Energy

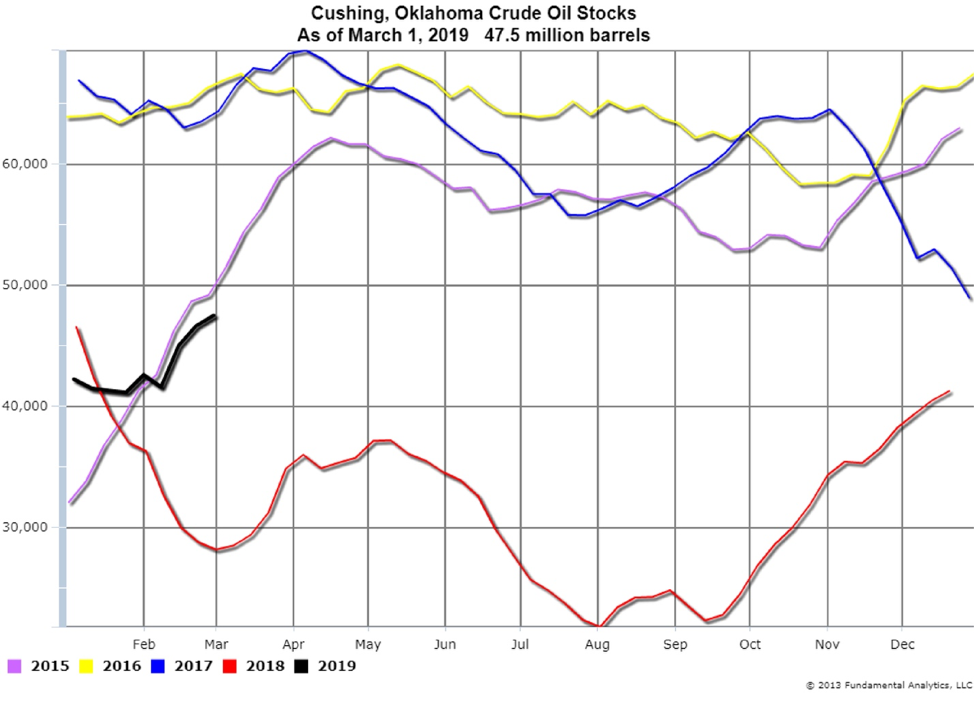

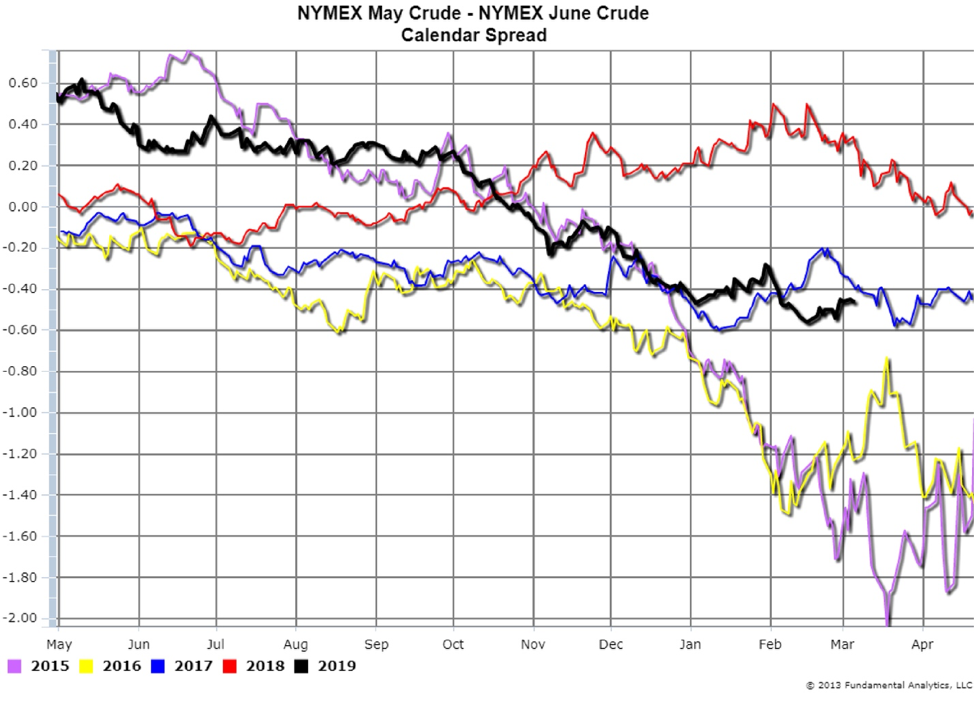

The calendar spread of NYMEX May Crude – NYMEX June Crude for the 2019 contracts has decreased from positive 60 cents last May (Chart 1, black line) to negative 39 cents as of March 5. These calendar spreads of consecutive months are often called “front-to-back” spreads. The value of the front-to-back spreads often is inversely correlated to crude stocks at Cushing, Oklahoma (Chart 2), the delivery point of the NYMEX crude oil contracts. As stocks increase at Cushing, there tends to be downward pressure on the front-to-back spreads. Cushing stocks have been increasing since last August, from 20 million barrels to 47.5 million barrels as of March 1 (Chart 2, red and black lines), and correspondingly the May-June Crude spread has been decreasing. See the Chart 3 scatterplot of this inverse relationship. Should the Cushing stocks continue to increase, as we expect, this will continue to pressure the front-to-back crude calendar spreads.

Chart 1

Chart 2