|

Dr. Ken Rietz In order not to start rumors, the answer to the question in the title of this commentary is NO. There are reasons for concern, however. Recent WASDE projections gave global wheat stocks-to-use (SU) at a 17-year low but have just raised it slightly. So, that answer does need to be examined in some detail, because there are nuances and trends that need to be addressed. The answer is at best qualified, since factors such as unforeseen conflicts, weather, and geopolitics could affect wheat production and distribution. Let’s start with the current front-month futures prices for US wheat. |

|

|

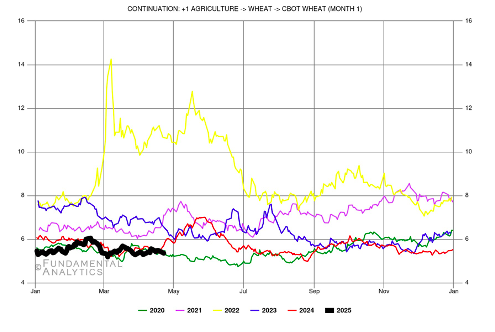

Figure 1: US Wheat Front Month Prices Note that the price of wheat in 2025 has been at or near the lowest in the past five years. This is not the behavior you would expect if the markets expected there to be a shortage of wheat on the horizon. Next, we look at the potential disruptors to wheat production and distribution that we listed earlier: conflicts, weather, and geopolitics. First, conflicts, but just the ones that have a direct bearing on wheat. Since Russia and Ukraine together supply almost 30% of the world’s wheat, drops in their wheat exports will have noticeable effect. The USDA’s agent in Kyiv put the 2025–2026 Ukrainian wheat harvest at a 13-year low, due to extreme dryness in the soil. Russia’s agencies place their 2025–2026 at slightly less than this year’s levels. The current ceasefire talks would have little effect on 2025–2026 wheat harvests, since the majority of that has been planted. We look at weather next, since that is the wild card every year and for every country. The global regions where weather is currently a limiting factor are the US Great Plains and the Black Sea (again). The Great Plains are dry enough to cut into yields, especially the central and southern Plains. Some rain might be on the way. The Black Sea region has had warm and dry weather and is only somewhat problematic. However, a serious hailstorm hit a primary wheat-producing region of Russia that could cut production by 30% in that region. But overall, globally, the conditions have been generally improving, putting downward pressure on wheat futures prices. Geopolitics, such as tariffs and sanctions, have had a large effect on the prices of wheat futures. There were some sanctions on Russian food or fertilizer. Those are now gone, but there are still sanctions on some Russian companies that deal with them. Generally, however, sanctions on Russian wheat are not a big hindrance. Tariffs are their own problem. China has been a major food importer from the US, but that has dropped to essentially zero due to tariffs, with the exceptions of soybean imports rising 12%. China bought 17% of the US wheat exported last year but has not ordered any since at least March of this year. That, by itself, could account for some of the drop in the price of wheat futures, since there is much more wheat available this year than last. And it is hard to tell how much wheat purchased is due to trying to get the wheat before tariffs return. All of these hindrances seem to be minor, again reinforcing the low wheat futures. The general turmoil of the wheat market makes trading a bit more difficult than usual. Overall, WASDE says that the wheat supply is going to be less than the demand, so the current low futures prices are likely to increase. A debit spread might be a safe way to play this. |