Can the Heating Oil Crack Spread Go Lower?

August 7, 2020

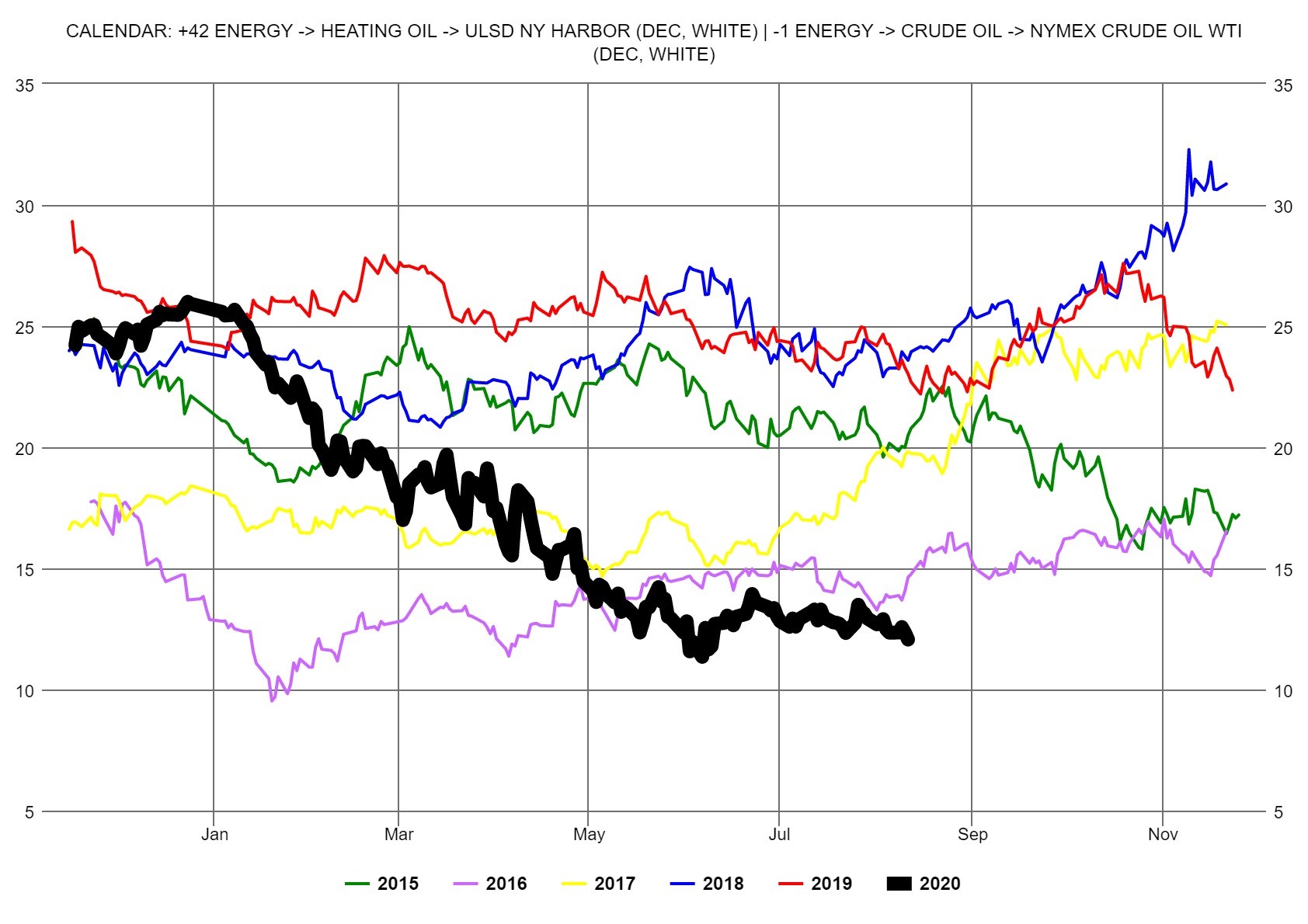

Heating oil prices (ULSD futures) are at some of the lowest values in ten years. Below is plot of the December 2020 Heating Oil contract crack spread (black line), at $12.06 for the August 6, 2020 settle. At this level the crack spread is not profitable for refiners. This spread reflects manufacturing and commercial activities which has been greatly reduced because of the Covid-19 pandemic. We do not believe this is an opportunity to go long the crack spread – low prices and low cracks do not necessarily signal a buying opportunity. In energy, if futures prices are low, they will often go lower.

The chart below can be constructed in the Fundamental Analytics platform under Prices > Energy > WTI Crude Oil > Instruments & Spreads.

If you would like access to the great insights and analysis provided by the Fundamental Analytics platform, sign up for a 15-day free trial and demonstration!

If you have any questions, please contact our Managing Director, Joel Fingerman, at [email protected]

We also invite you to read our other articles and follow us on social media!

Best Regards,

The Fundamental Analytics Team

The information provided here is for general informational purposes only and should not be considered individualized investment advice. All expressions of opinion are subject to change without notice in reaction to shifting market conditions.