Gold, Silver, and Palladium Commentary

July 8, 2020

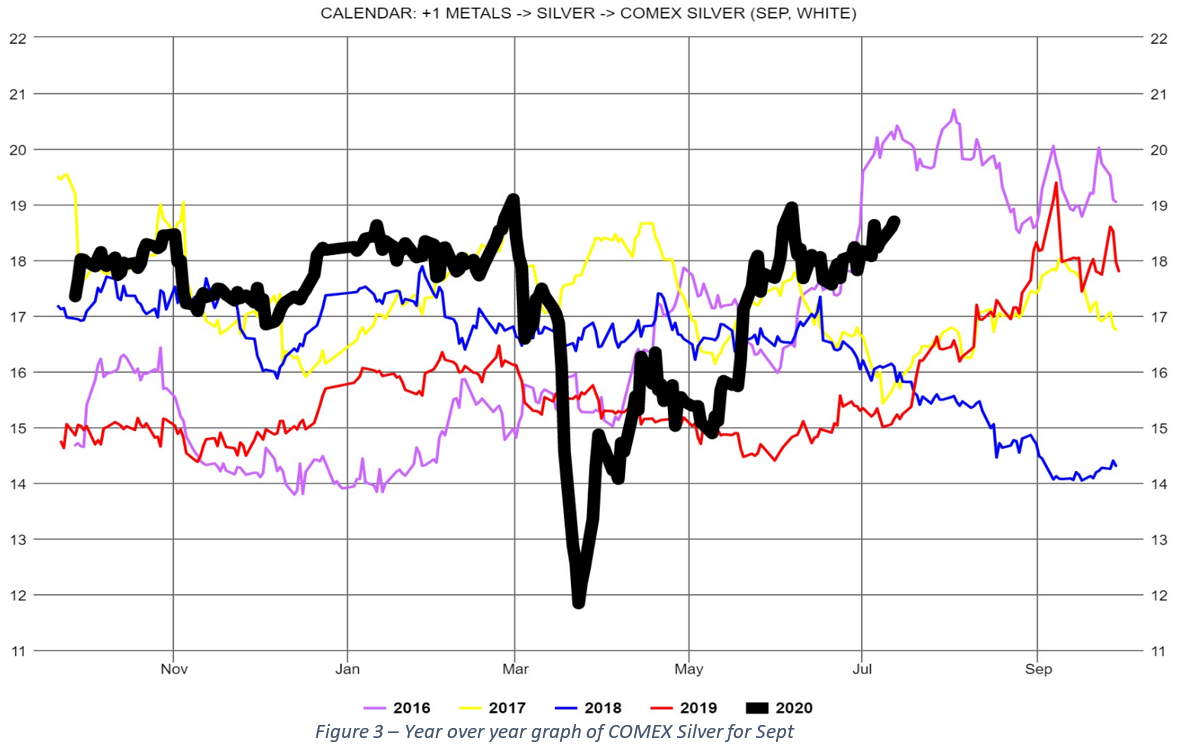

The ratio of the 1-month Gold contract to the 1-month Silver contract (Figure 1) continued to slip lower over the last week. With the front month silver and gold contracts closing yesterday at $18.62 and $1,804.2, respectively, the gold/silver ratio is now 96.85, down about 1% from last week. August Gold (Figure 2) continued moving up, again trying to remain above 1800 while September silver (Figure 3) moved up to $18.699 from $18.218 last week. While silver remains in the trading range between 16.5 and 19, total open interest increased for the last few trading days but remains well below the recent peak of June 22, 2020.

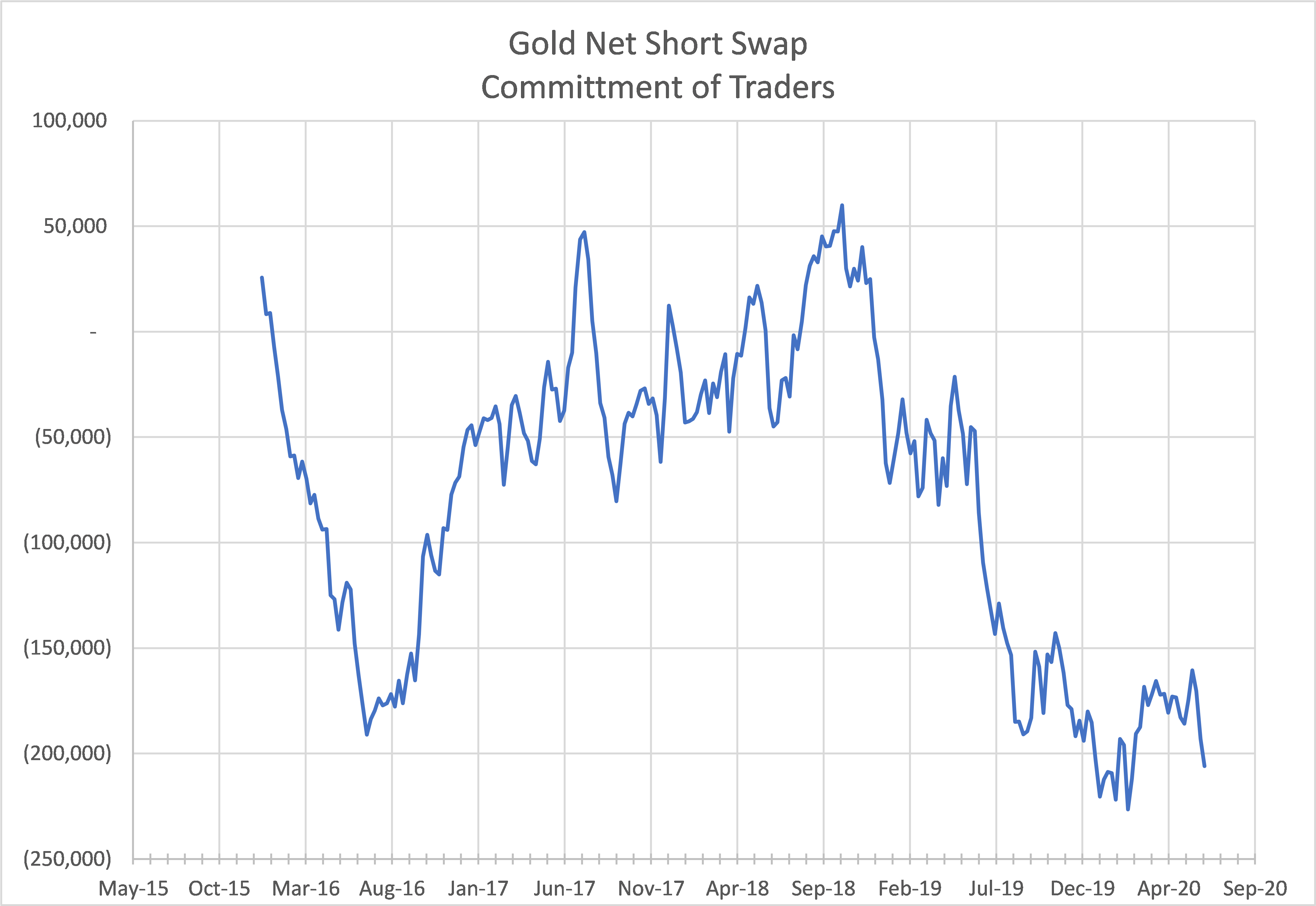

On 7/7/2020 the August COMEX gold contract (Figure 2) ended the day at $1,809.9, up from $1,800.5 at the close on 6/30/2020. Open interest has leveled off since last week and it is interesting to note that it remains at levels seen 2017 – 2019, but the volume 50-day SMA remains at levels more consistent with Dec 2009 – Nov 2016. Gold is moving up today with expectations of increasing inflation from money added to the economy due to COVID. This continues to drive down real yields of Treasuries, which negatively correlates with gold prices. However, should equities turn south, this could drive demand for liquidity, causing some downward pressure on gold. We expect gold to trade in the range between $1,774 and $1,837 for the next week.

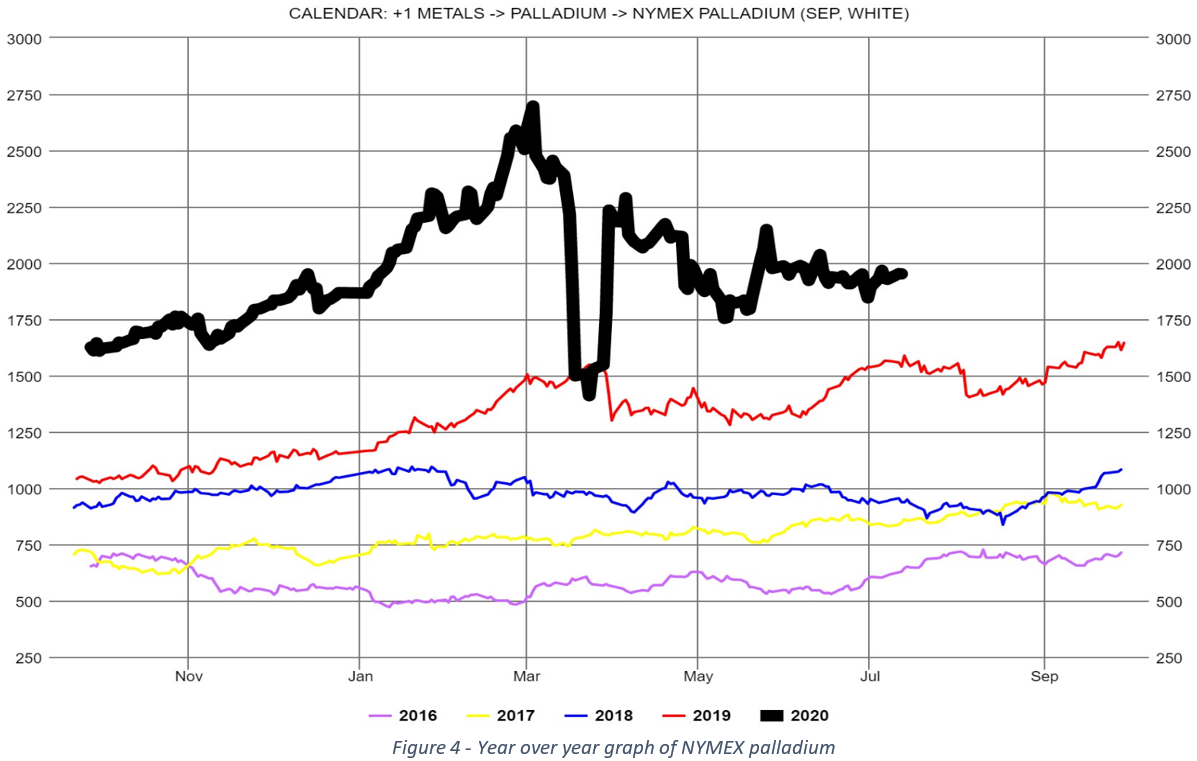

Palladium remains essentially unchanged since last week, and open interest continues to build very slowly, but it is still below values at the end of March 2020. As mentioned last week we will continue to watch this trend to see if there may be early signs of a directional move. Without a clear signal of increasing open interest or news on increased production demand, we expect palladium to continue to trade in a similar pattern for the near future.

If you would like access to the great insights and analysis provided by the Fundamental Analytics platform, sign up for a 15-day free trial and demonstration!

If you have any questions, please contact our Technology Manager, Mike Secen at [email protected]

We also invite you to read our other articles and follow us on social media!

Best Regards,

The Fundamental Analytics Team

The information provided here is for general informational purposes only and should not be considered individualized investment advice. All expressions of opinion are subject to change without notice in reaction to shifting market conditions.