Gold, Silver, and Palladium Commentary

June 17, 2020

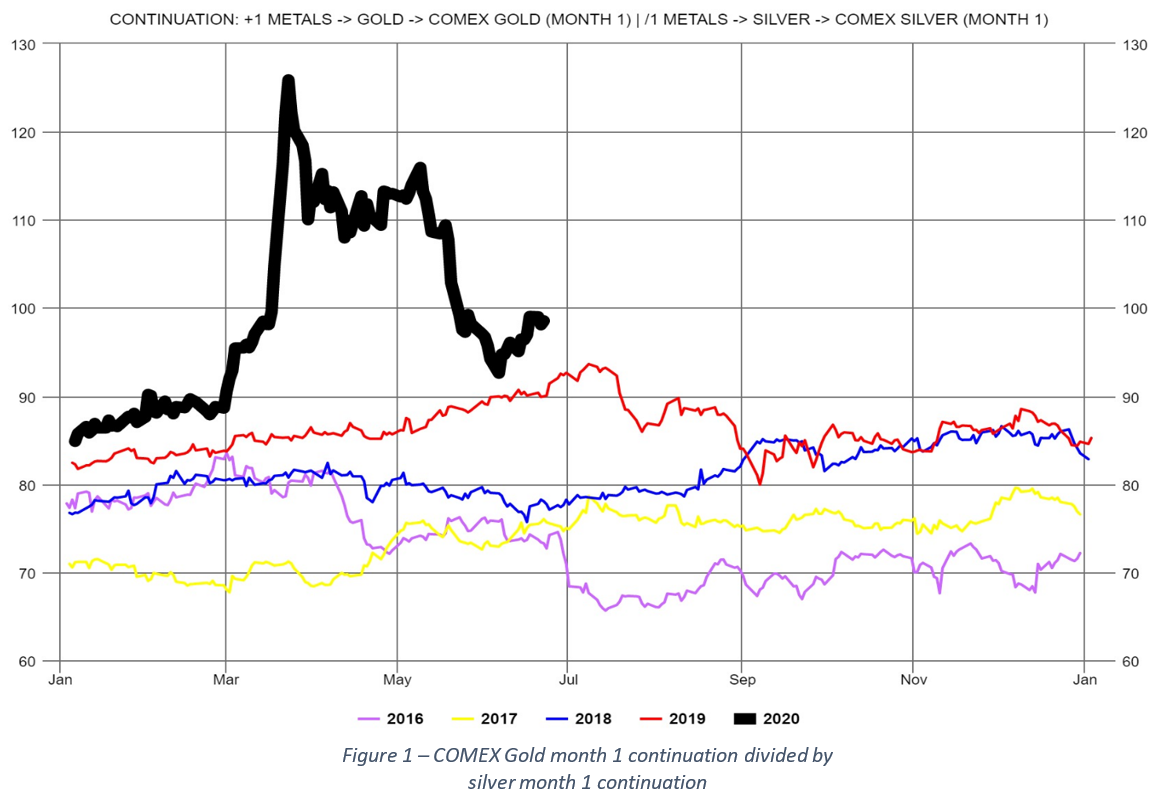

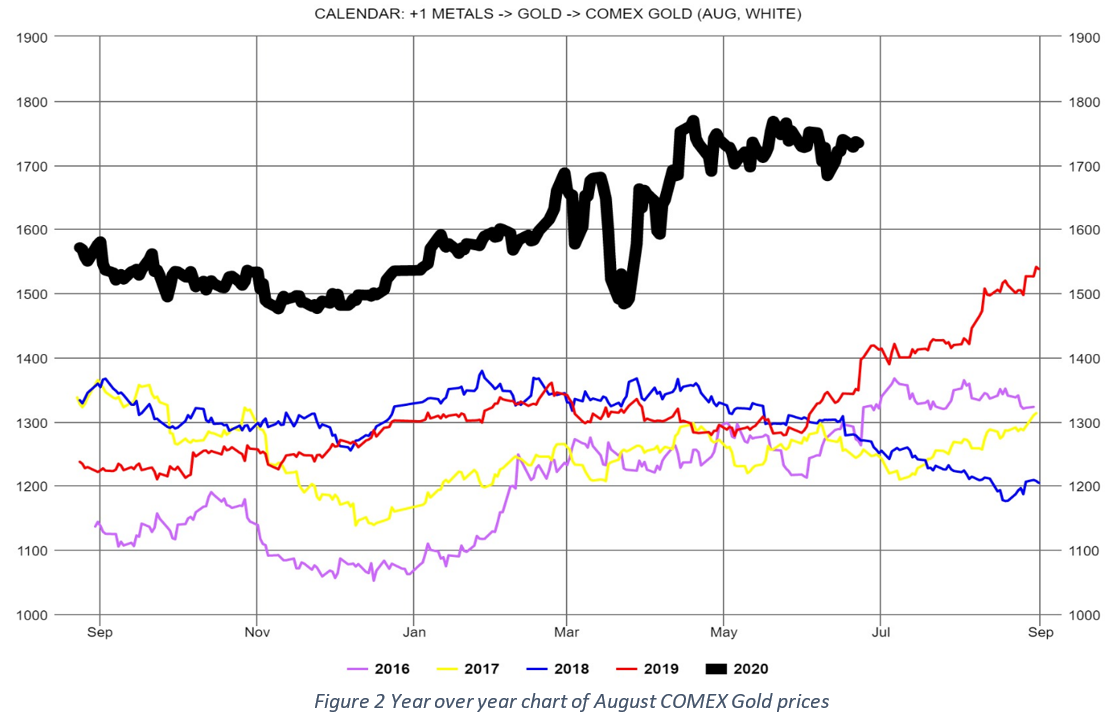

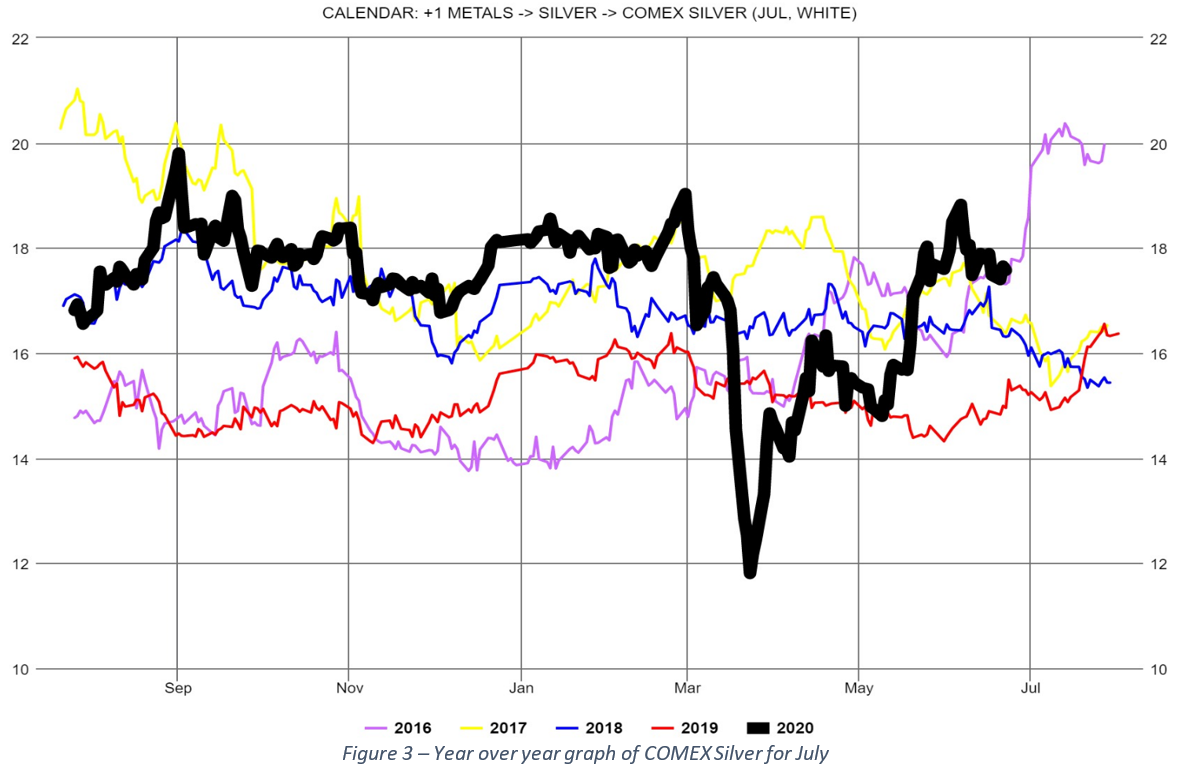

On 6/16/2020 the August COMEX gold contract (Figure 2) ended the day at $1,733, up from $1,721 at the close on 6/8/2020 while for the first time since mid-May, there was a small increase in open interest. This combined with an increase in implied volatility, over the last three weeks, and skewing to the downside may indicate traders are preparing for retest of the $1,680 area. This taken together with the thesis of the 2015 In Gold We Trust extended report highlighting the tendency for gold to go lower while the gold/silver ratio is increasing, increases the likelihood of short-term selling. We expect gold will continue to trade in the range between $1,674 and $1,771 for the next 7 days.

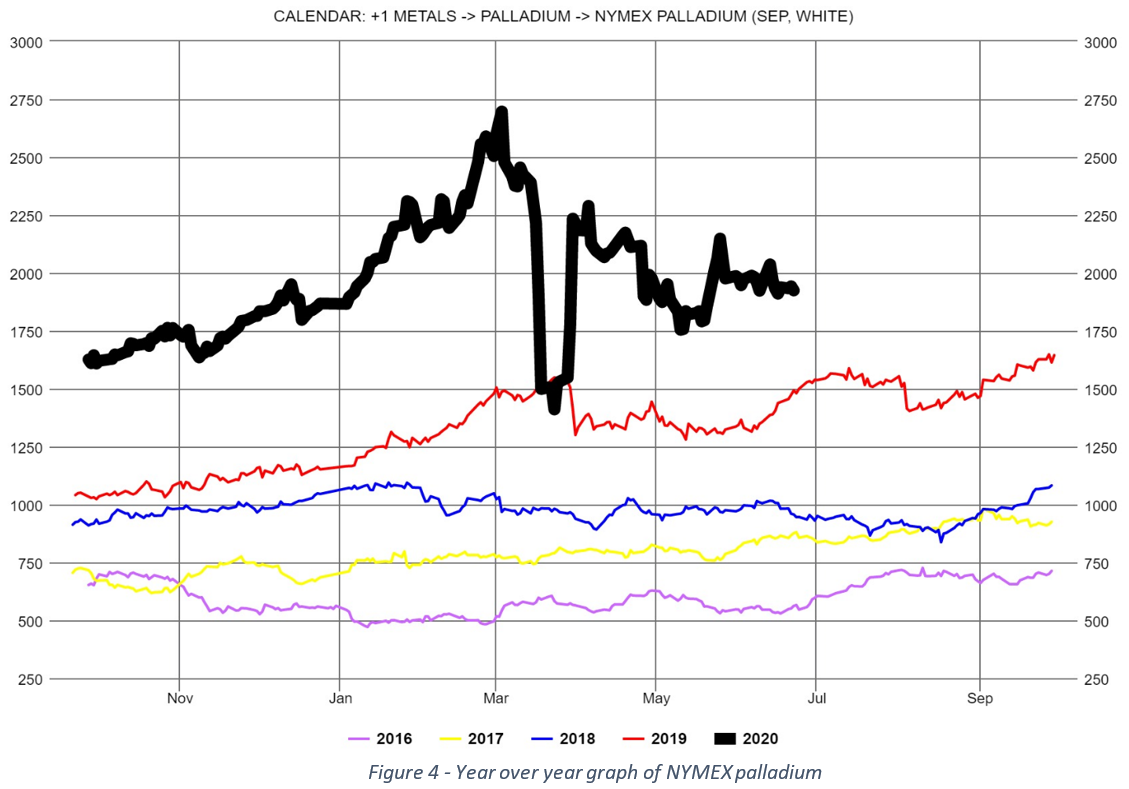

Palladium was essentially unchanged for the last few weeks while total open interest, as it continues to decline, is doing so slowly. Without a clear signal of increasing open interest or news on increased production demand, we expect palladium to continue to trade in a similar pattern for the near future.

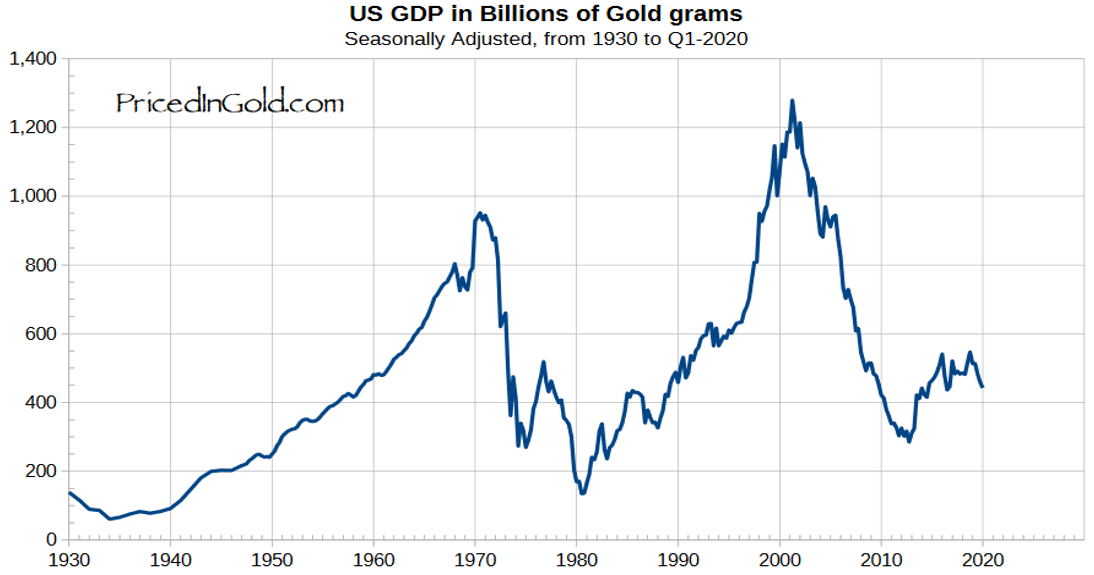

Finally, I leave you with the PricedInGold.com chart showing GDP in billions of gold grams. The price of gold began its latest climb in June of 2019, while this chart shows the GDP in terms of gold grams began to decline at the end of 2018. Even with the FED intervention beginning again in 2019, this chart was declining before gold began its climb. It seems that increasingly larger injections may be required to maintain a system that depends so much on Fed’s monetization. As gold prices rise, it takes less gold to buy the nation’s GDP, implying an upward trend for gold prices.

If you would like access to the great insights and analysis provided by the Fundamental Analytics platform, sign up for a 15-day free trial and demonstration!

If you have any questions, please contact our Technology Manager, Mike Secen at [email protected]

We also invite you to read our other articles and follow us on social media!

Best Regards,

The Fundamental Analytics Team

The information provided here is for general informational purposes only and should not be considered individualized investment advice. All expressions of opinion are subject to change without notice in reaction to shifting market conditions.