Energy commodities slid this week, due to China’s growth being below estimates and better than expected weather conditions.

|

Crude Oil

WTI rude at $80 with potential oversupply just around the corner |

- WTI crude futures fell 3.2% to settle at $80.13 per barrel on Friday, marking the second consecutive weekly loss, decreasing by -2.5%.

- Renewed hopes of a ceasefire in Gaza influenced market sentiment.

- A stronger dollar and concerns over China’s economic outlook exerted downward pressure on prices, offsetting a tighter supply scenario.

- US production remained at 13.3m bpd all-time high for the second consecutive week, +1m as compared to the same period last year.

Gasoline

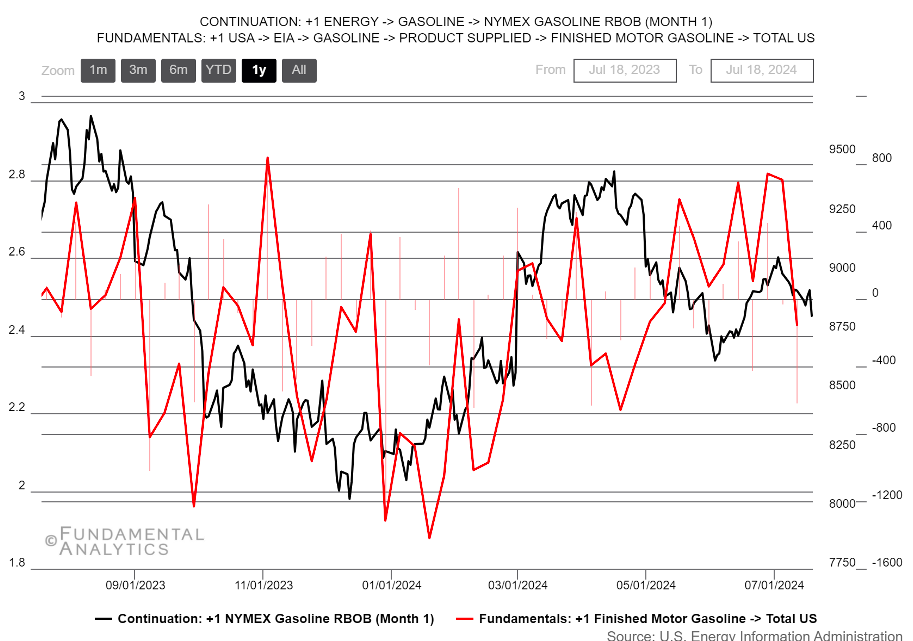

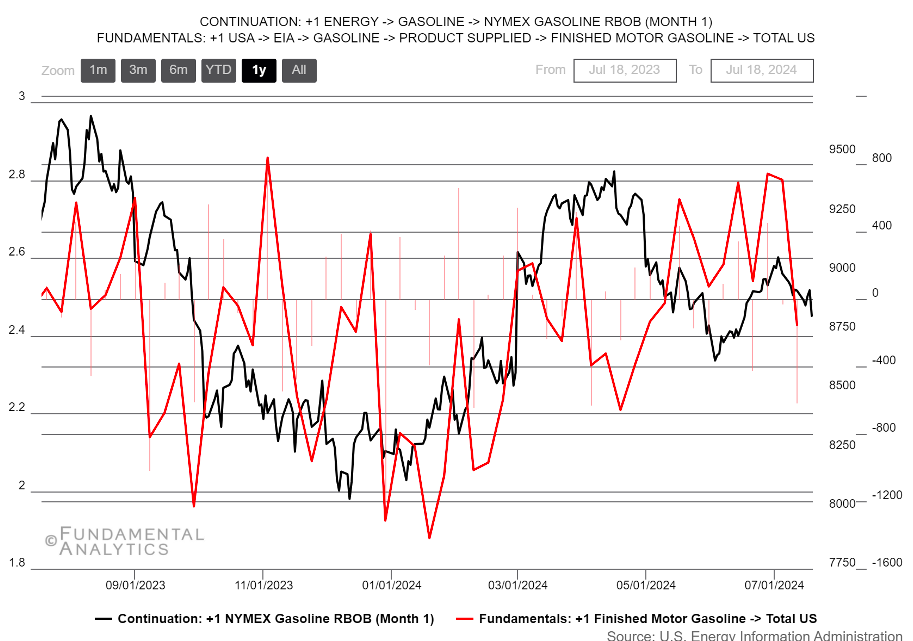

Gasoline supply raises concerns

|

|

- Gasoline futures in the US edged higher toward the $2.5 per gallon mark from the one-month low of $2.46 touched on July 16th, as fresh signs of lower crude oil inputs for gasoline refineries momentarily offset increasing concerns of poor gasoline demand.

- Gasoline product supplied compiled by the EIA, a key gauge for consumer demand, sank by 615k barrels last week to help lift inventories by 3.3m barrels, the most since January.

- Deflationary pressure for Chinese producers magnified the view of poor energy demand in the country, shortly after maritime data showed that the number of oil supertankers headed for China dropped to its lowest level in two years.

- On the supply front, data from OPEC showed that Russia, Iraq, and Kazakhstan continued to supply oil levels above their latest quotas, pressuring fuel prices and raising uncertainty over whether members of the cartel will eventually achieve their output cuts.

Natural Gas

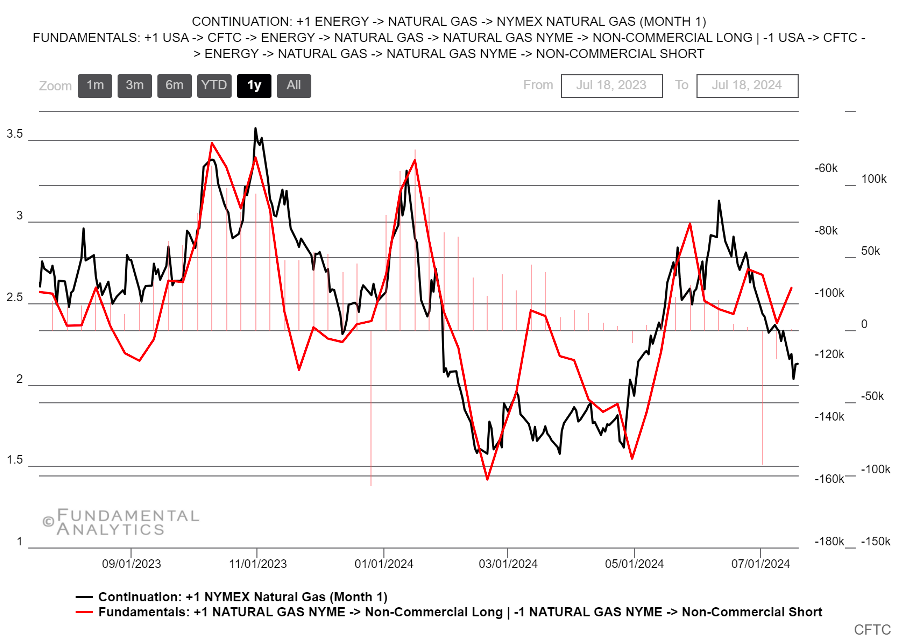

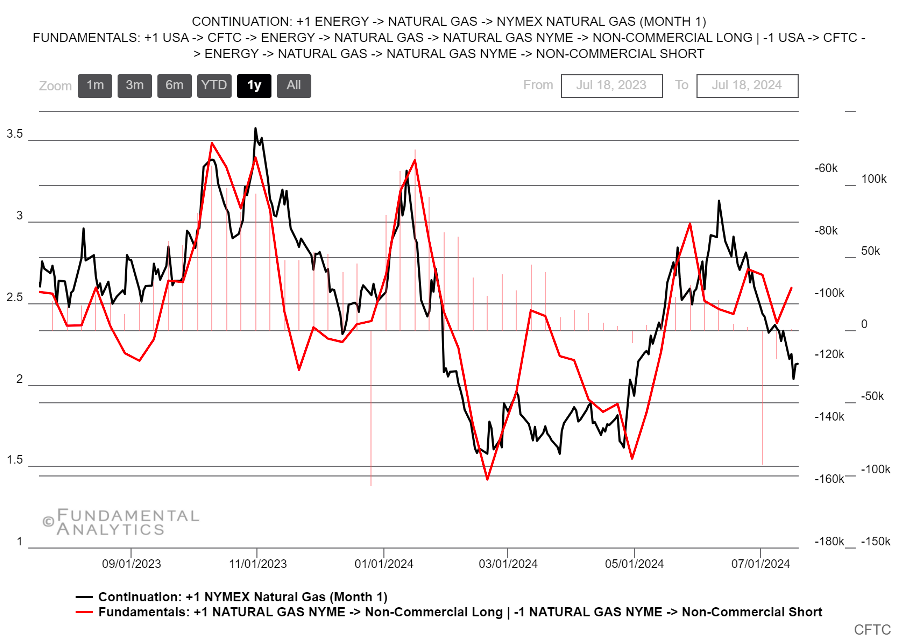

Speculators anticipate correction in the short-term

|

|

- US natural gas futures fell by over 10% to below $2.1/MMBtu this week, influenced by milder weather forecasts and reduced feedgas (11.6bcfd versus 12.8 bcfd in June, same period) to LNG export plants.

- Additionally, the EIA reported that US utilities added 10bcf of gas into storage last week, below the expected 28bcf increase, bringing total stockpiles to 3,2 Bcf, 16.9% above the 5-year average.

- Meteorologists forecast near-normal weather across the Lower 48 states through July 24, followed by hotter-than-normal conditions until August 1.

- Money-managed funds returned to the previous year’s values for natural gas futures, which also matched the 5-year average price.

|