Refiners Trying to Reduce Distillates Oversupply

July 10, 2020

Distillates demand is increasing, but it has been sluggish and uneven. As a result, refiners have been left making too much despite shifting their processes to maximize summer driving-season gasoline output and reduce distillate yields.

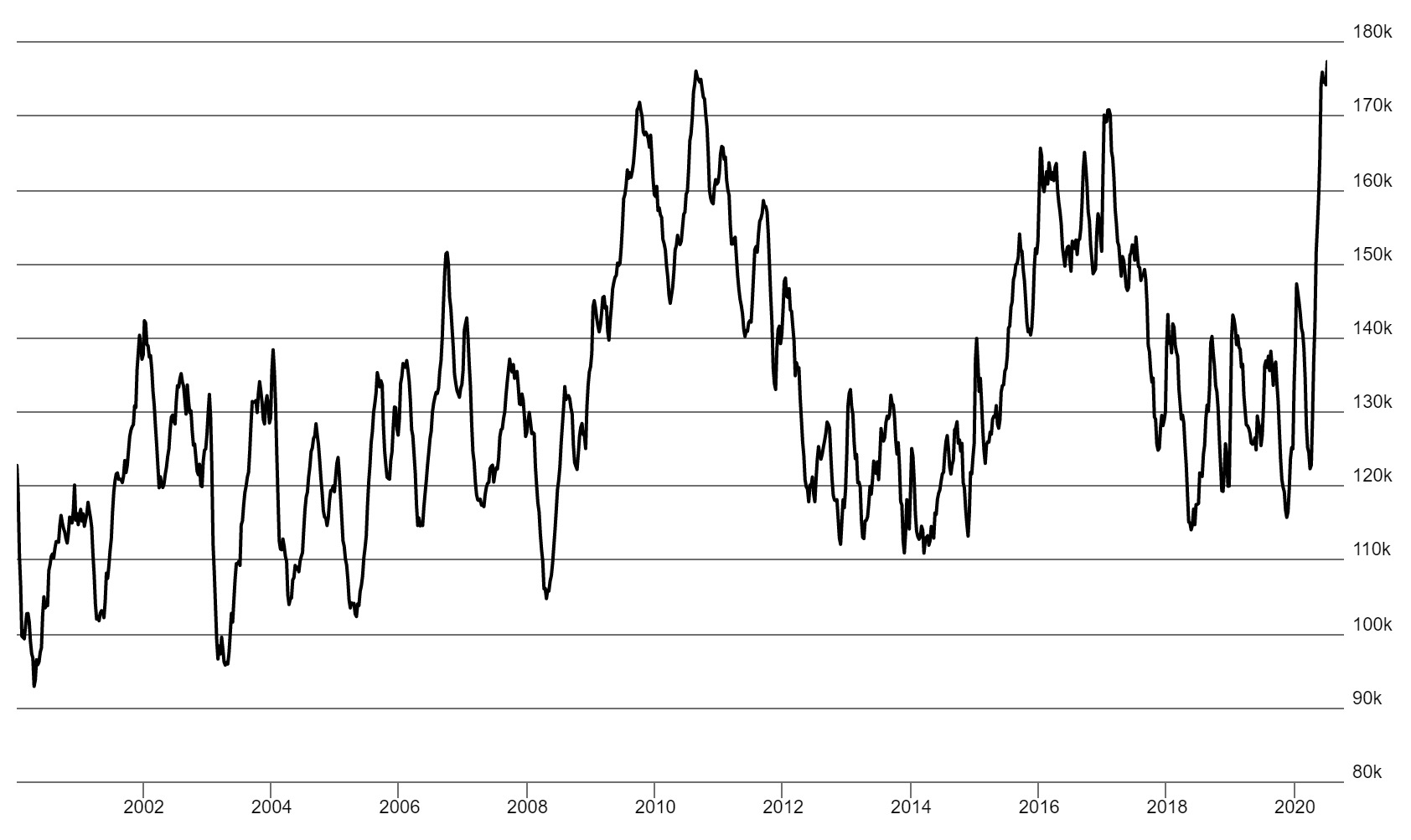

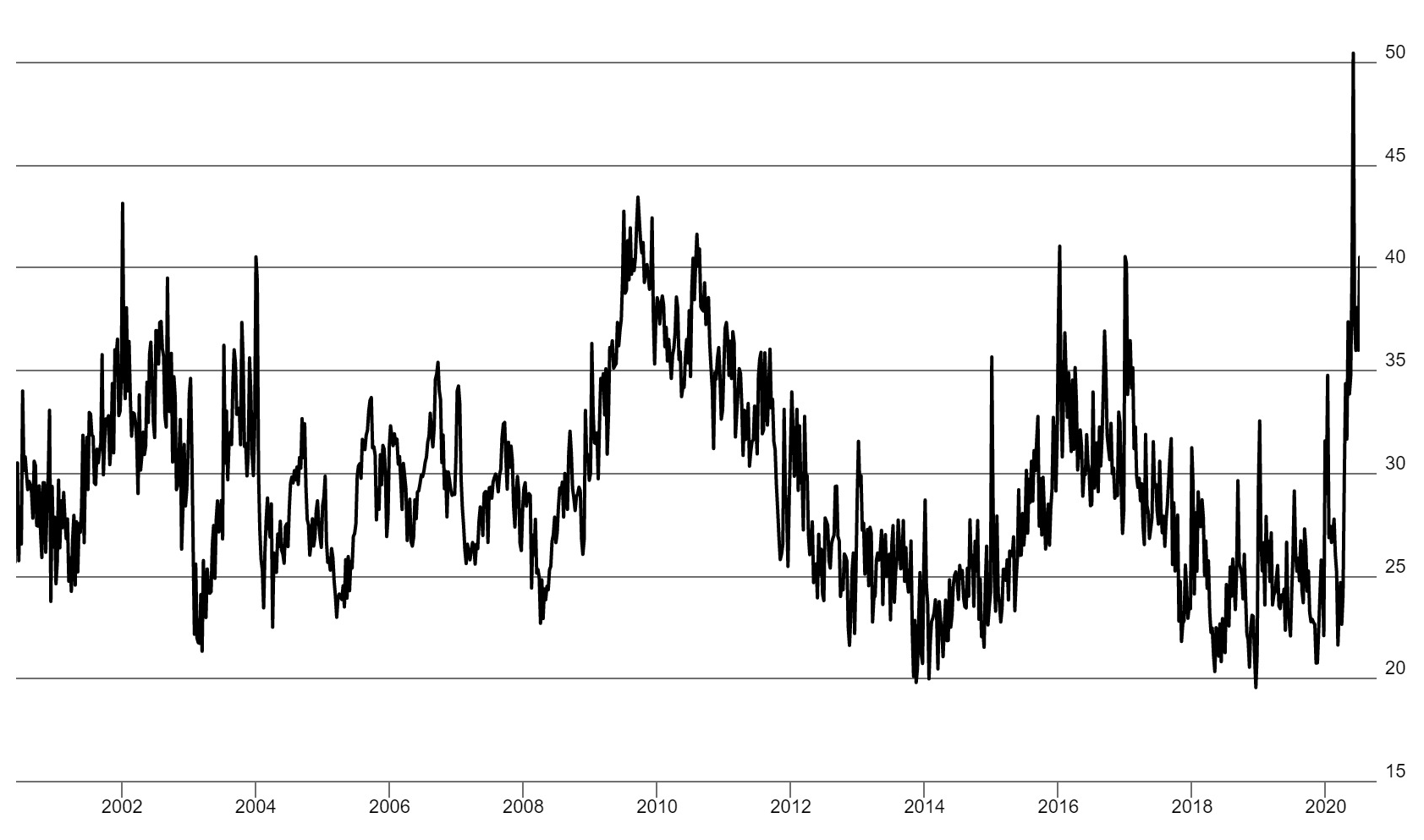

Distillate stocks have continued to climb, hitting 177.6 million barrels as of the July 3, 2020 EIA report. This level is 39 million barrels higher than the five-year average, and the highest level for almost 38 years. (See figure 1) When the stocks are adjusted relative to demand, the current stocks are now at 40.5 days of forward supply, having peaked at 50.7. (See figure 2) This oversupply of distillate stocks means refiners may have to change strategy and reduce output even further over the next few weeks to get diesel stocks under better control.

The chart below can be constructed in the Fundamental Analytics platform under Fundamentals > DOE > Distillate Fuel Oil > Stocks > Total US.

Figure 1 – Total Distillates Stocks

Latest Data as of Friday, July 3, 2020 177.6 million barrels

The chart below can be constructed in the Fundamental Analytics platform under Fundamentals > DOE > Distillate Fuel Oil > Days Forward Supply.

Figure 2 – Days Forward Supply

Latest Data as of Friday, July 3, 2020 40.5 Days Forward Supply

If you would like access to the great insights and analysis provided by the Fundamental Analytics platform, sign up for a 15-day free trial and demonstration!

If you have any questions, please contact our Managing Director, Joel Fingerman, at [email protected]

We also invite you to read our other articles and follow us on social media!

Best Regards,

The Fundamental Analytics Team

The information provided here is for general informational purposes only and should not be considered individualized investment advice. All expressions of opinion are subject to change without notice in reaction to shifting market conditions.