Crude and gasoline avoided weekly losses, partly because of intensified geopolitical risk, while natural gas suffered due to producers increasing production.

|

Crude Oil

WTI went up ~+12% in H1, while supply steadily increases |

- WTI crude futures rose above $82 per barrel on Friday and were set to advance for the 3rd straight week as an escalating conflict in the Middle East amplified demand-side uncertainties. Oil prices are also set to gain more than 6% in June and nearly 15% for the first half of 2024.

- Meanwhile, the latest figures pointed to rising US crude and gasoline inventories, raising concerns about lower-than-expected demand in the world’s largest oil consumer.

- US crude oil stocks rose by 3.591 million barrels last week, contrary to market expectations of a 3-million-barrel decline, as per EIA, while production remained at an all-time high.

Gasoline

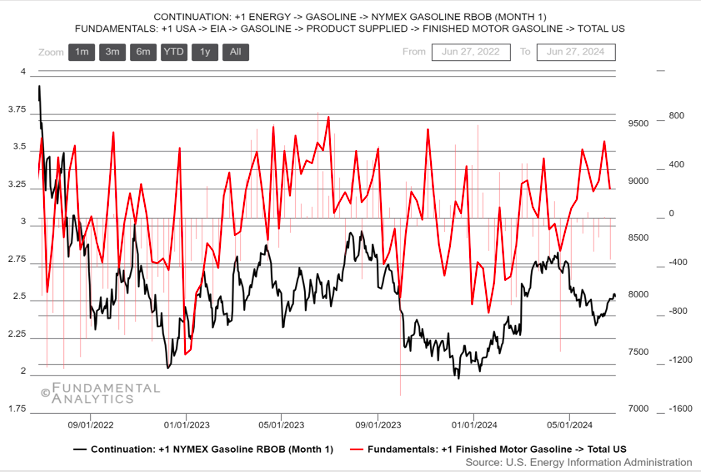

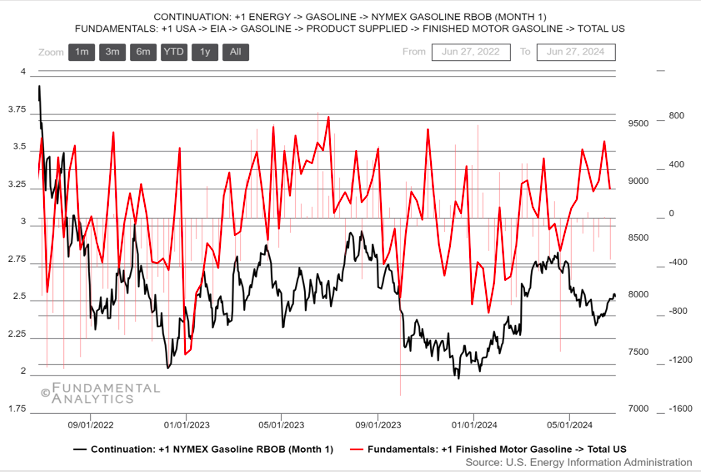

Gasoline surpassed the $2.5 mark, as production weakened y/y

|

|

- Gasoline futures in the US held above $2.5 per gallon in late June, hovering close to their highest level in one month amid stronger seasonal demand ahead of the North American summer, while markets continued to assess threats to global supply.

- The availability of refined petrochemicals remained uncertain toward the end of the second quarter as Saudi Arabia underscored that OPEC+ is entitled to reverse production changes and prolong output cuts.

- Further gains were prevented by new data from the EIA showing that gasoline stocks in the US jumped by 2.645 million barrels on the week ending June 21st, compared to market expectations of a 1.1 million draw.

- Product Supplied from Refineries during H1 has fallen by -5.2% compared to the same period one year before.

Natural Gas

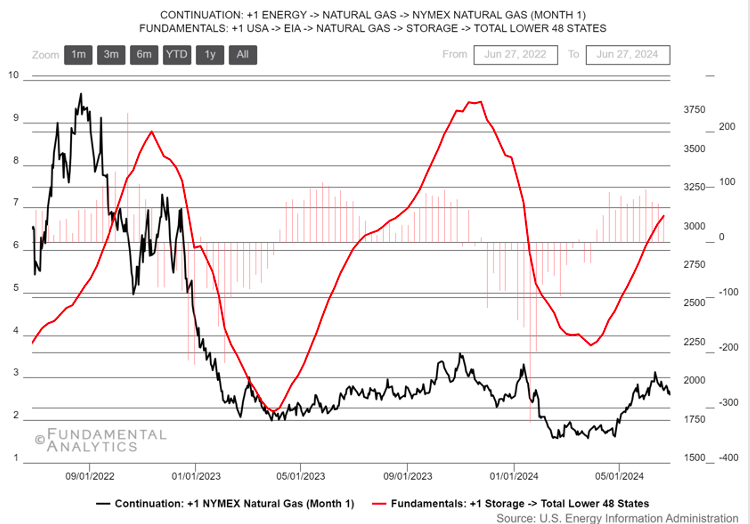

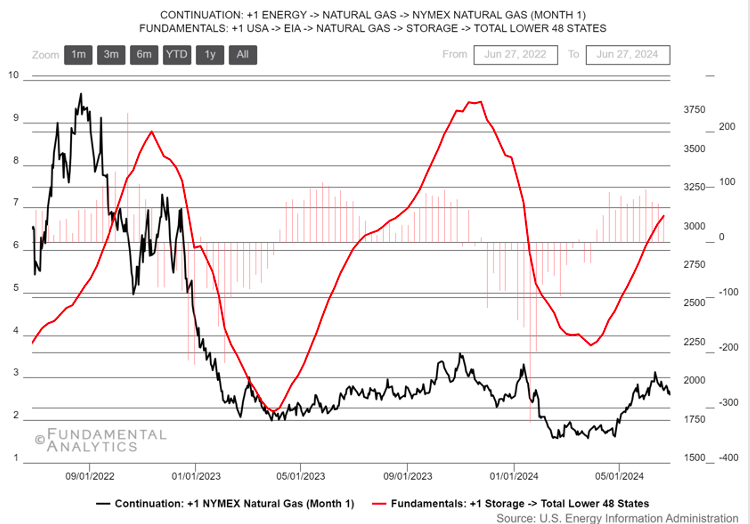

Lower than expected build did not prevent gas from declining w/w

|

|

- US natural gas futures fell below $2.7/MMBtu after the EIA’s storage build report.

- The data showed US utilities added 52 billion cubic feet of natural gas into storage last week, slightly below the expected 53 bcf build. Gas in storage is now 20.6% above the seasonal normal.

- Despite this, natural gas prices are headed for a third consecutive week of declines due to increased output, as higher prices in recent weeks encouraged companies to resume production.

- Gas output averaged 98.6 bcfd in June, up from a 25-month low of 98.1 bcfd in May

- On the demand side, hotter-than-normal weather is projected through at least July 12, maintaining high gas consumption for air conditioning.

|