Andreas Anastasiadis

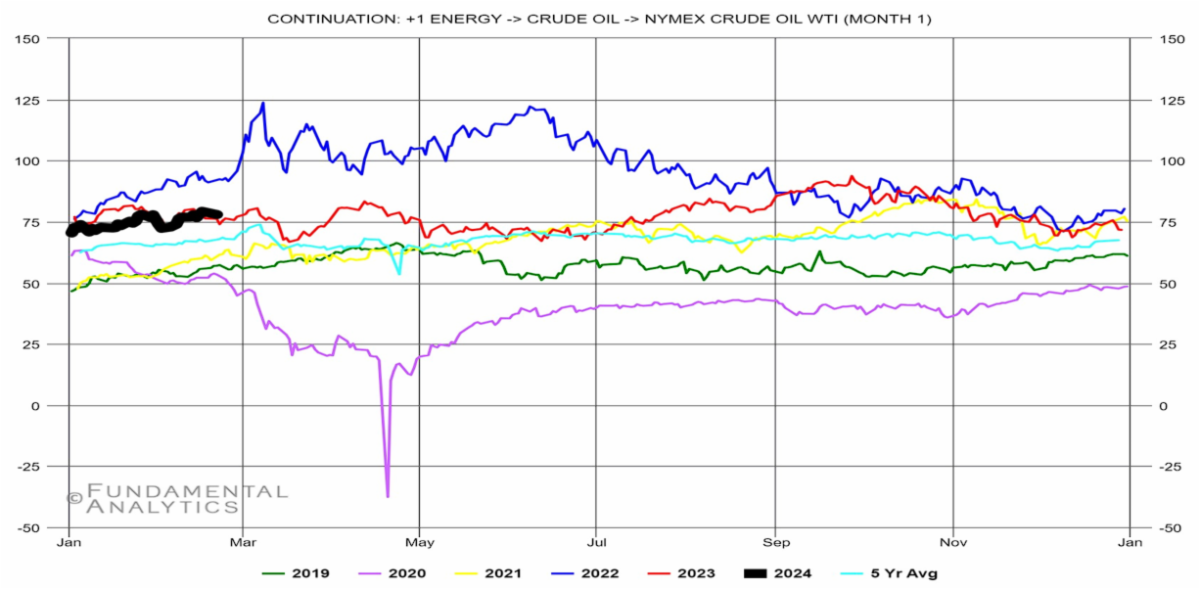

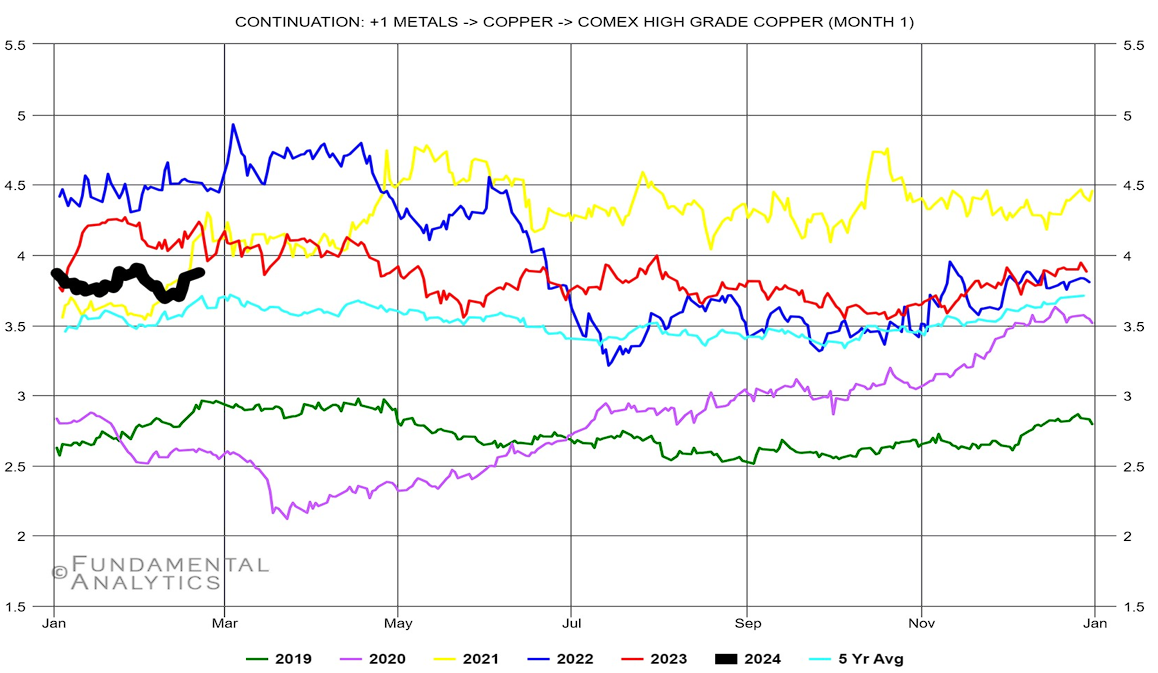

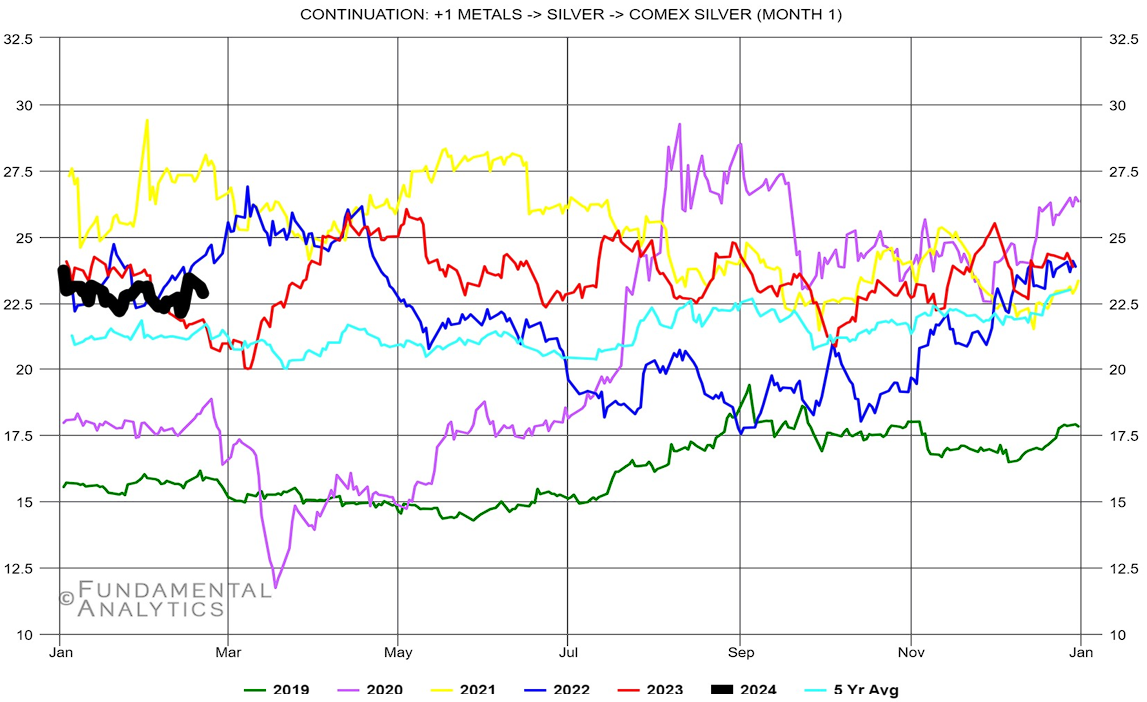

With the Russia-Ukraine war and conflicts in the Middle East persisting alongside OPEC’s implemented production cuts, it’s reasonable to expect that commodity prices would hover close to historic peaks; this should be the case especially for energy and metals. In reality, WTI is trading -11.8% below highs (Figure 1) since Hamas attacked Israel and drumbeats of war were heard. Furthermore, copper and silver prices are relatively flat on a YTD basis (Figures 2 and 3). While we should have been expecting higher commodity prices given the geopolitical environment, there are forces that are keeping them down, with one important one being China.

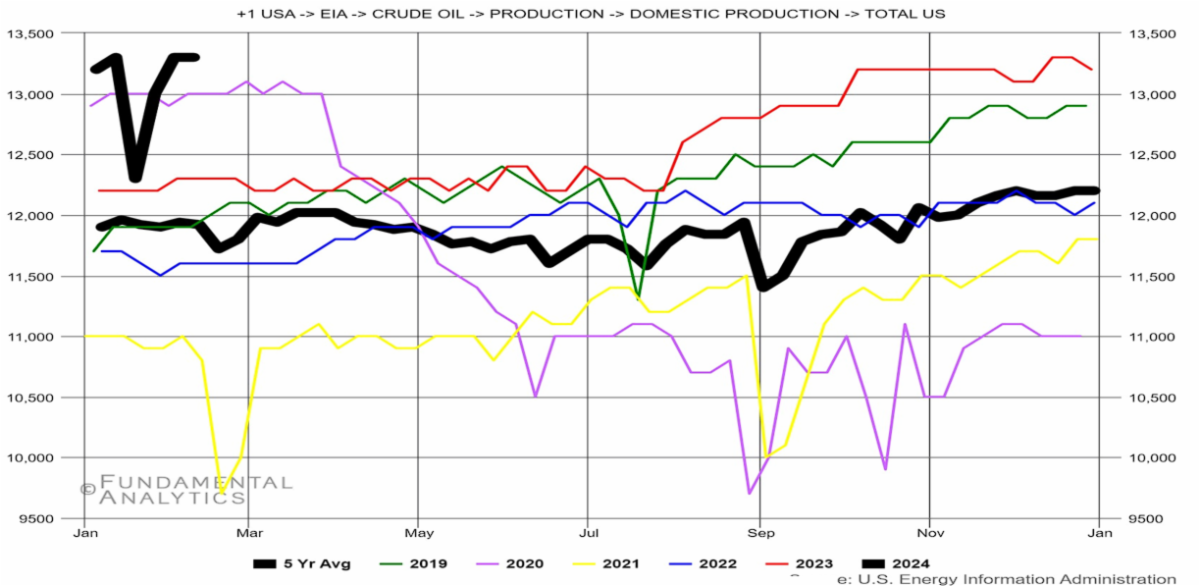

For oil, part of the explanation is attributed to surging US crude oil production after mid-January (Figure 4), partially offsetting OPEC’s cuts. However, the primary factor behind the lack of a commodity rally can be succinctly summarized in one word: China. China stands as the globe’s largest consumer of raw materials, importing approximately 40% of industrial metals worldwide and 10% of global crude oil. Many commodity producers had anticipated stronger growth in China’s economy, only to find it hasn’t materialized as expected. In the previous year, China saw a 5.2% annual growth rate, which may appear favorable at first glance. However, it’s important to recall that this growth figure is relative to 2022, a year marked by extensive lockdown measures across China. China’s economy has grappled with substantial debt, plummeting real estate values, sluggish industrial output and consumer expenditure, and a significant decline in imports and exports. These factors have reverberated throughout commodity markets, typically mirroring China’s growth trajectory with a lag of around one year.

Nevertheless, the recent Chinese stimulus actions provide an additional favorable tailwind for improved US crude oil exports. Moreover, copper and silver futures anticipate a hike after China’s decision to cut its reserve ratio, but additional measures need to be taken to create a new bull market in the industrial metal sector.