Gold, Silver, and Palladium Commentary

July 29, 2020

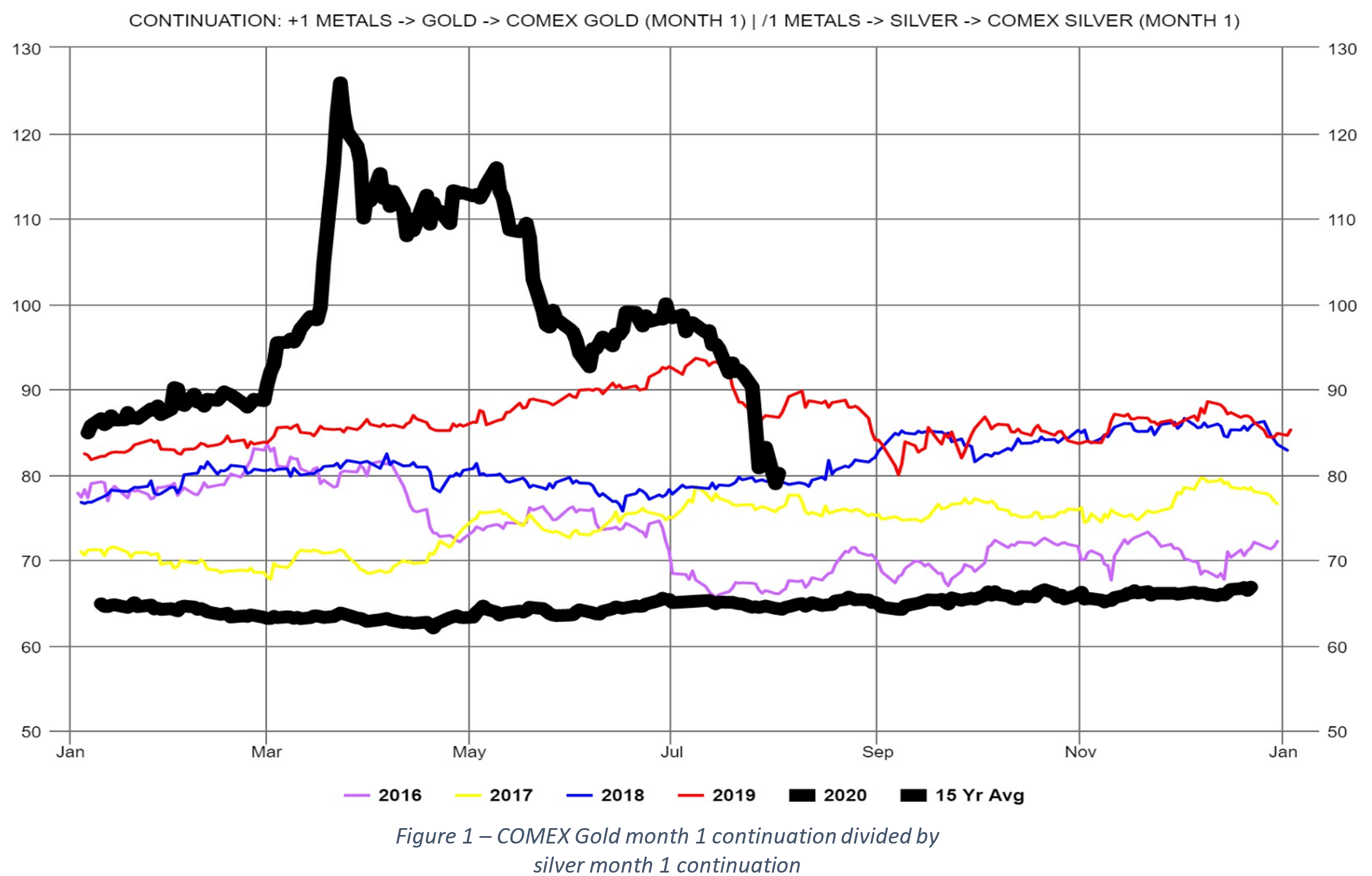

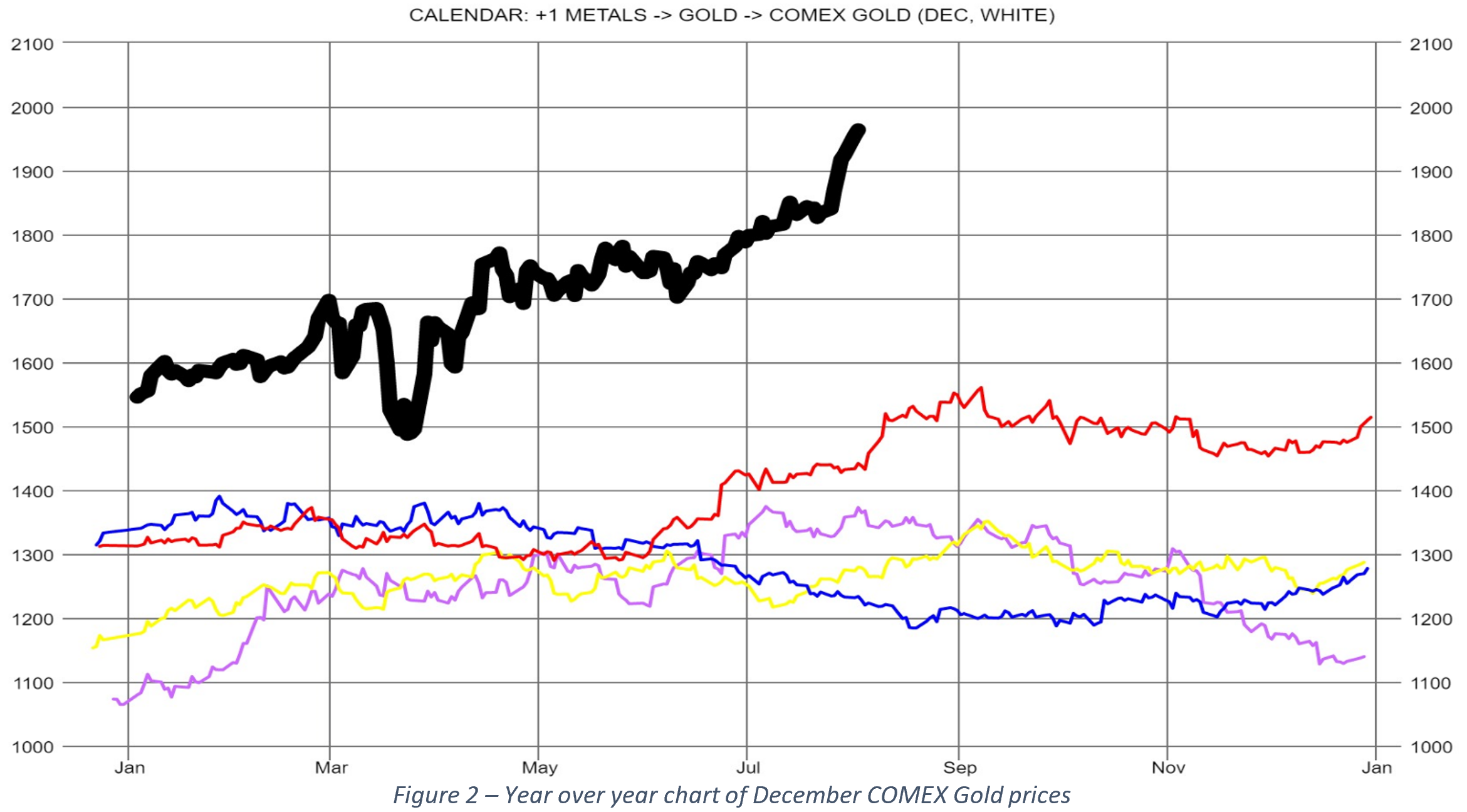

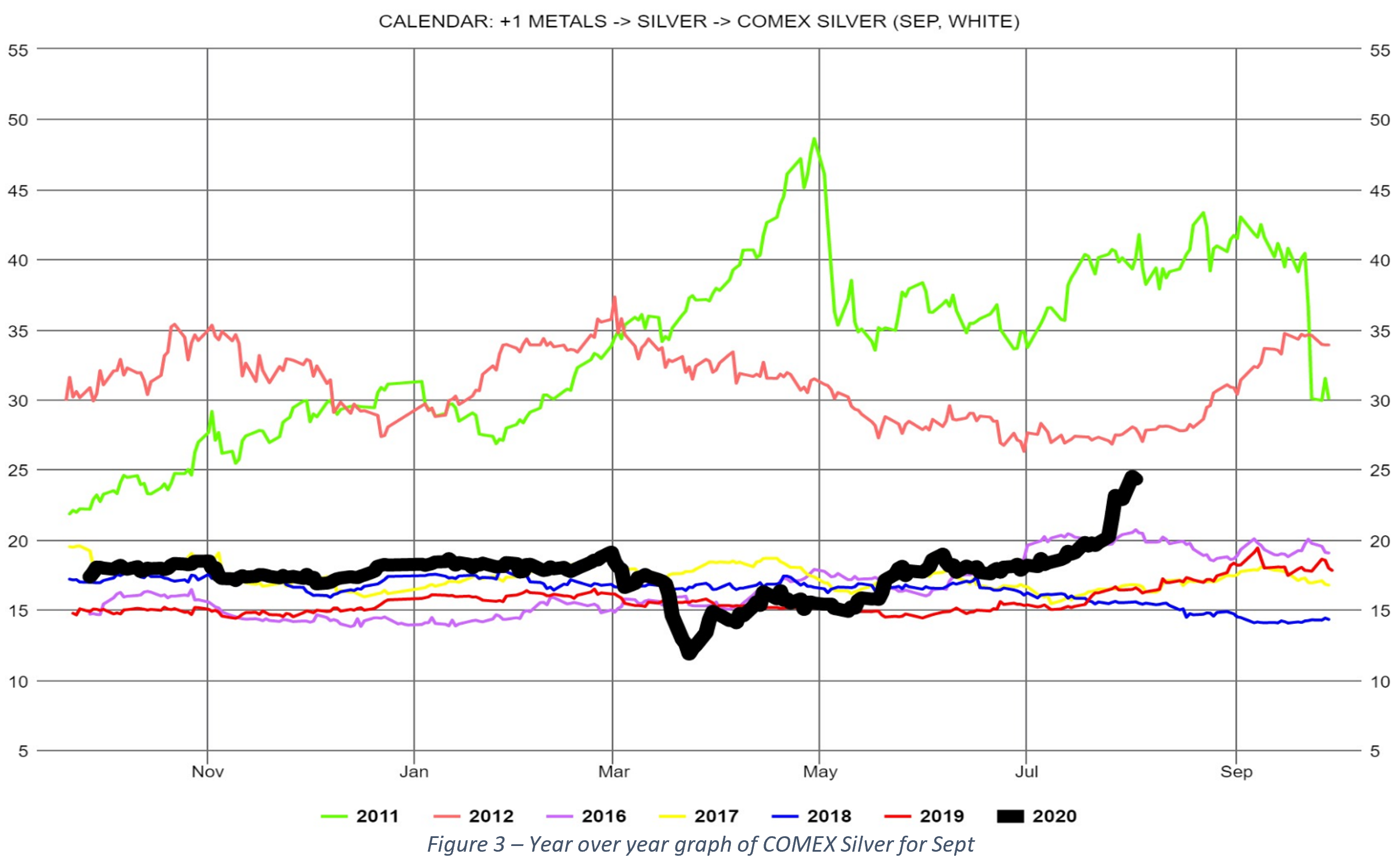

The past few days have been for the financial history books. This might be true for the few weeks too. Both gold and silver made significant gains since our last commentary a week ago. The ratio of the 1-month Gold contract to the 1-month Silver contract (Figure 1) continued the downward trending falling another 6.5% this last week as silver rallied much more than gold. With the front month silver and gold contracts closing yesterday at $24.27 and $1,944.70, respectively, the gold/silver ratio is now 80.14, or 24.9% higher than the 15-year average. Astute readers will observe that we changed our comparison this week from the 5-year average to the 15-year average to provide a better longer-term view of the ratio. December Gold (Figure 2) closed yesterday at $1963.90, up 5% since the 7/21 close, and September silver (Figure 3) moved up to $24.3 from $21.557 last week, reflecting an increase of 12.7% since the close on 7/21.

Total open interest for both metals continue to increase along with increasing prices which tends to indicate increased long positions versus short covering. Open interest on gold is up 30% since recent low in June 2020 and volume increased dramatically this week, up about 200% over last week. As with gold, silver volumes are close to historic highs and the most recent COT report shows continued increase in non-commercial net long positions. The number of gold short positions currently held by the bullion banks remain elevated from historic levels with difference between spot and front month contract at about $3.80/oz. In addition, the difference between the December and August gold contracts are down to $19.2/oz from this same time last week. As we have been saying over the last weeks, we believe longer-term health of the global economy as well as expectations about higher inflation may tend to keep gold elevated and rising.

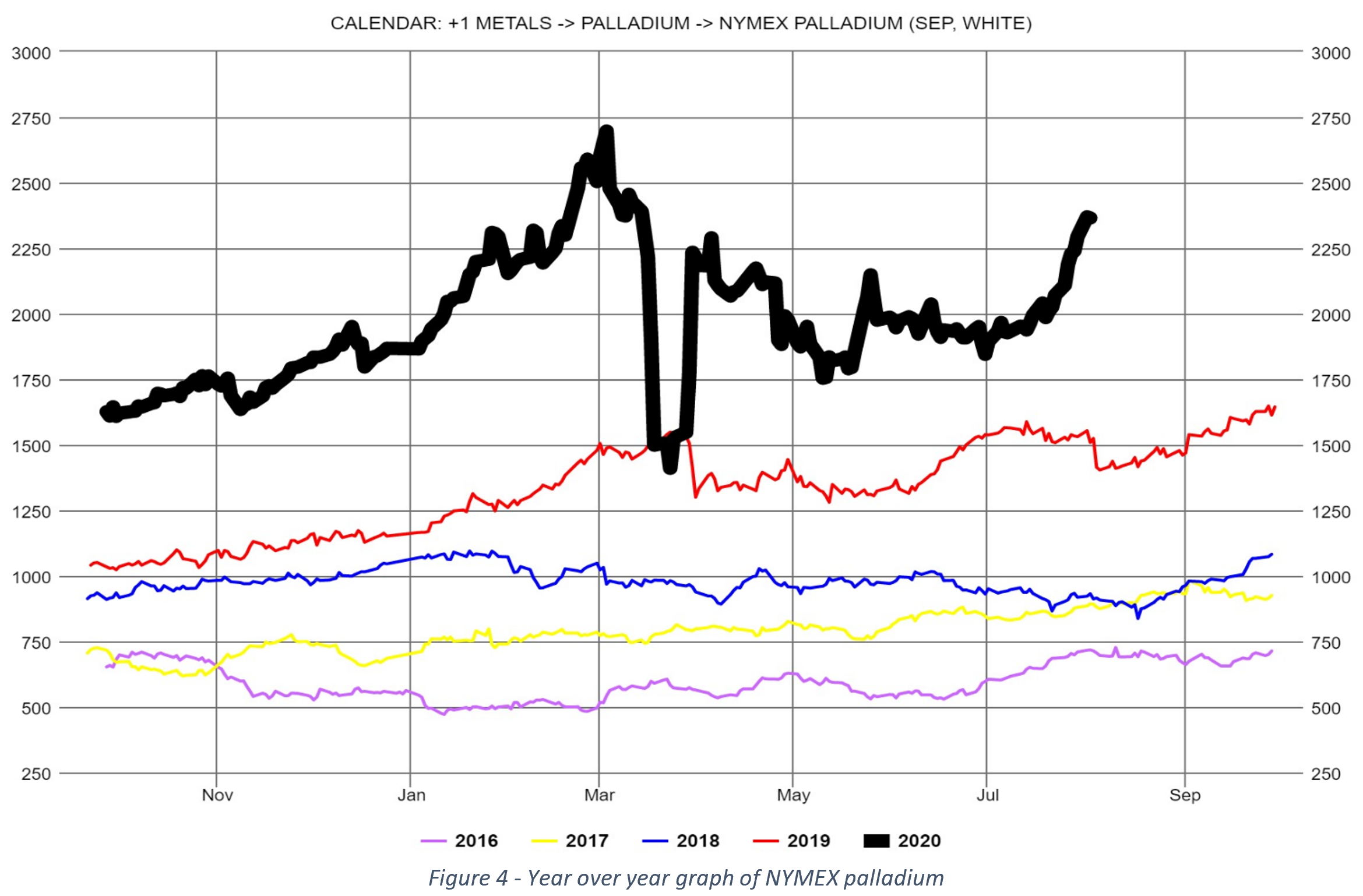

Now for Palladium. Palladium saw a large move up this last week and even with this move up, the palladium/silver ratio continues to fall. Total open interest as well as non-commercial net-position of funds continue to increase for palladium. While down significantly from before February 2020, total open interest is now up nearly 60% from its recent low in March, and the most recent COT report shows net non-commercial positions continue to increase as well. These factors bode well for continued support for palladium.

The final thoughts I leave with you today are from a paper and interview published this year. Both have to do with inflationary pressures, the same root cause, but explained in different ways. The first was written by Hans Fredrik Hansen, which was published in this years’ “In Gold we Trust” report, pages 160 – 176 titled “Monetary Endgame Head? When Absurdity Becomes the New Normal”. Hans discusses that they only way to increase growth in this environment is to increase the velocity of money which will eventually result in higher inflation. The interview was given by Scottish market strategist Russell Napier, who has for two decades seen deflation as the dominant theme. He is now warning of rising inflation, driven the need to reduce the massive government debt by ensuring inflation remains above bond yields for years. Both of these papers point to potential higher inflation and keeping government yields low, which will result in lower real rates which is good for the price of gold.

If you would like access to the great insights and analysis provided by the Fundamental Analytics platform, sign up for a 15-day free trial and demonstration!

If you have any questions, please contact our Technology Manager, Mike Secen at [email protected]

We also invite you to read our other articles and follow us on social media!

Best Regards,

The Fundamental Analytics Team

The information provided here is for general informational purposes only and should not be considered individualized investment advice. All expressions of opinion are subject to change without notice in reaction to shifting market conditions.