Commodity News Update

June 5, 2018

The goal of this report is to provide our readers with some important fundamental and technical trends in commodity markets this week.

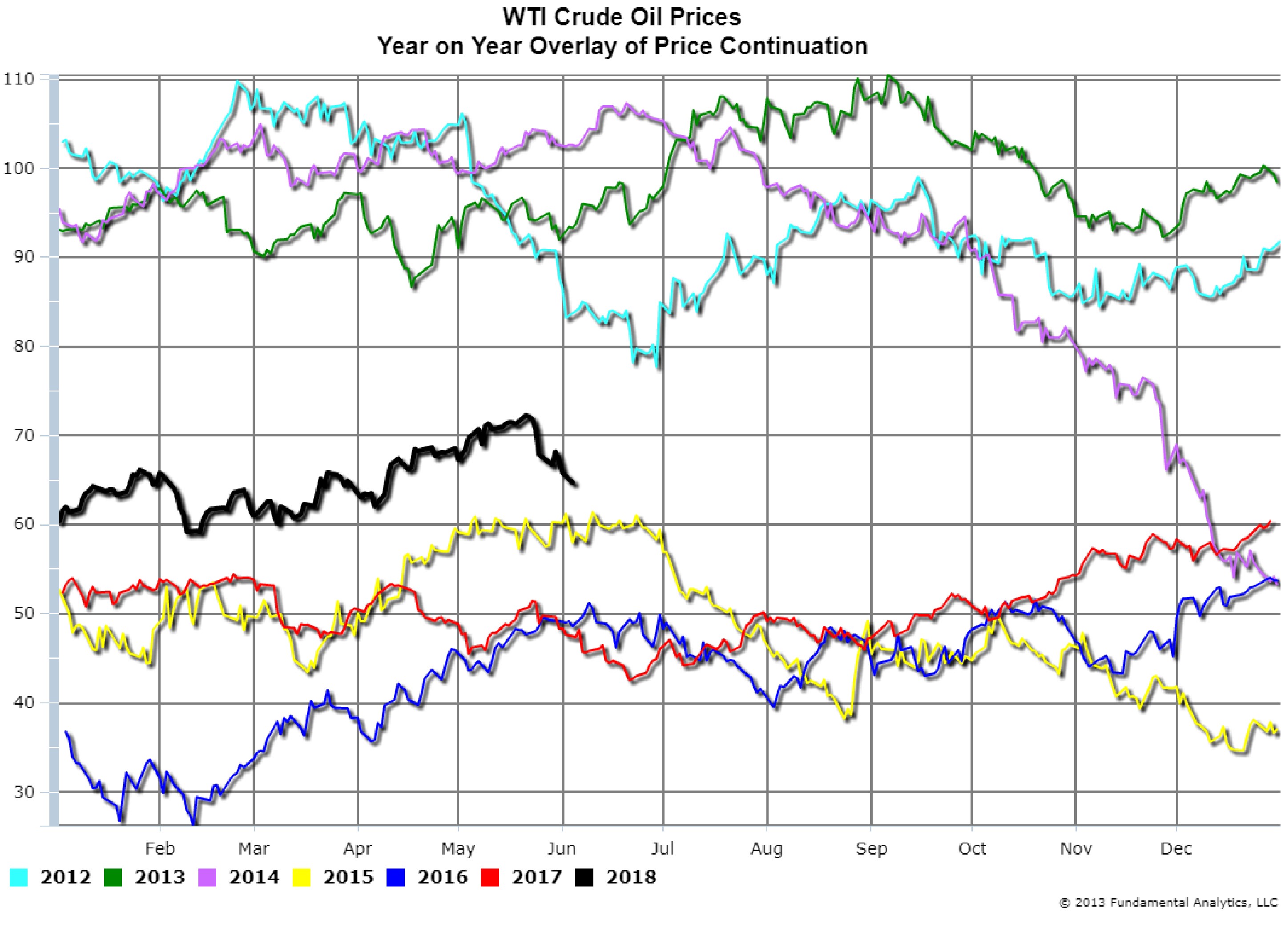

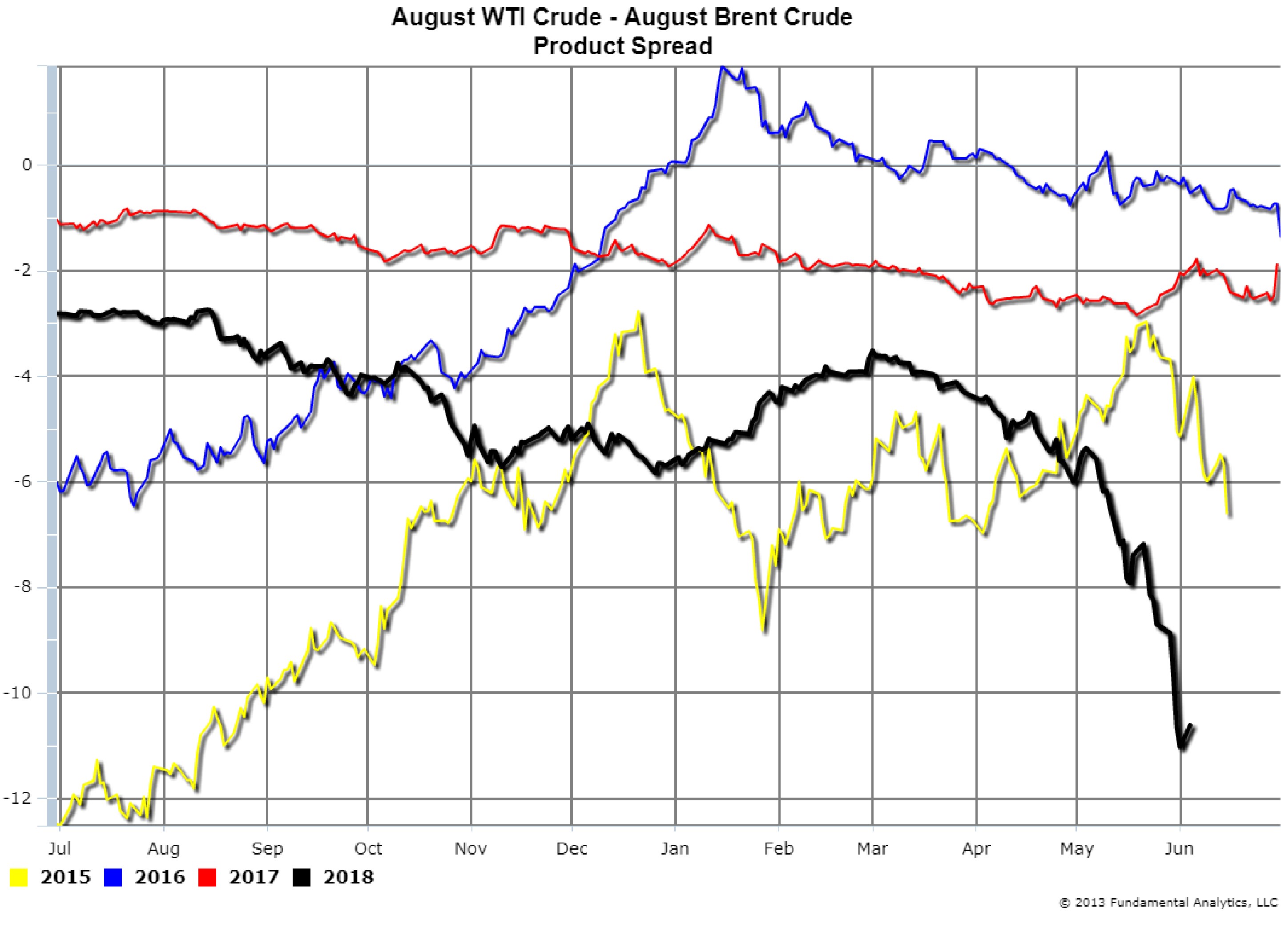

US WTI Crude Oil Prices have dropped from over $72 a barrel to $65 a barrel since May 25, partially because of the expectation of increased Crude Oil supplies from OPEC and Russia. See the chart below, where the black line represents 2018 prices.

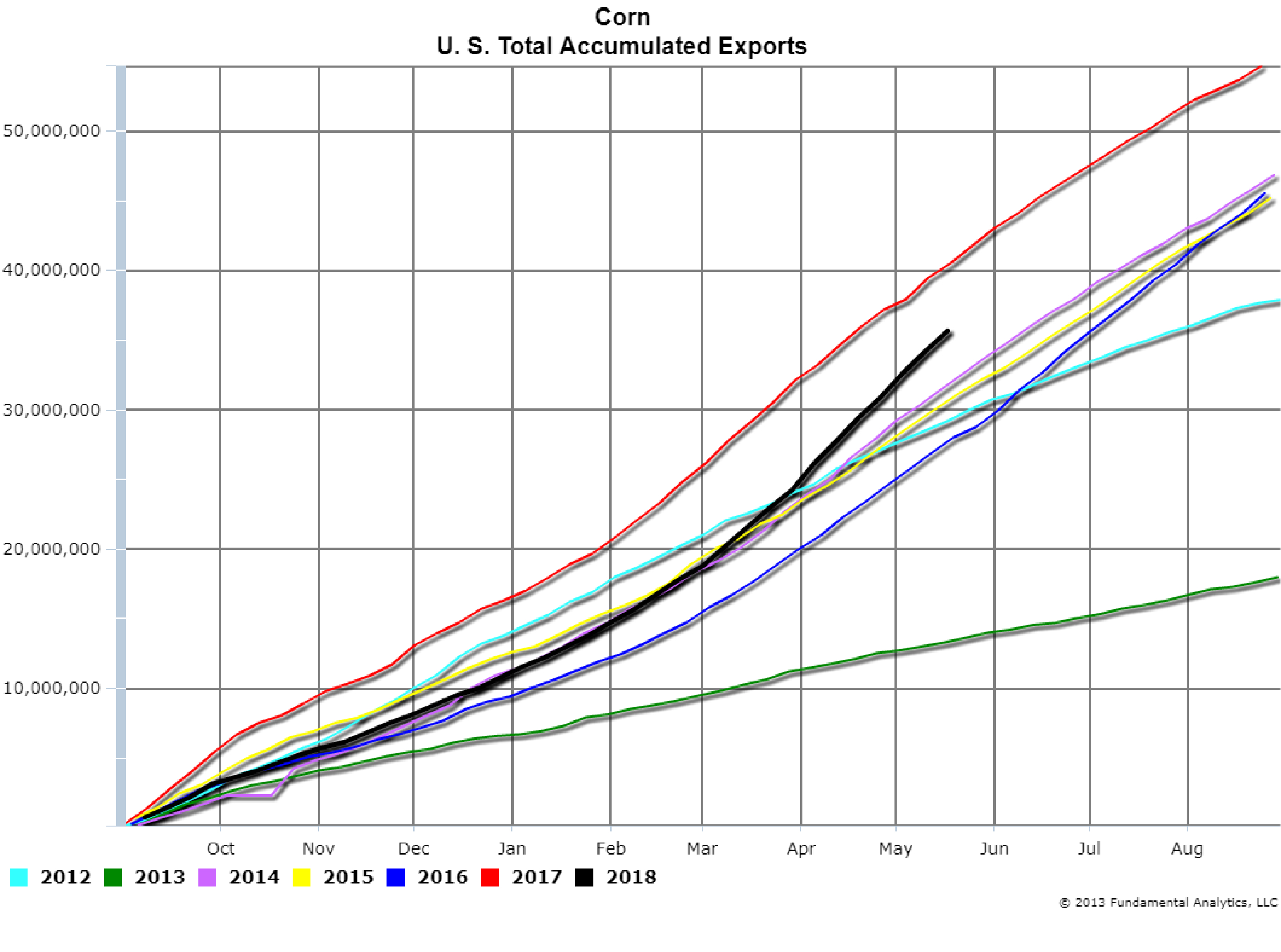

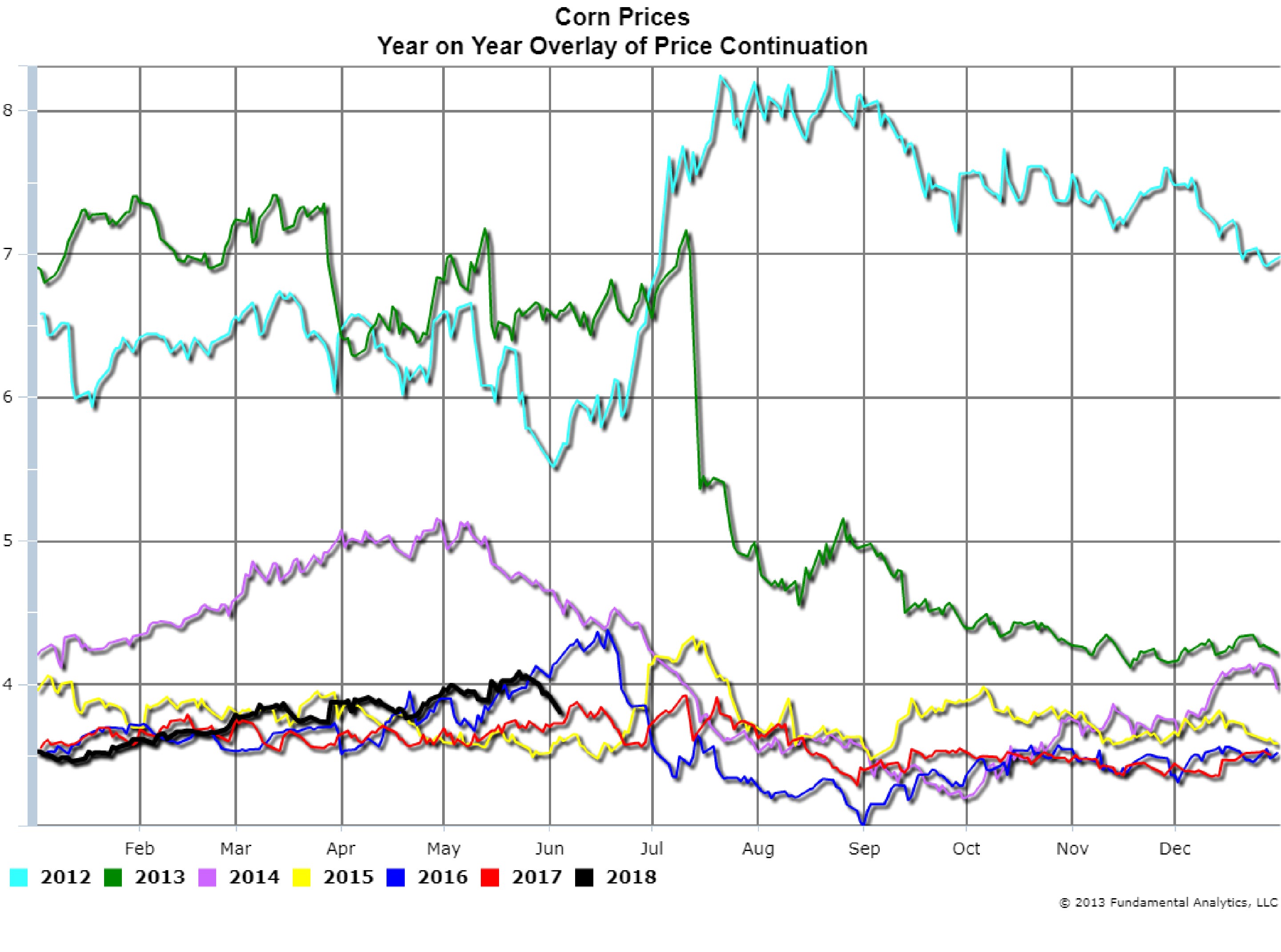

According to the latest Foreign Agriculture Service (FAS) report, as of May 24, 2018, the Corn Accumulated Exports was 37,557,206 metric tons. The Total Accumulated Export chart below shows that, if the new trend continues, the Accumulated Exports could reach the record level of the 2017 market year (represented by the red line on the first chart below). World Demand for corn is strong and US corn prices are relatively low, encouraging foreign purchasing of US corn. See the charts below, where the black line represents the current market year.

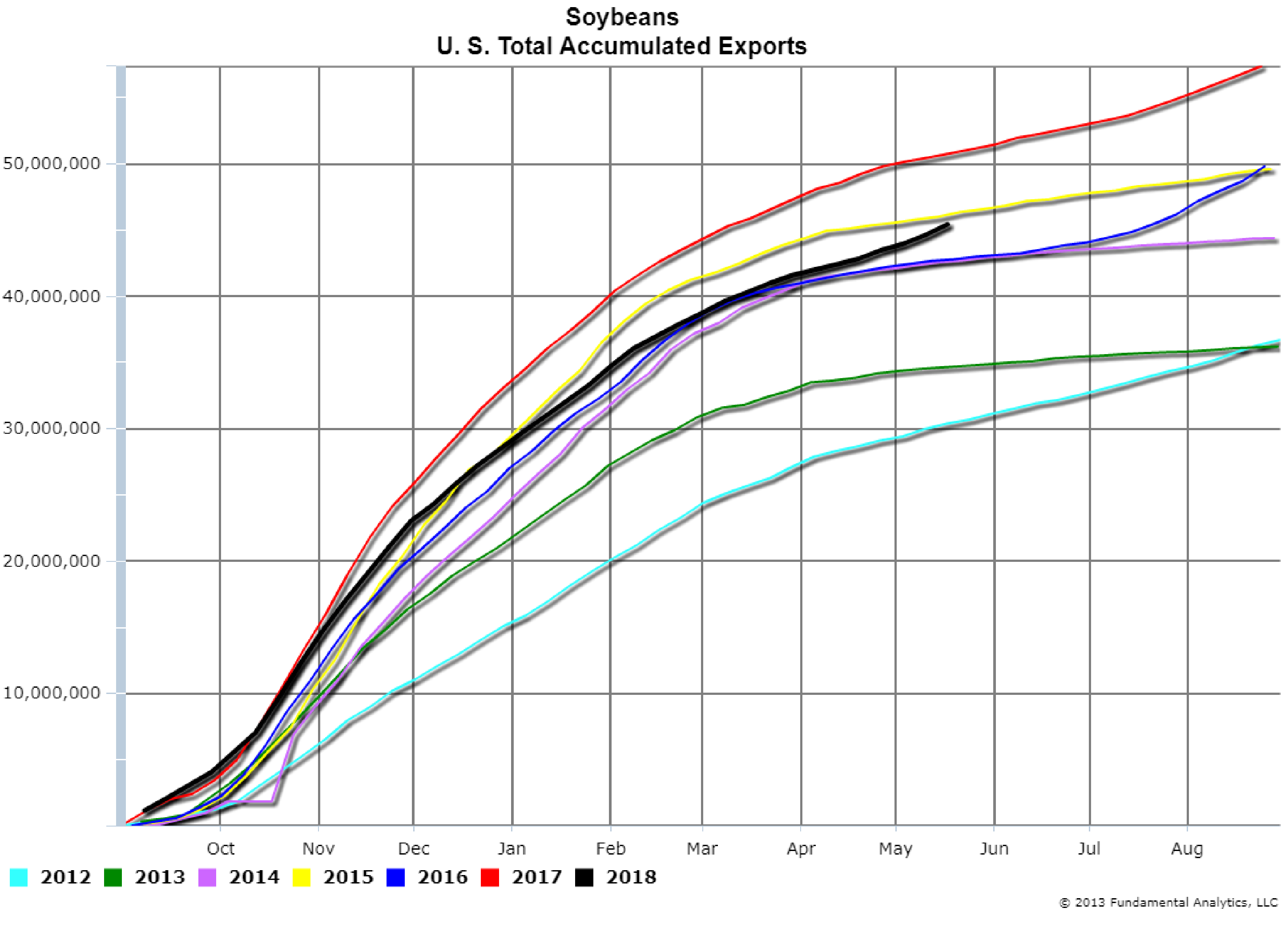

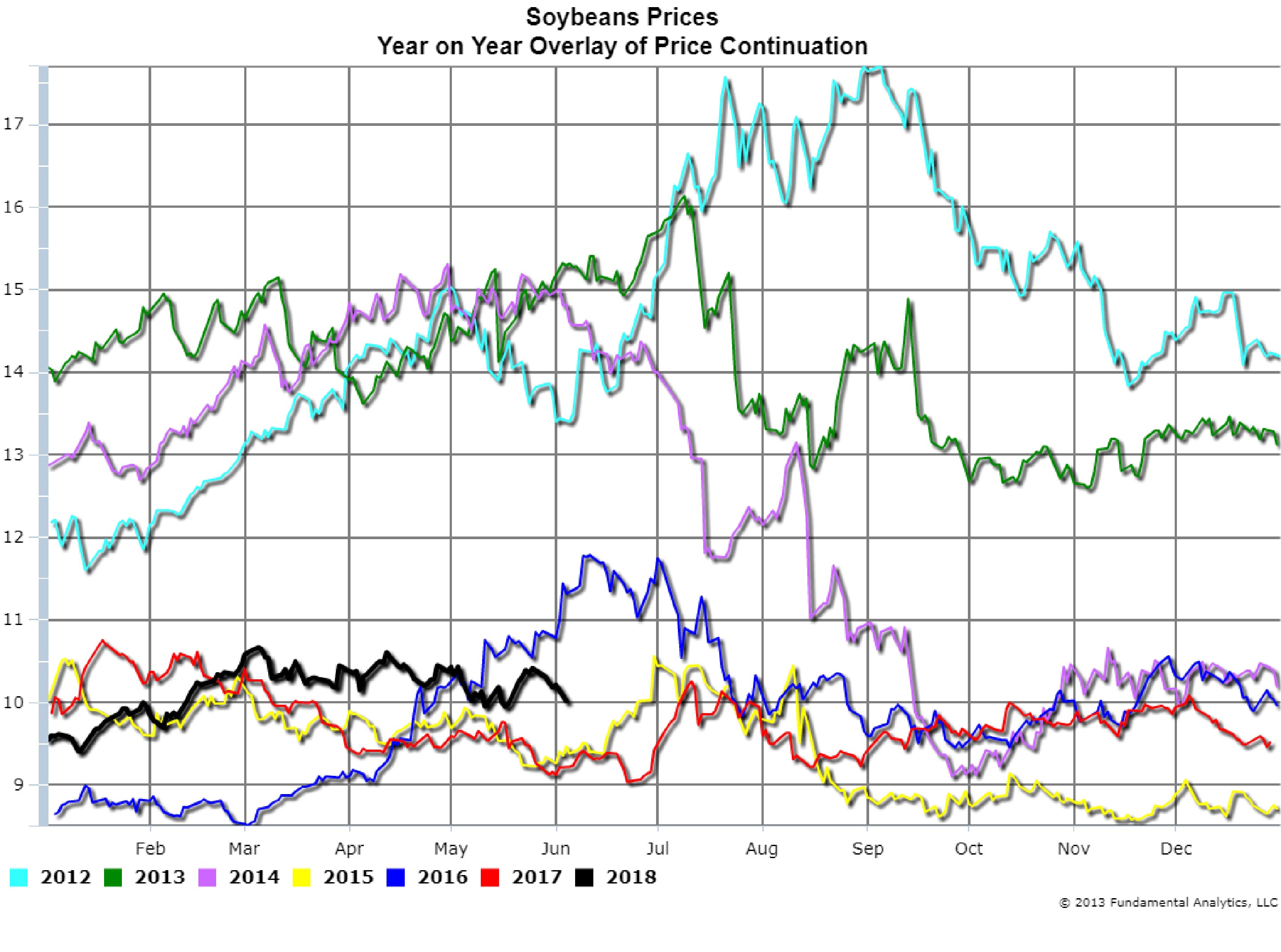

Similarly, according to the latest Foreign Agriculture Service (FAS) report, the Soybeans Accumulated Exports was 46,088,141 metric tons. The Total Accumulated Exports chart below shows that exports are strong, although the seasonal trend tends to flatten during this coming period in the market year, so we do not expect Accumulated Exports to reach the level of 2017 (represented by the red line on the first chart below). However, as we mentioned above with corn, World Demand for soybeans is strong and US soybeans prices are relatively low, encouraging foreign purchasing of soybeans. See the charts below, where the black line represents the current market year.