Gold, Silver, and Palladium Commentary

August 5, 2020

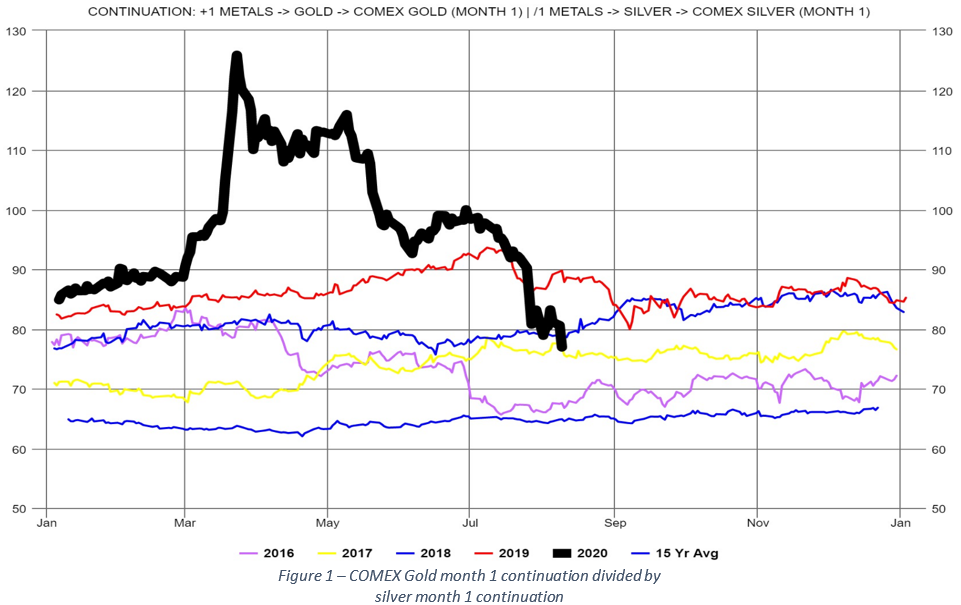

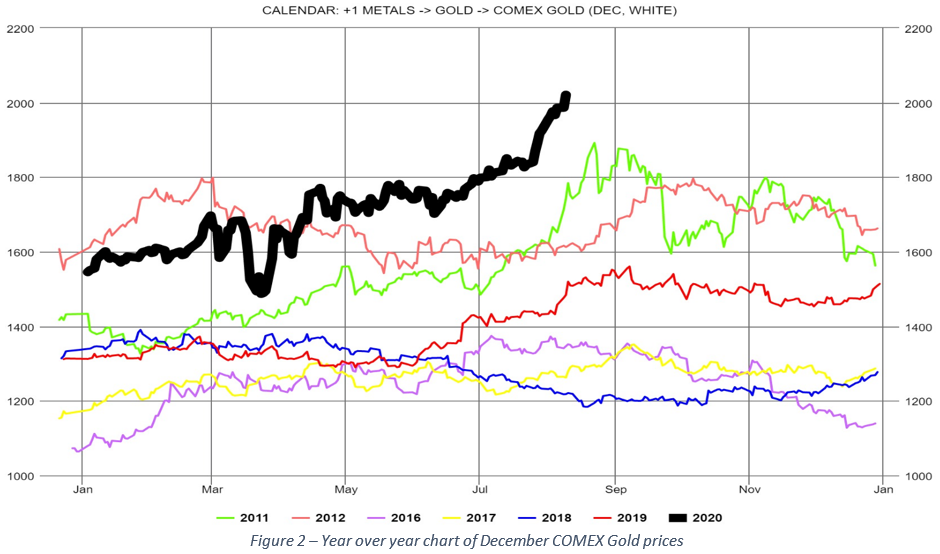

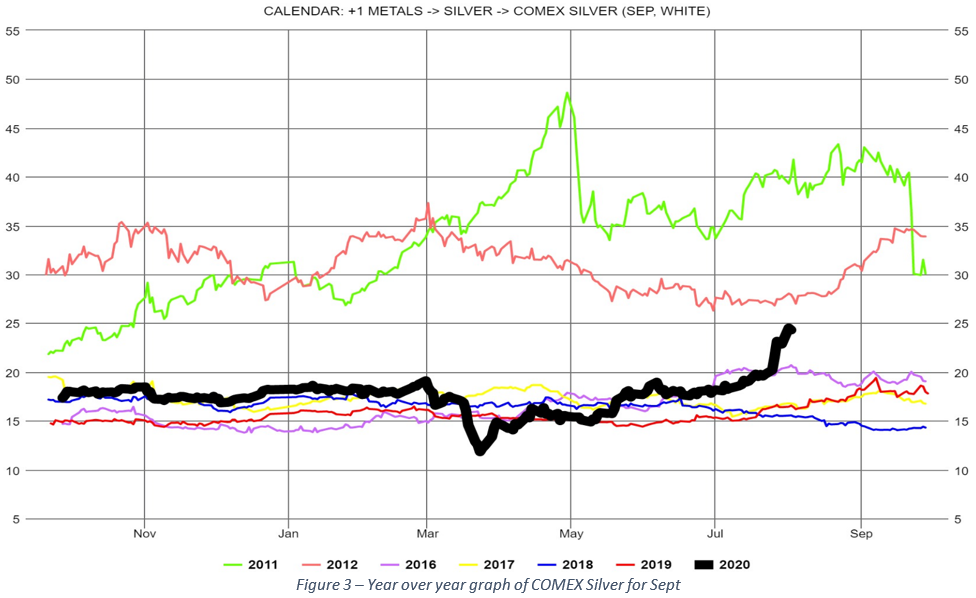

Both gold and silver continue to make significant gains due to several underlying factors in the market (negative real interest rates, Covid-19, inflationary fears, overvalued markets, political risks, geopolitical tensions, hedging). The ratio of the 1-month Gold contract to the 1-month Silver contract (Figure 1) continued the downward trending, falling another 4% this last week as front month silver rallied 7.2% and front month gold 2.9%. With the front month silver and gold contracts closing yesterday at $26.01 and $2001.2, respectively, the gold/silver ratio is now 76.93, or 18.5% higher than the 15-year average. December Gold (Figure 2) closed yesterday at $2021 and September silver (Figure 3) moved up to $26.03 from $24.3 last week. Both gold and silver have risen 10.2% and 33%, respectively, since July 17.

From an open interest perspective, gold’s open interest is down 5% from 7/17, the beginning of the recent bull run, and down 8.3% from its recent peak on 7/23. This is different than silver, where silver’s open interest continues to climb, up 11% from 7/17. Both gold and silver saw drops in the COT net funds positions between the 7/21 and 7/28 reports. While the number of gold short positions held by the bullion banks are at historic positions, they fell 7.7% from the previous week’s report. The difference between the December and August gold contracts at $19.8/oz, which is similar to last week. We continue to believe that for the longer-term, fear of inflation resulting in negative real interest rates will continue to pressure gold higher. But does the rapid rise in gold, combined with falling total open interest falling as gold rises, possibly signal this recent rise may be partly an attempt to close shorts?

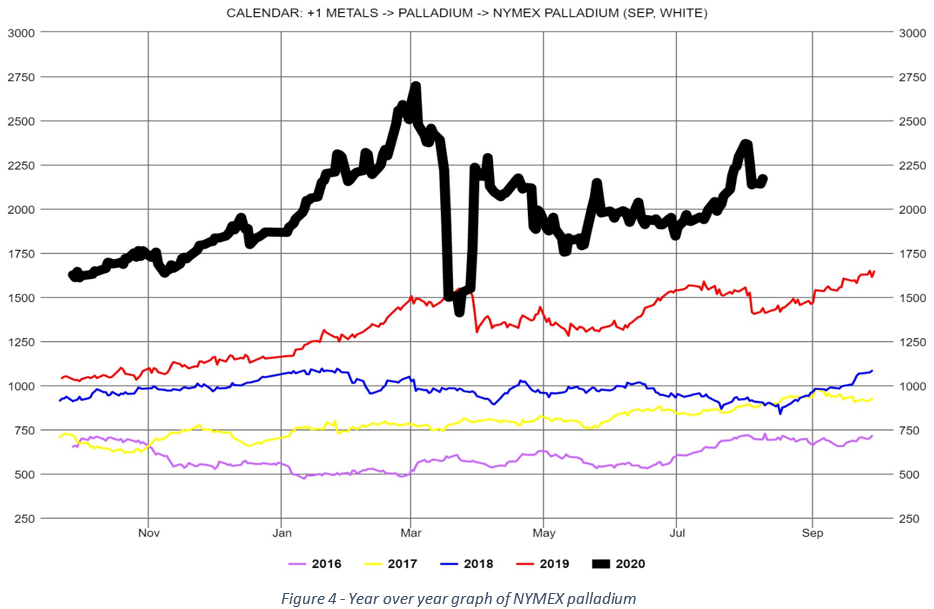

Now for Palladium. Palladium saw a large move down this last week and even with this move down, the palladium/silver ratio continued to fall, highlighting the significance in the silver move. Total open interest as well as non-commercial net-position of funds continue to increase for palladium. Even though total open interest fell last week, it is still climbing with respect to 7/17. The most recent COT report shows net non-commercial positions continue to increase in palladium as well. Continued demand for palladium as well as a continued rise in total open interest should continue to provide support for the metal.

If you would like access to the great insights and analysis provided by the Fundamental Analytics platform, sign up for a 15-day free trial and demonstration!

If you have any questions, please contact our Technology Manager, Mike Secen at [email protected]

We also invite you to read our other articles and follow us on social media!

Best Regards,

The Fundamental Analytics Team

The information provided here is for general informational purposes only and should not be considered individualized investment advice. All expressions of opinion are subject to change without notice in reaction to shifting market conditions.