Gold, Silver, and Palladium Commentary

July 1, 2020

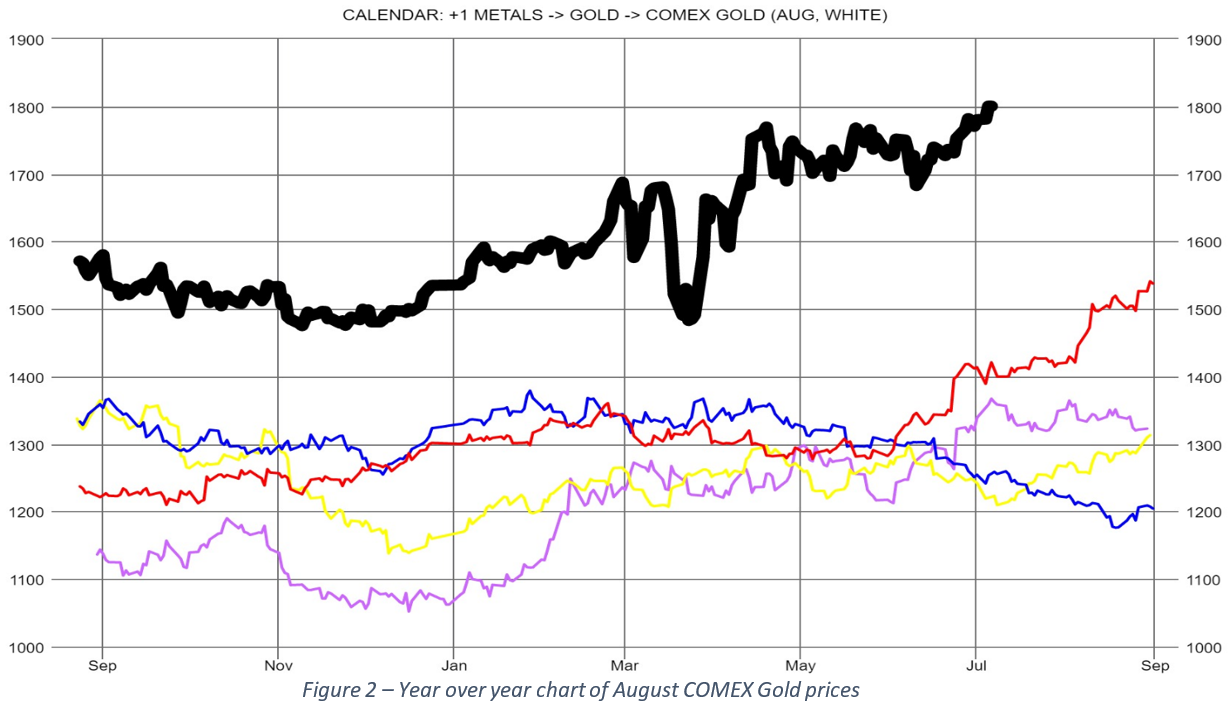

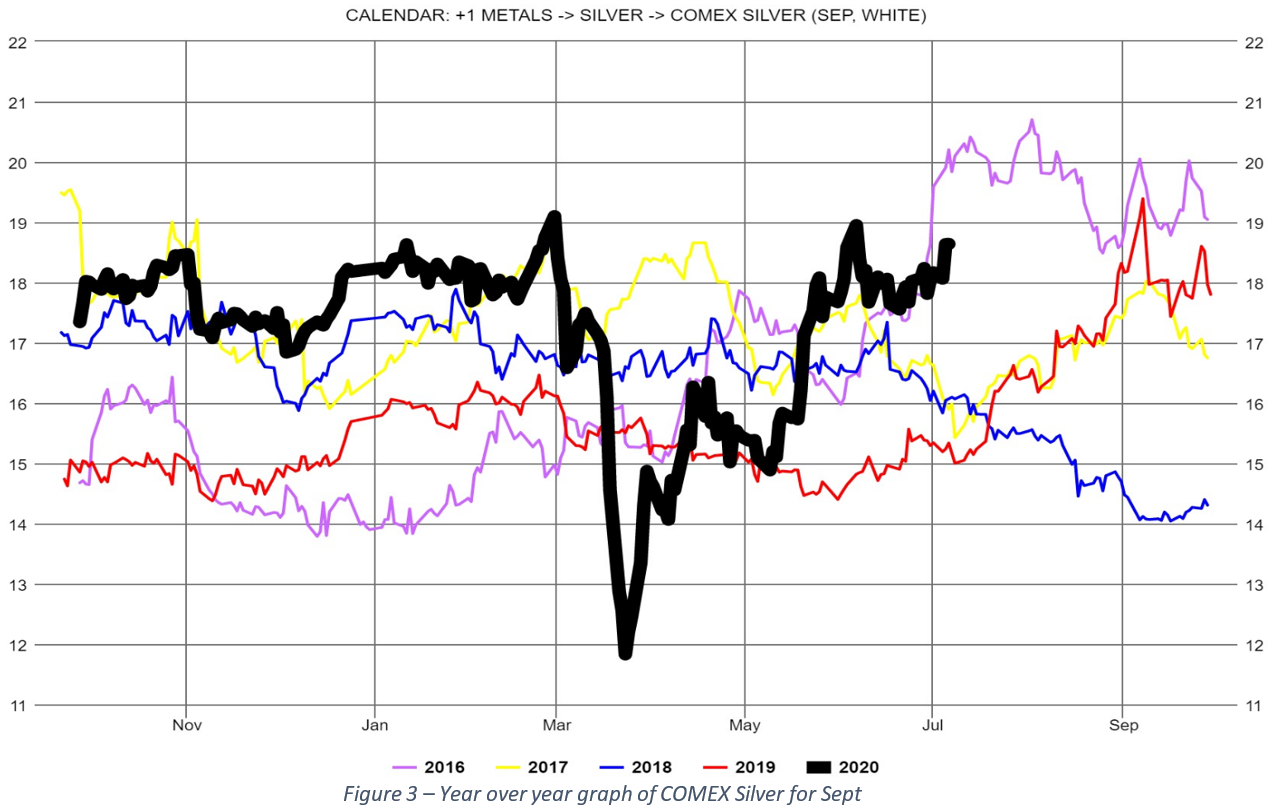

The ratio of the 1-month Gold contract to the 1-month Silver contract (Figure 1) fell from the value last week. With the front month silver and gold contracts closing yesterday at $18.54 and $1,793, respectively, the gold/silver ratio is now 96.70, up 24% from the its five-year average of 78. August Gold (Figure 2) moved to the top of the trading range listed for last week while September silver (Figure 3) is up 2.1% since last week’s commentary. While silver remains in the trading range between 16.5 and 19, the latest rise in silver appears to have occurred on falling open interest, so silver may be slowing its ascent.

On 6/30/2020 the August COMEX gold contract (Figure 2) ended the day at $1,800.5, up from $1,782 at the close on 6/23/2020. Open interest has continued to climb during the same time and is up 2% since Tuesday 6/23/2020. As we have mentioned over the last several weeks, there is a good case for an increase in the price of gold due to demand for safe-havens due to COVID and other geopolitical issues. While gold is pushing to the top of its recent trading range, we expect gold will continue to trade in the range between $1,784 and $1,812 for the next 7 days.

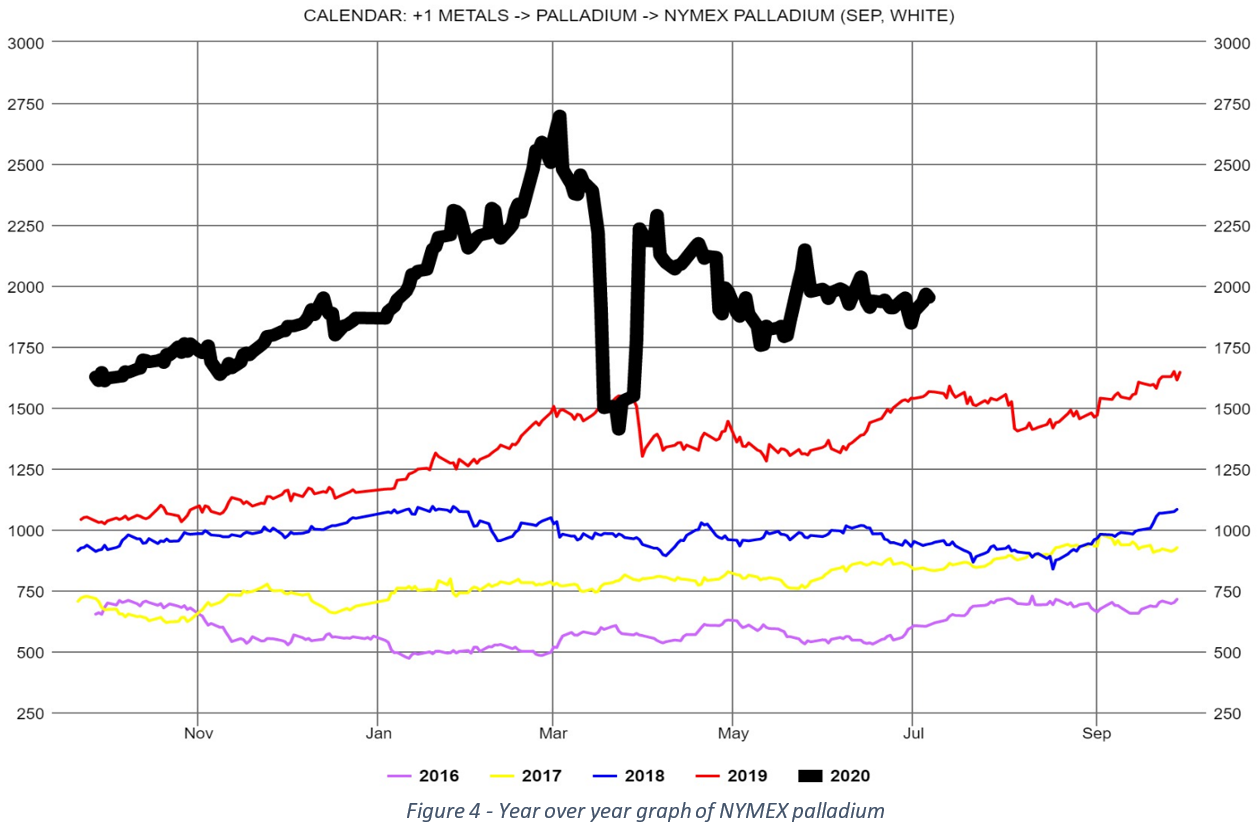

Palladium remains essentially unchanged since last week, even though it dipped during the week open interest continues to slowly increase. As mentioned last week we will continue to watch this trend to see if there may be early signs of a directional move. Without a clear signal of increasing open interest or news on increased production demand, we expect palladium to continue to trade in a similar pattern for the near future.

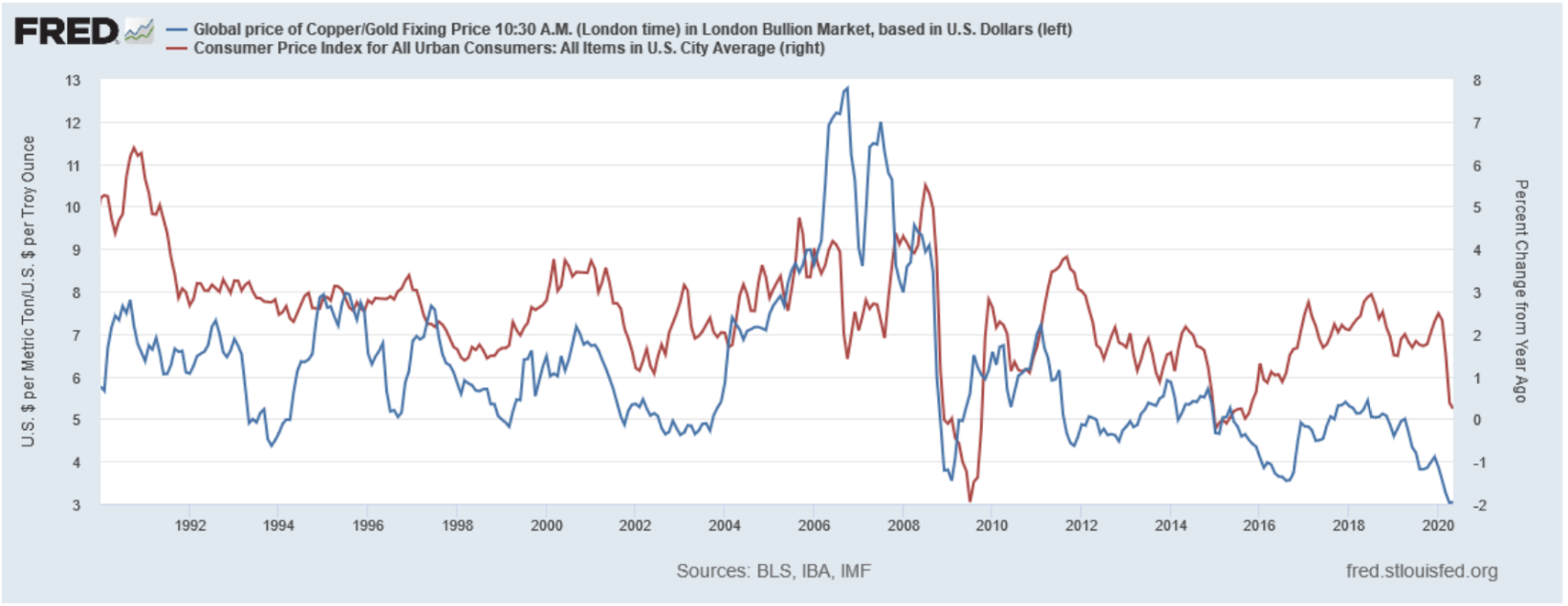

Finally, I leave you with the graph of ratio of copper to gold along with the yearly change in the consumer price index. While not perfect, there is reasonable correlation between the two and may be useful in signaling rising inflation. As there are significant discussions surrounding the large influx of easy money by the Fed, inflation, and the price of gold, we wanted to present this chart. (A similar chart was presented in the 2020 In Gold we Trust report, published in late May of 2020.) Although it is difficult to see due to the time scale, the ratio is beginning to rise from its low on April 9 of 2020. While much of this rise may be in the recovering of the price of copper, due to the fall in demand, this may be useful to watch longer term.

If you would like access to the great insights and analysis provided by the Fundamental Analytics platform, sign up for a 15-day free trial and demonstration!

If you have any questions, please contact our Technology Manager, Mike Secen at [email protected]

We also invite you to read our other articles and follow us on social media!

Best Regards,

The Fundamental Analytics Team

The information provided here is for general informational purposes only and should not be considered individualized investment advice. All expressions of opinion are subject to change without notice in reaction to shifting market conditions.