Dr. Ken Rietz

November 16, 2023

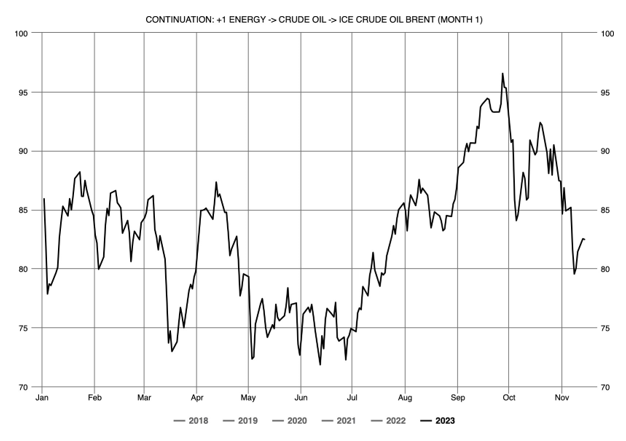

One of the more curious price changes lately has been the decrease in the price of crude oil, of all sorts. There are numerous reasons why this should not be happening, such as inflation, armed conflict in the Middle East that could easily spread to major exporters of crude oil, and that US rig counts are down. The markets dislike uncertainty, and the slightest indication of potential disruption is usually enough to cause prices to burst upward. Yet, crude oil has been on a fairly steady decline for nearly 4 weeks now. This requires an explanation. But first, here is the graph of the price of Brent Crude oil from the ICE exchange.

Figure 1: The price of Brent crude oil on the ICE exchange, in dollars per barrel

The consequences of the drop in crude oil prices have echoed through the entire economy. For example, the drop in gasoline prices was clearly a major factor in the drop in CPI announced on Tuesday. Similarly, the entire energy sector of the stock market has been dropping, since profits suffer when crude oil becomes cheaper.

There are numerous plausible, but possibly insufficient, explanations. Here are a few of them. It could be a signal that a recession is coming; true, but inflation is still in control, and prices generally are still going up. It could be more exports from Venezuela; true, but those haven’t reached a level to cause this much of a decline. OilPrice.com notes that “The Saudi Energy Minister … claimed that the drop was a ‘ploy’ that hides the real strength of the oil markets, adding that speculators are abusing export figures as they fail to distinguish them from production numbers.” Others have pointed out that EU natural gas storage is at near-record high levels, so demand for crude could drop somewhat. In addition, Chinese demand has declined, in part because of increased shipping costs. All of these are valid and, combined, might be enough to cause the price of crude oil to drop as much as it has. But there is one, single explanation that by itself might be enough to explain crude’s decline.

On November 13, 2023, the US Energy Information Administration (EIA) released an analysis of the crude oil market. Their data show that, despite the drop in rig count, the production of crude oil per rig has increased to an extent that there has been a record amount of oil produced, and it is increasing. The reason for this, by their account, is the use of horizontal drilling, which captures far more of the oil in a specific well than vertical drilling. There have also been record levels of exported crude oil from the US in the first half of 2023.

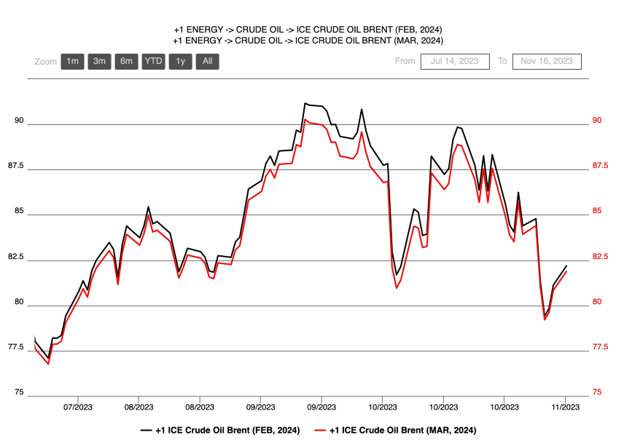

What about the future? The EIA report gives short-term predictions about crude oil, specifically that supply will increase and demand will remain steady or decrease. This is the classic situation in which prices would go down. But nothing is guaranteed. The price of crude oil is sensitive to news. The Middle East right now is much more of a tinder box than usual, and the price of crude oil could change very rapidly higher. OPEC+ will be meeting at the end of this month, and that makes predictions more difficult. Even if OPEC+ members reach an agreement, they don’t all have a good track record of sticking to their export restrictions. A look at the futures markets as of the closing Tuesday shows this.

Figure 2: The February 2024 (exp. 12/28/2023) and March 2024 (exp. 1/31/2024) futures on crude oil