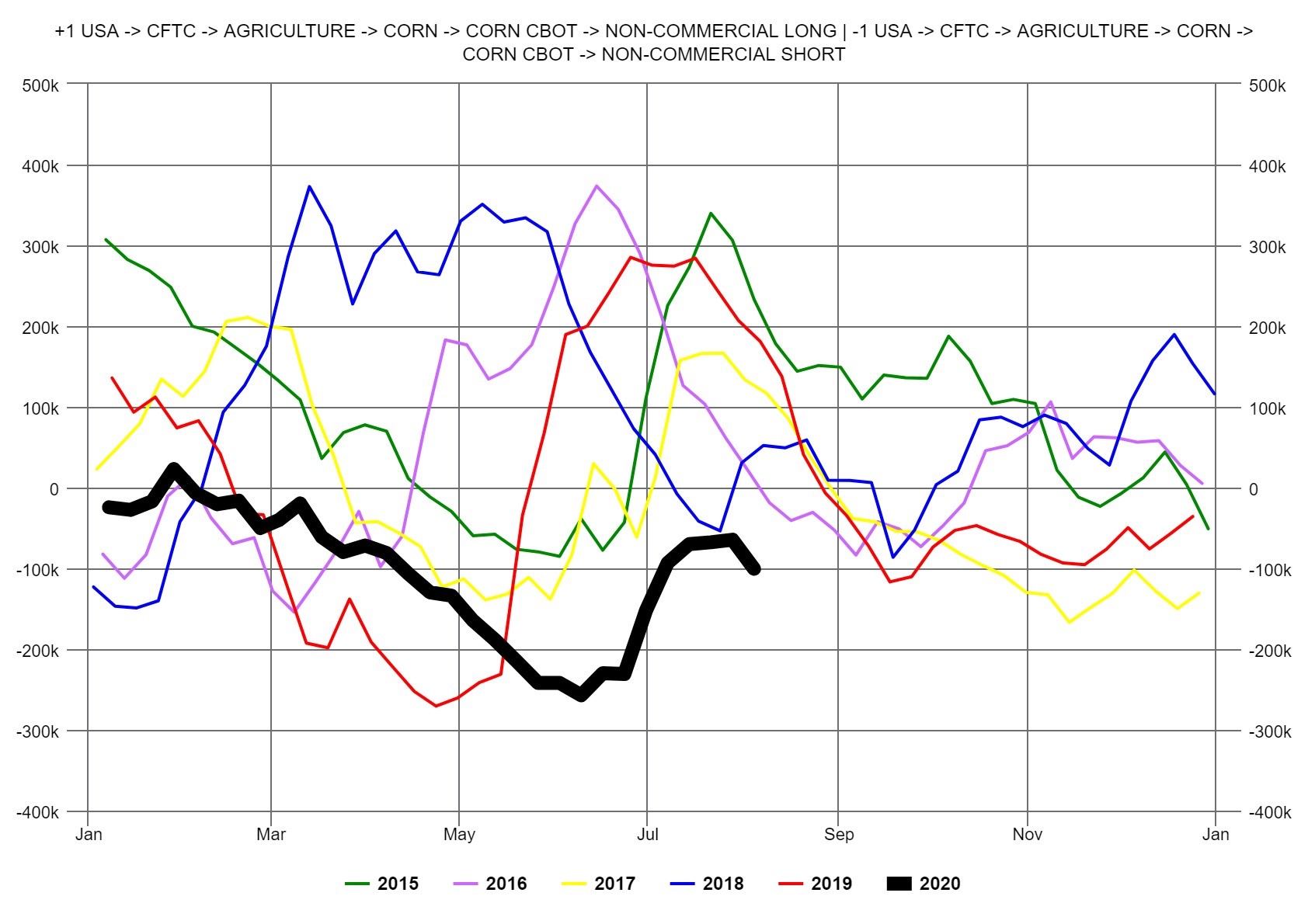

Hedge Funds Still Very Bearish on Corn

August 10, 2020

Despite the concerns in the US and China for this year’s corn crop because of high temperatures and dampness that stunt the growth of corn plants, the Hedge Funds are still bearish on corn prices. In mid-May the Funds were net short about 250,00 contract and now are less so, net short about 100,000. However, they are at a record net short compared to their positions during this week of the year versus previous years. We would not be surprised to see the Funds increase their net short positions as prices weaken, and then the increase in the net short positions would further pressure prices.

The chart below can be constructed in the Fundamental Analytics platform under Fundamentals > CFTC > Agriculture > Corn CBOT > Non-Commercial.

CBOT Corn – Net Short Positions

If you would like access to the great insights and analysis provided by the Fundamental Analytics platform, sign up for a 15-day free trial and demonstration!

If you have any questions, please contact our Managing Director, Joel Fingerman, at [email protected]

We also invite you to read our other articles and follow us on social media!

Best Regards,

The Fundamental Analytics Team

The information provided here is for general informational purposes only and should not be considered individualized investment advice. All expressions of opinion are subject to change without notice in reaction to shifting market conditions.