Gold, Silver, and Palladium Commentary June 10, 2020

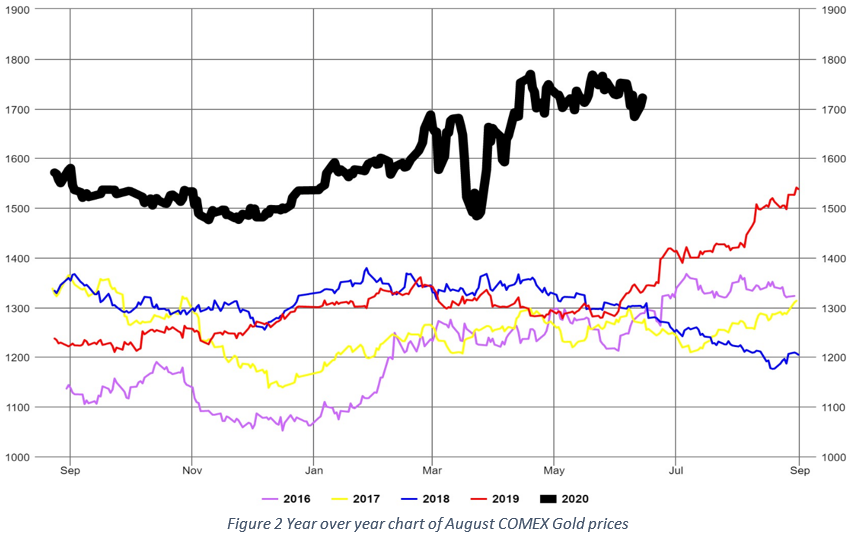

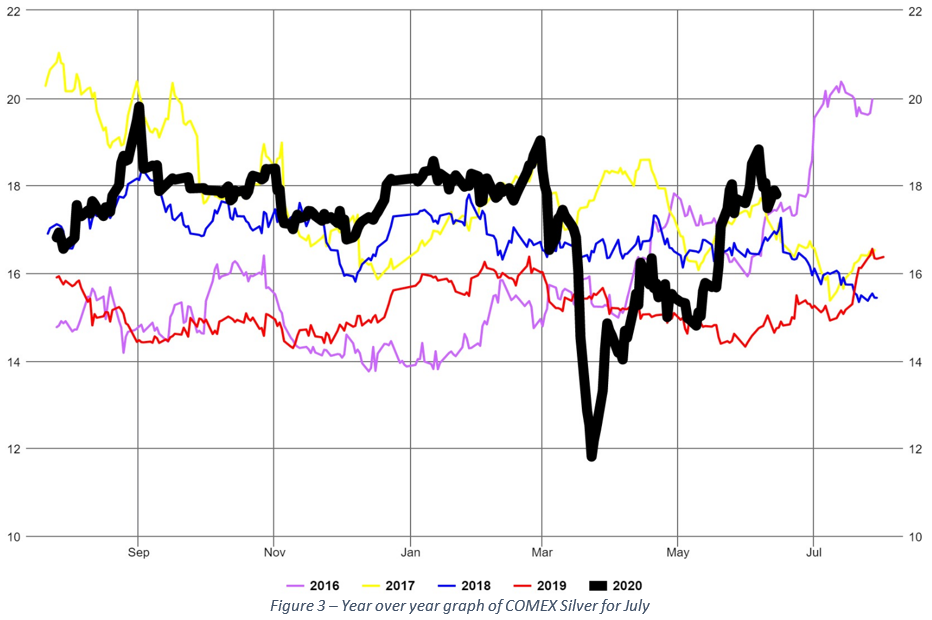

The ratio of the 1-month Gold contract to the 1-month Silver contract (Figure 1) halted its decline this week. With the front month silver and gold contracts closing yesterday at $17.83 and $1,716.10, respectively, the gold/silver ratio is now 96.25, down 23.6% from its all-time high set on 3/18/2020. August Gold (Figure 2) continued to trade sideways while July silver (Figure 3) has paused after breaking out of a channel in the early part of May. Silver’s recent runup coincided with a 30% increase in open interest, seeming to indicate an increase in net longs. This was confirmed by commitment of trader data. As of the first week of June this accumulation has paused while price has declined from its high on June 1, 2020. Silver now appears to be settling back into a trading range between $16.50 and $19.00, waiting for the next catalyst to drive the metal’s prices.

The Fed’s announcement earlier today that it intends to hold rates near or at zero level supports precious metals’ prices. On 6/8/2020 the August COMEX gold contract (Figure 2) ended the day at $1,721, down from $1,734 at the close on 6/2/2020. This change has coincided with a continued drop in gold open interest, bringing levels back to those seen in May 2019. Several articles were written over last month raising concerns about the short positions many banks found themselves in, resulting in some deciding to exit the gold markets. Any effects of this will need to be monitored in future months.

While unemployment news and market directions appear to be positive, we continue to have reservations about the speed of the recent recovery. Even though last week’s news and market uptrend are putting downward pressure on gold, we believe the massive stimulus, flattening of the yield curve, and a slower recovery than expected will keep upward or supporting pressure on the price of gold. We expect gold will continue to trade in the range between $1,665 and $1,750 for the next 7 days.

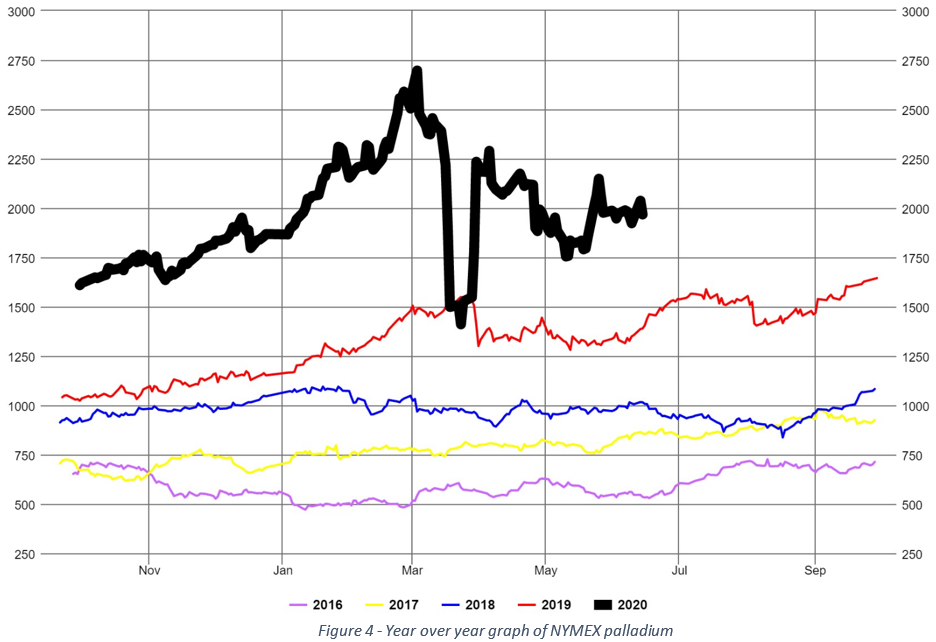

Palladium was essentially unchanged for the last few weeks as total open interest, while it continues to fall, has slowed its decent. Without a clear signal of increasing open interest or news on increased production demand, we expect palladium to continue to trade in a similar pattern for the near future.

If you would like access to the great insights and analysis provided by the Fundamental Analytics platform, sign up for a 15-day free trial and demonstration!

If you have any questions, please contact our Technology Manager, Mike Secen at [email protected]

We also invite you to read our other articles and follow us on social media!

Best Regards,

The Fundamental Analytics Team

The information provided here is for general informational purposes only and should not be considered individualized investment advice. All expressions of opinion are subject to change without notice in reaction to shifting market conditions.