DOE Insights August 15, 2018

Crude Oil Stocks Draw, Greater than Expectations

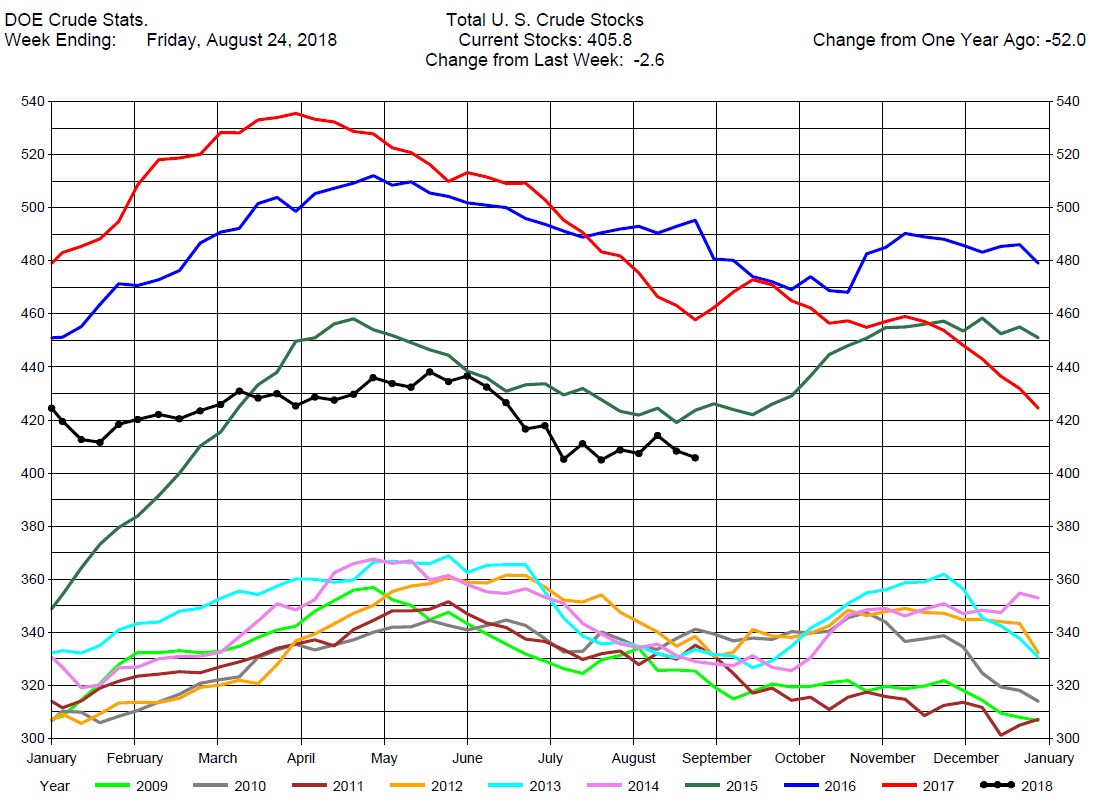

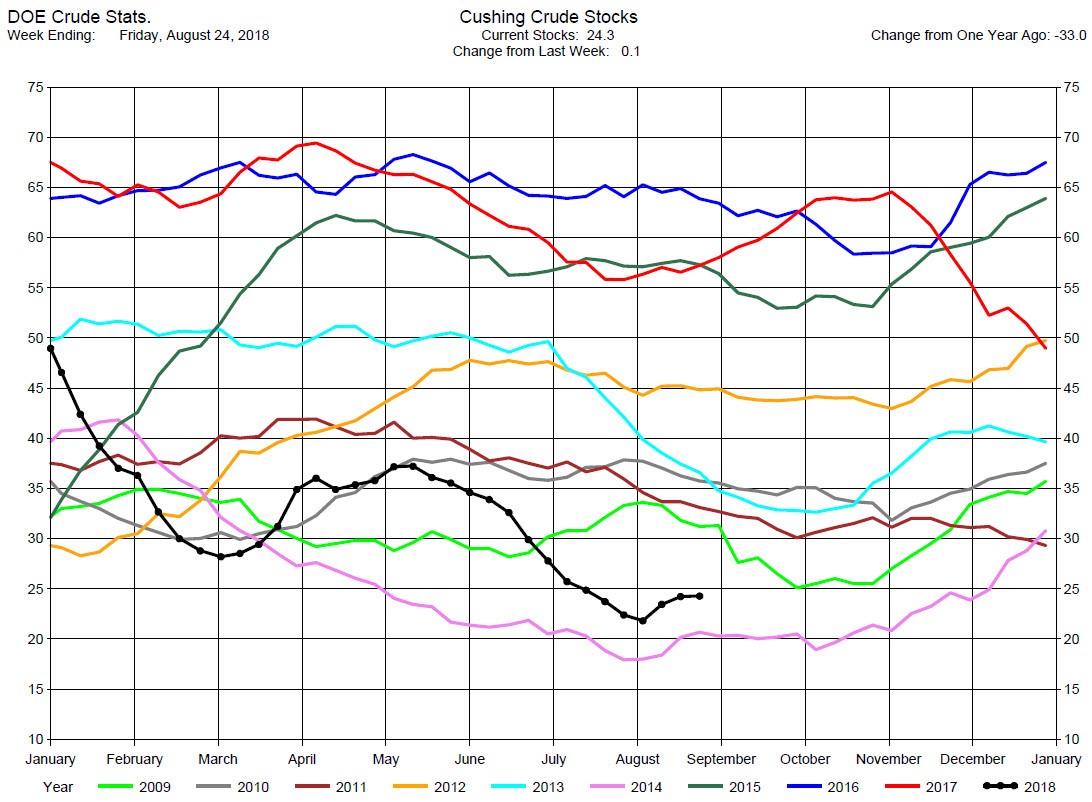

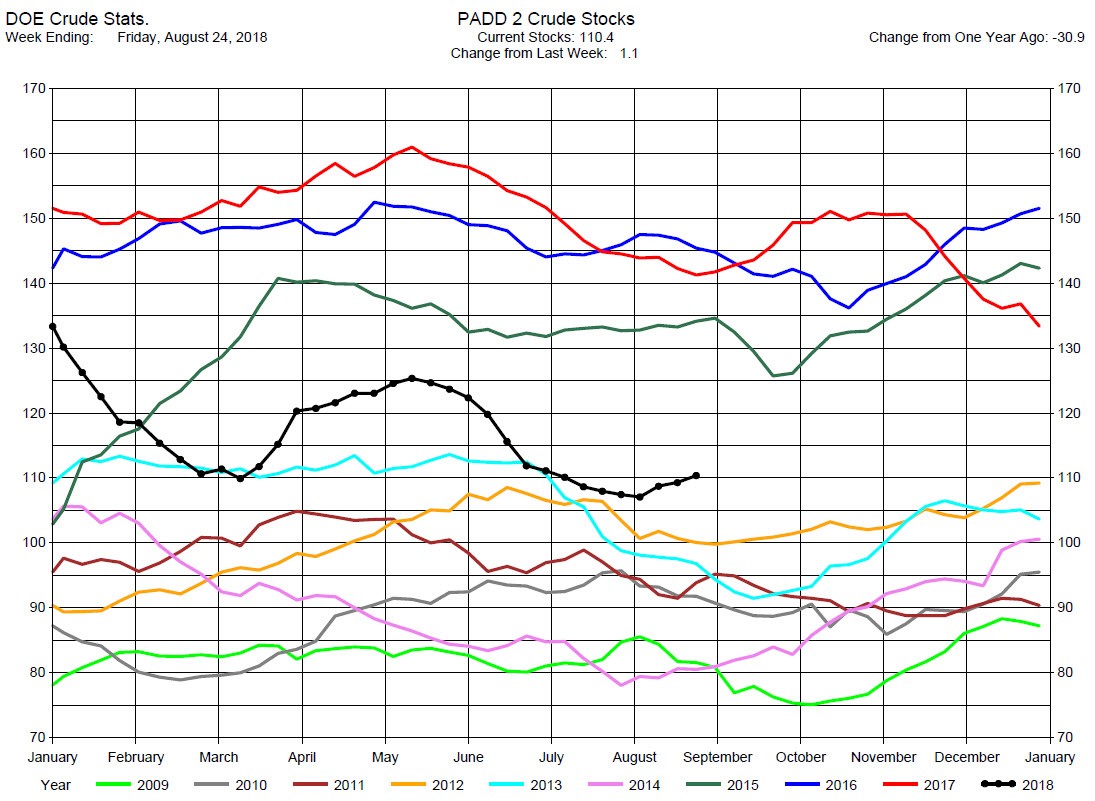

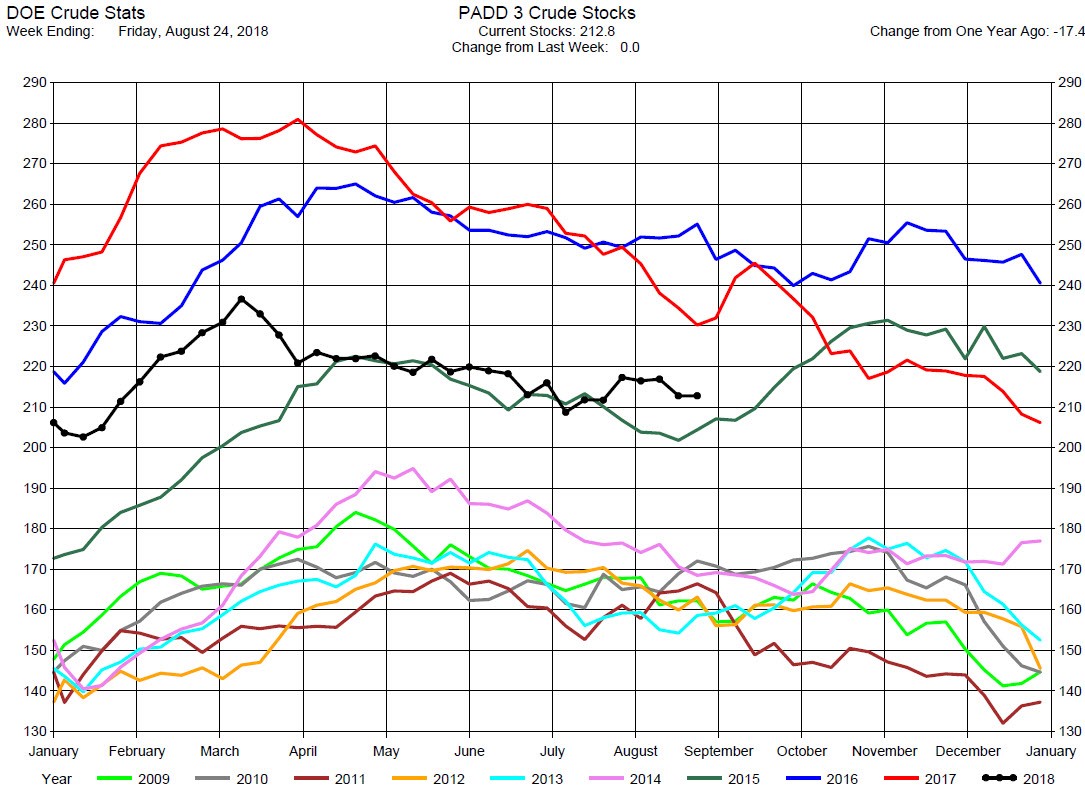

The DOE reported Total Crude Oil Inventories decreased by 2.8 million barrels to 405.8 million barrels for the week ending August 24, 2018, while expectations average was for a 1.0 million barrel decrease.

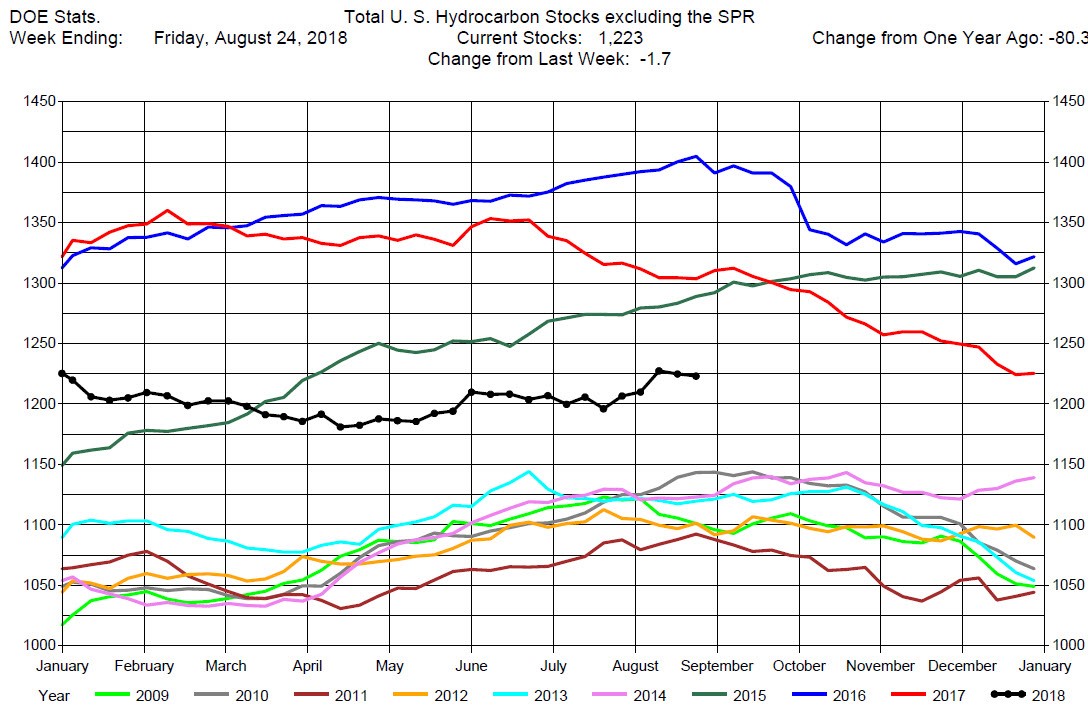

Overall hydrocarbon supplies decreased by 1.75 million barrels to 1,223 million barrels.

Crude Oil Production was unchanged at 11.0 million barrels per day.

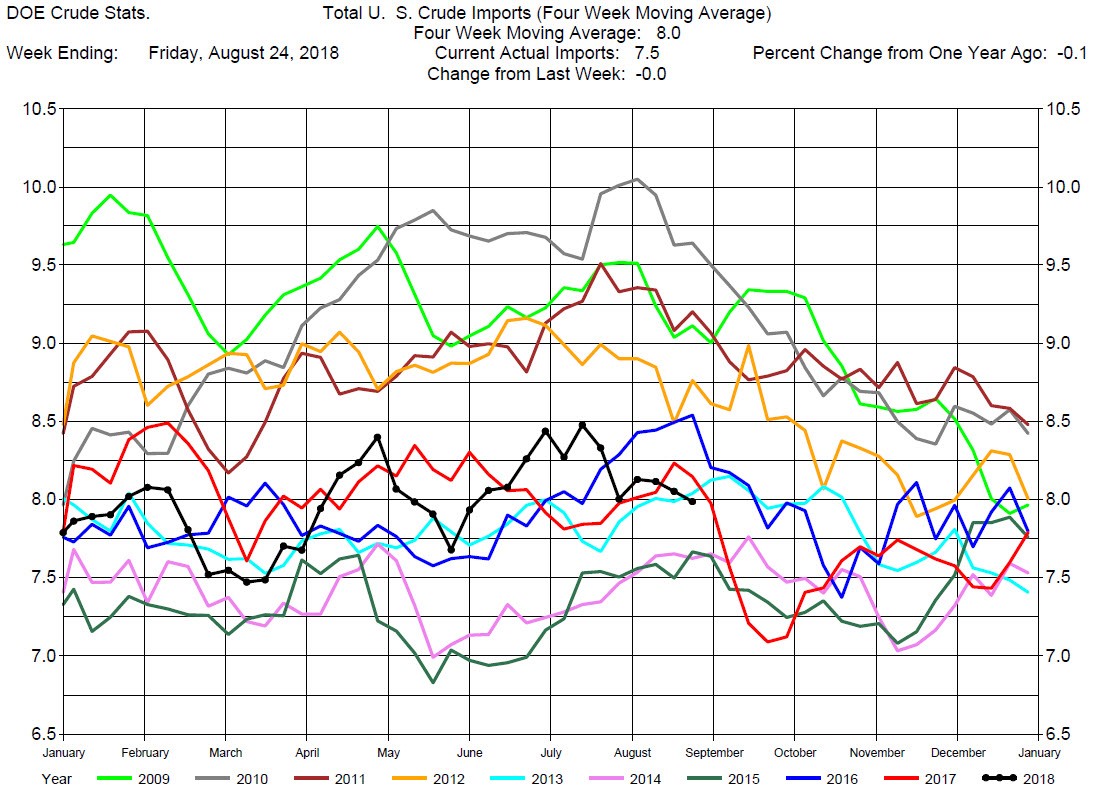

Total Crude Imports were also unchanged at 7.5 million barrels per day.

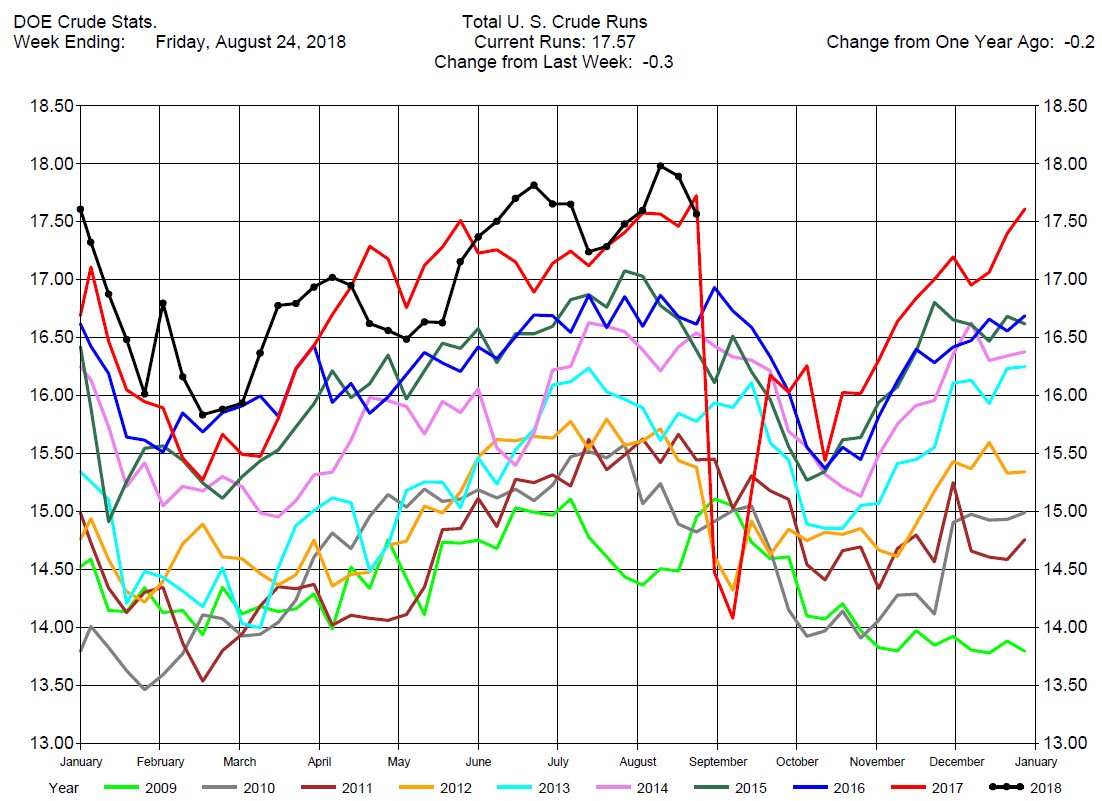

Total Refinery Crude Runs were down 300,000 barrels per day to 17.57 million barrels per day.

Prices jumped 55 cents with the release of the report. After a brief pullback prices traded higher throughout the day, ending up $1.15.

Crude Oil prices have moved up in 8 of the last 10 trading days, increasing by nearly 6 dollars. With the October contract settling today close to $70 the trend is bullish. A definitive close above $72 would indicated a sustained bull trend to the upside. We suggest considering crude oil calendar spreads such as Nov-Dec or Dec-Jan calendar spreads.

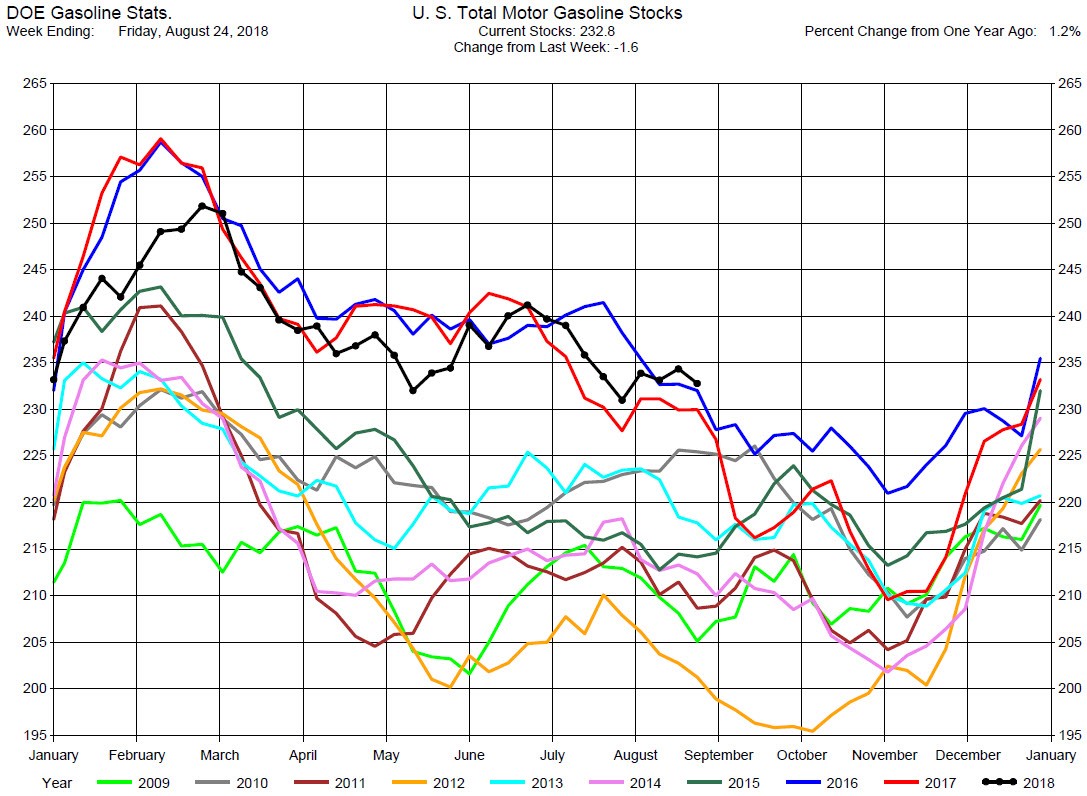

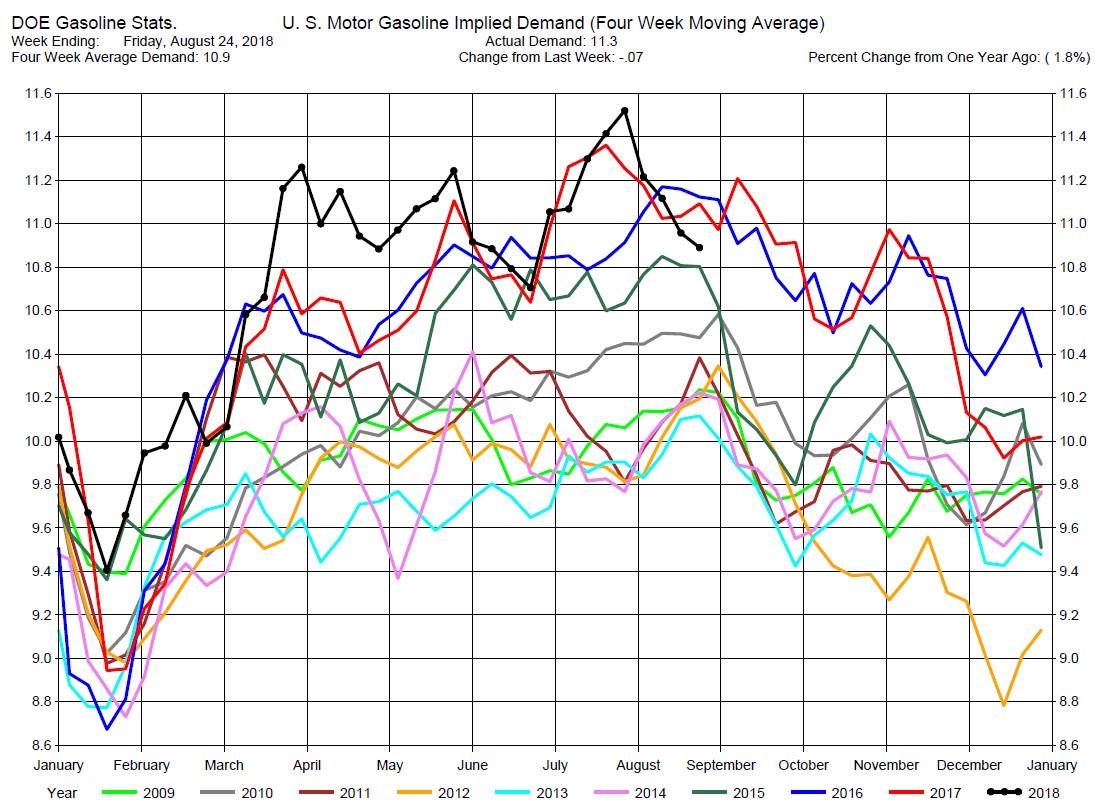

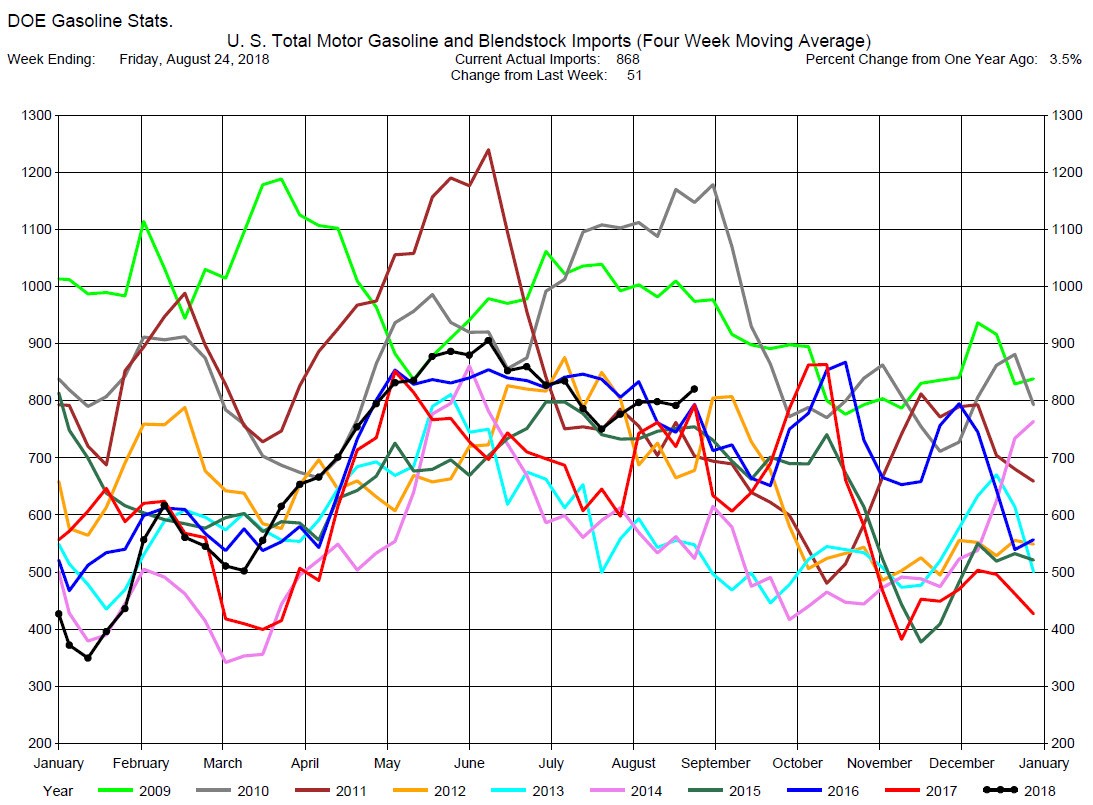

Gasoline Stocks Draw. Expectations were for a Build.

Total MotorGasoline Inventories decreased by 1.6 million barrels to 232.8 million barrels for the week ending August 24, 2018, while expectations average was for a 800,000 barrel increase.

Implied Demand was off by 70,000 barrels per day to 10.3 million barrels per day.

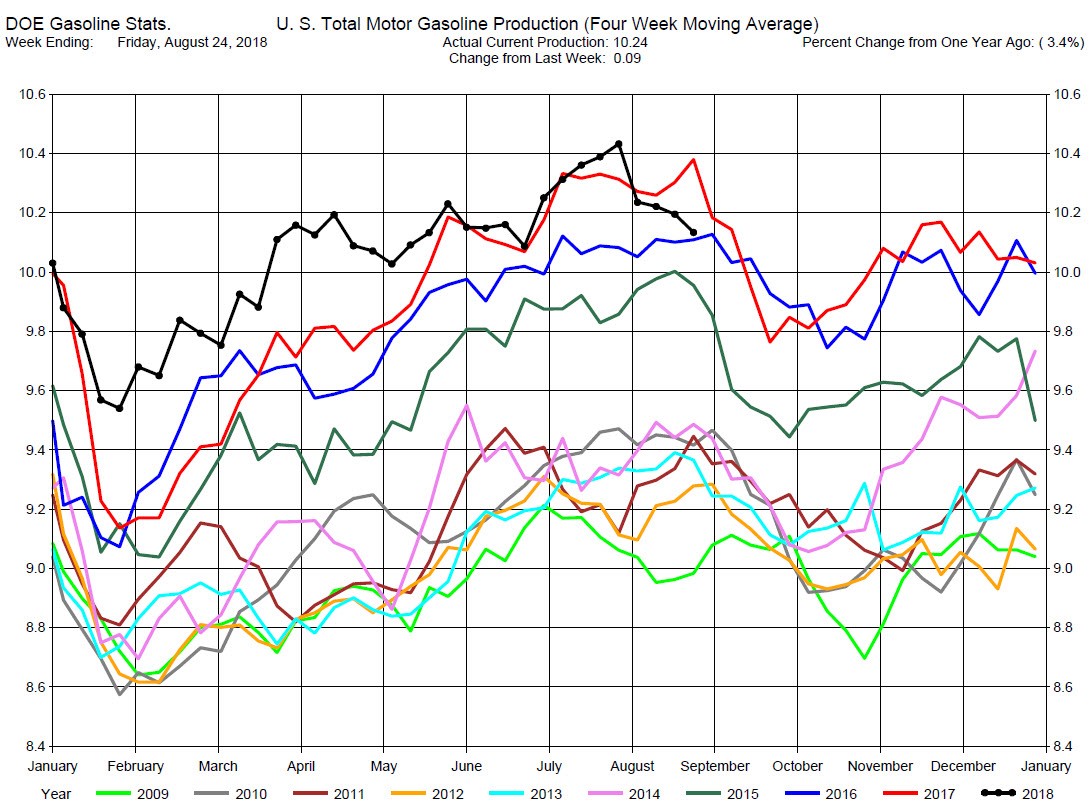

Gasoline Production was up 90,000 barrels per day to 10.24 million barrels per day.

Gasoline crack spreads have widened as crude oil has moved up. We now suggest considering long positions in the out month cracks such as the November or December gasoline cracks.

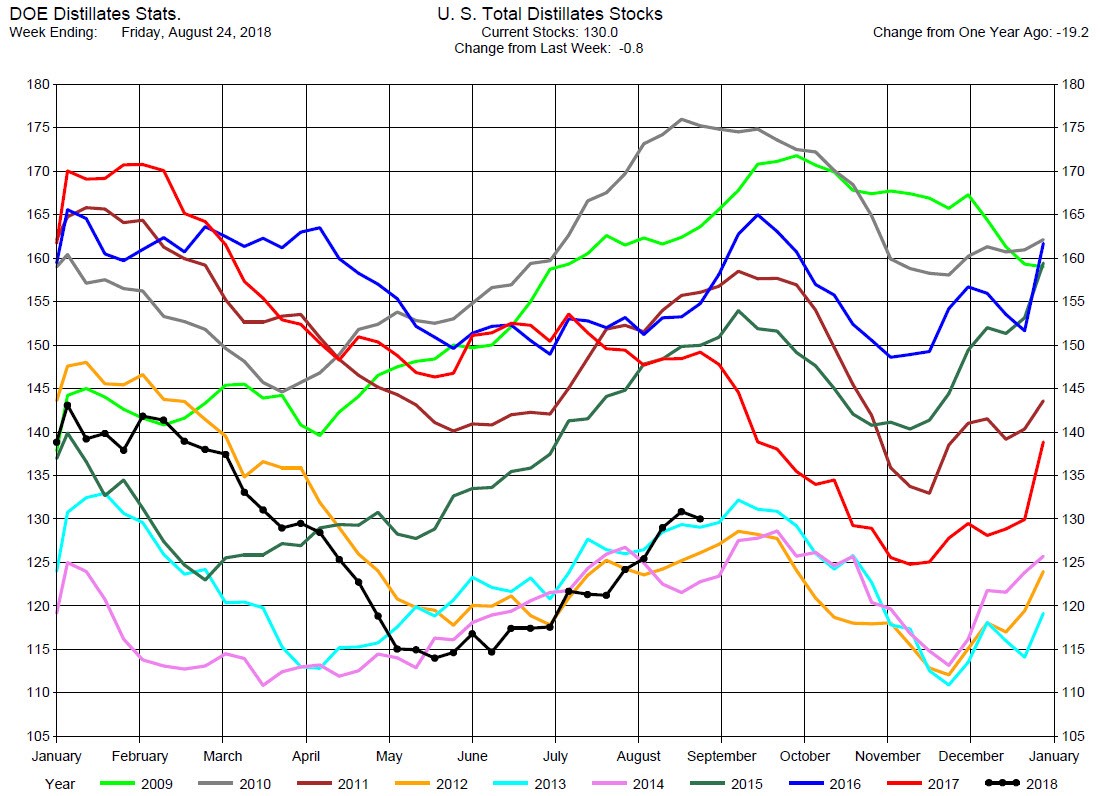

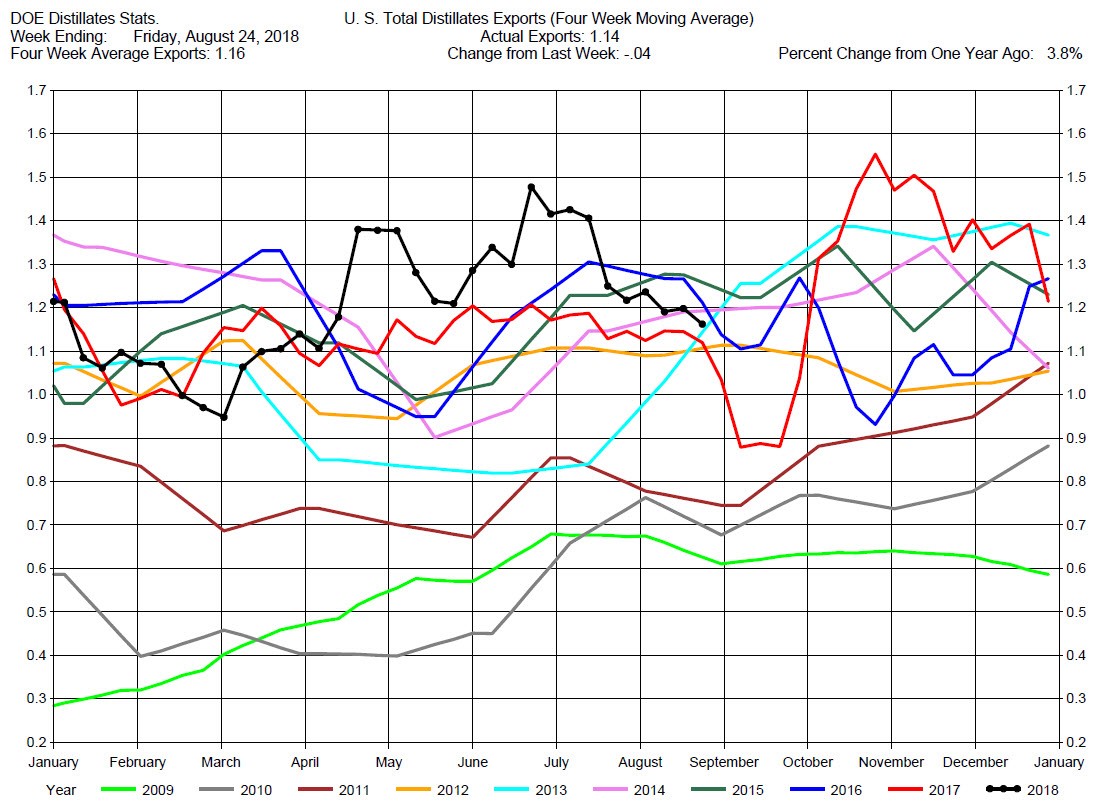

Distillates Stocks Draw, Expectations were for a Build

Total Distillates Stocks decreased by 800,000 barrels to 130.0 million barrels for the week ending August 24, 2018, while expectations average was for a 1.6 million barrel draw.

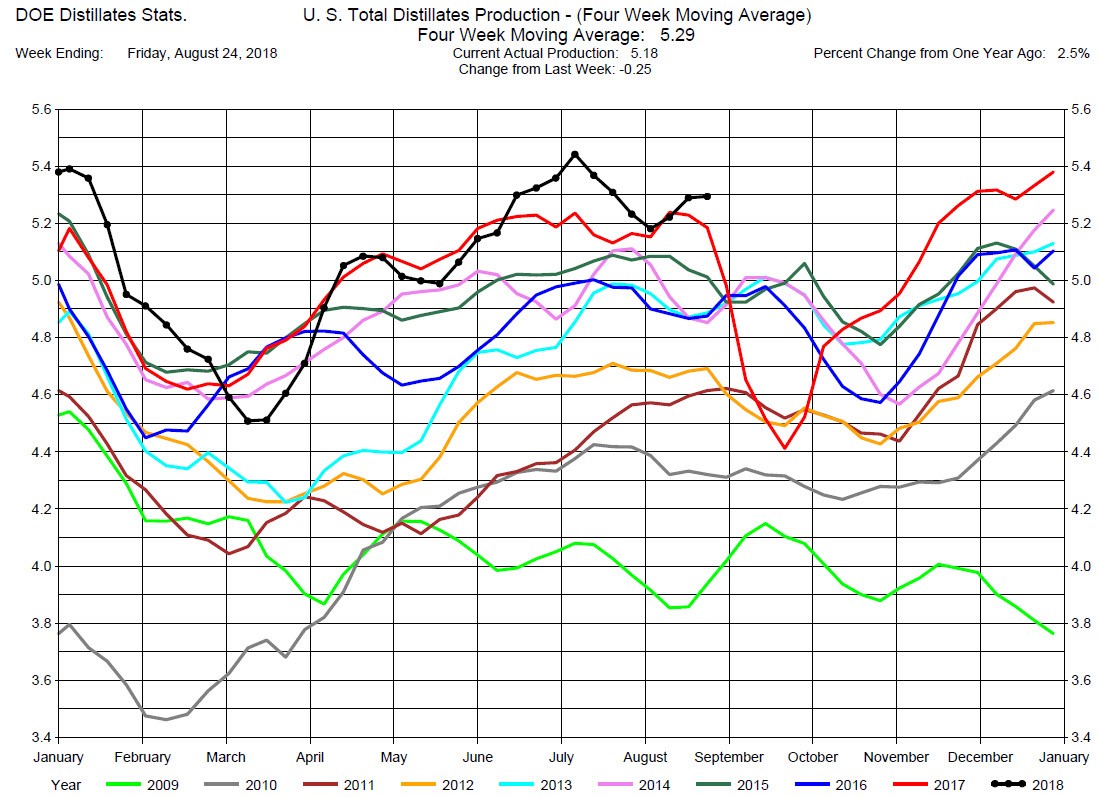

Total Distillates Production was down 250,000 barrels per day to 5.18 million barrels per day.

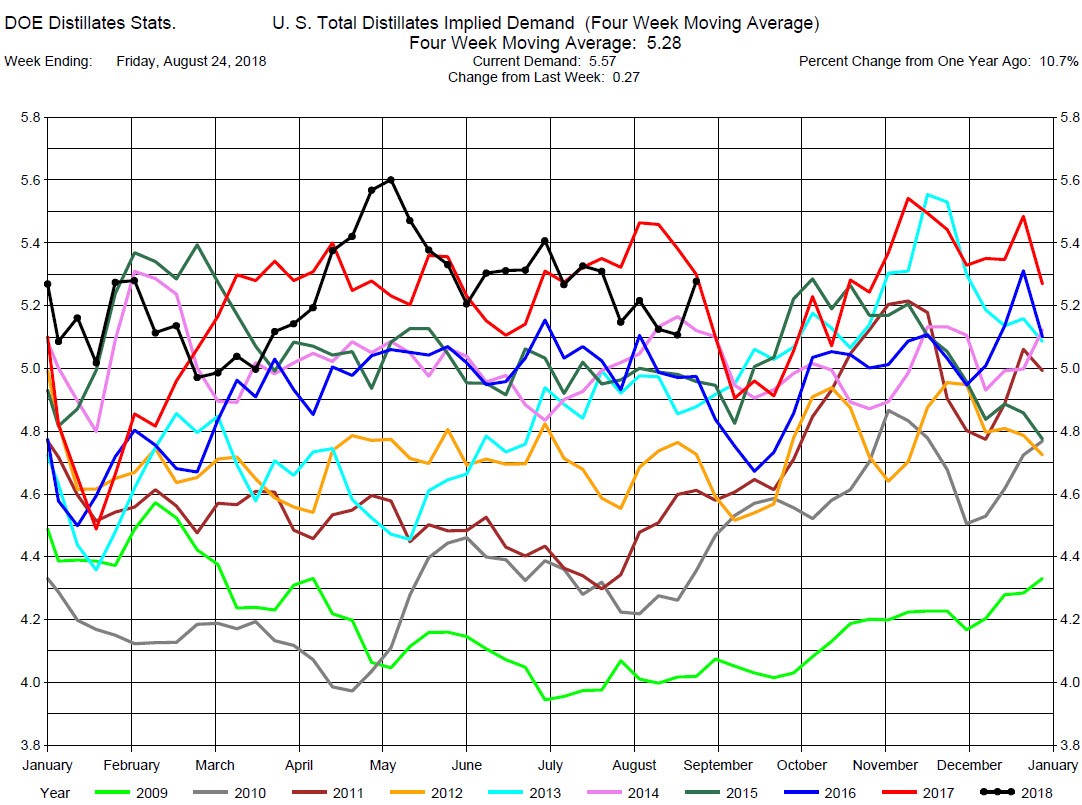

Total Distillates Implied Demand increased by 270,000 barrels per day to 5.57 million barrels per day.

With good Distillates Demand and low Distillates Stocks distillates prices have moved in tandem with crude oil prices. And like Gasoline, Heating Oil crack spreads have widened. We also now suggest considering long positions in the out months Heating Oil cracks such as the November or December cracks.