الطاقة

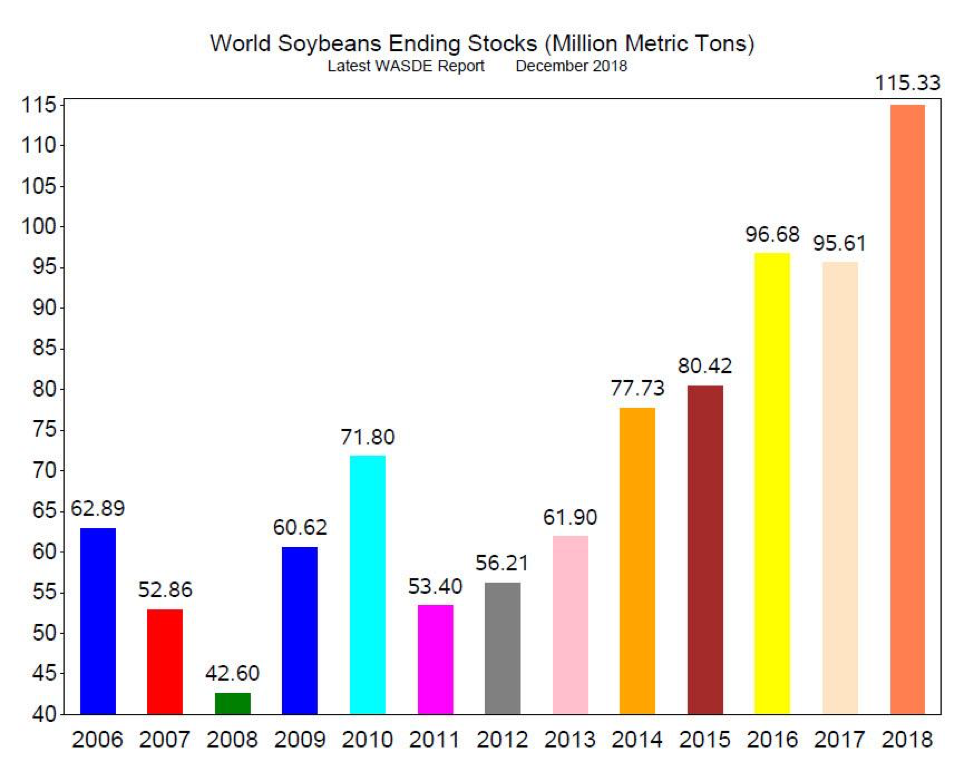

The latest CFTC Commitment of Traders Report as of Tuesday, December 4, 2018 shows the Non-Commercials Net Long Positions decreased during the week by 15,940 contracts to 382,836 contracts (Chart 1, black line). 11,569 Long positions were closed and 4,371 Short positions were established.

This latest report has data through Tuesday, December 4, so we must wait for the next report with data through December 11 to observe possible Funds’ response to the December 6-7 OPEC meeting. OPEC with Russia have agreed to a production cut of 1.2 million barrels per day. The expectation is that this reduction in output will balance global crude oil supply against demand.

Prices have remained in the low $50 level as traders wait for confirmation of compliance with the output cut. We expect this geopolitical uncertainty to contribute to high price volatility.

Chart 1

Grains

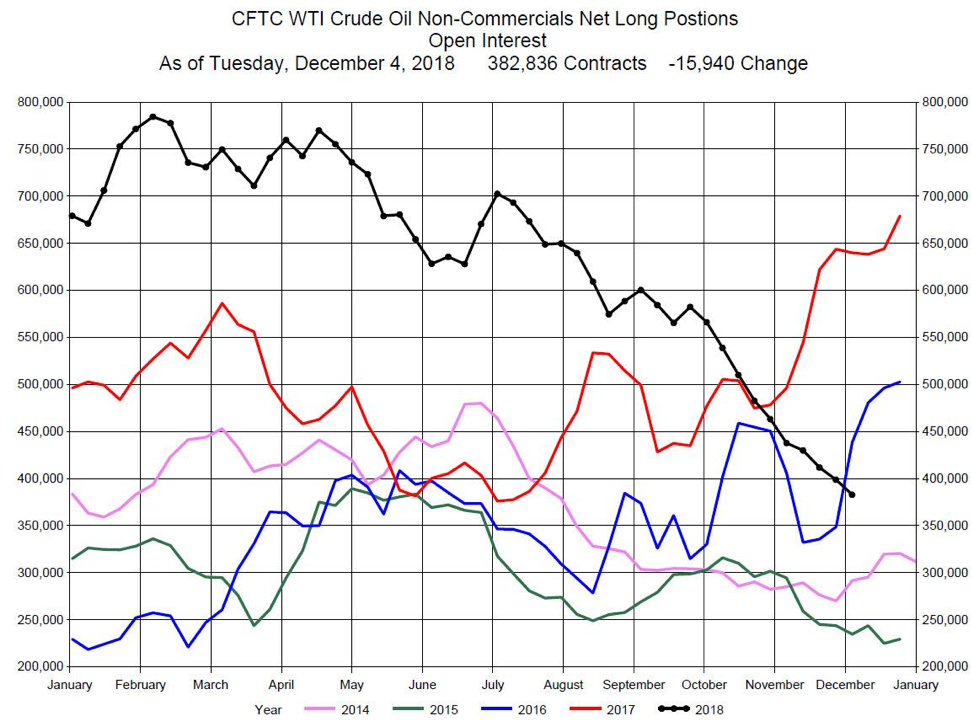

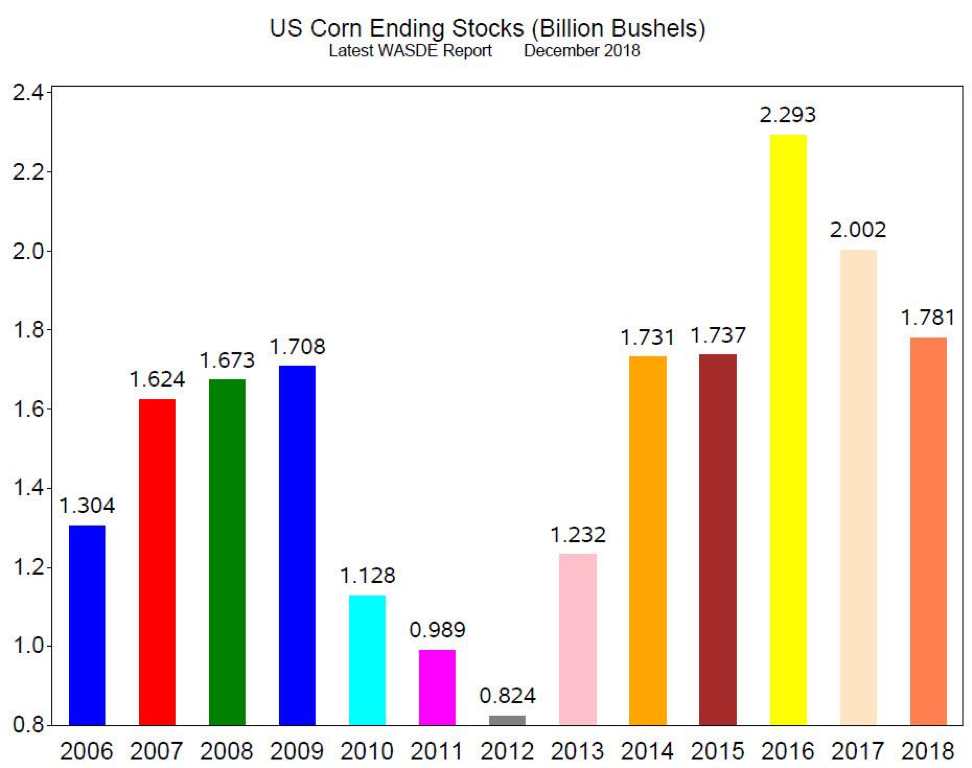

The USDA WASDE December 2018 report was released Tuesday, December 11, 2018. US Corn Ending Stocks were reported at1.781 billion bushels compared to estimates of 1.738 billion bushels (Chart 2,2018). World Corn Ending Stocks were reported at 308.80 million metric tons compared to estimates of 307.59 metric tons (Chart 3, 2018). US Ending Stocks will support US corn prices, but the World Ending Stocks continue at record levels (Chart 3, 2018).

Chart 2

Chart 3

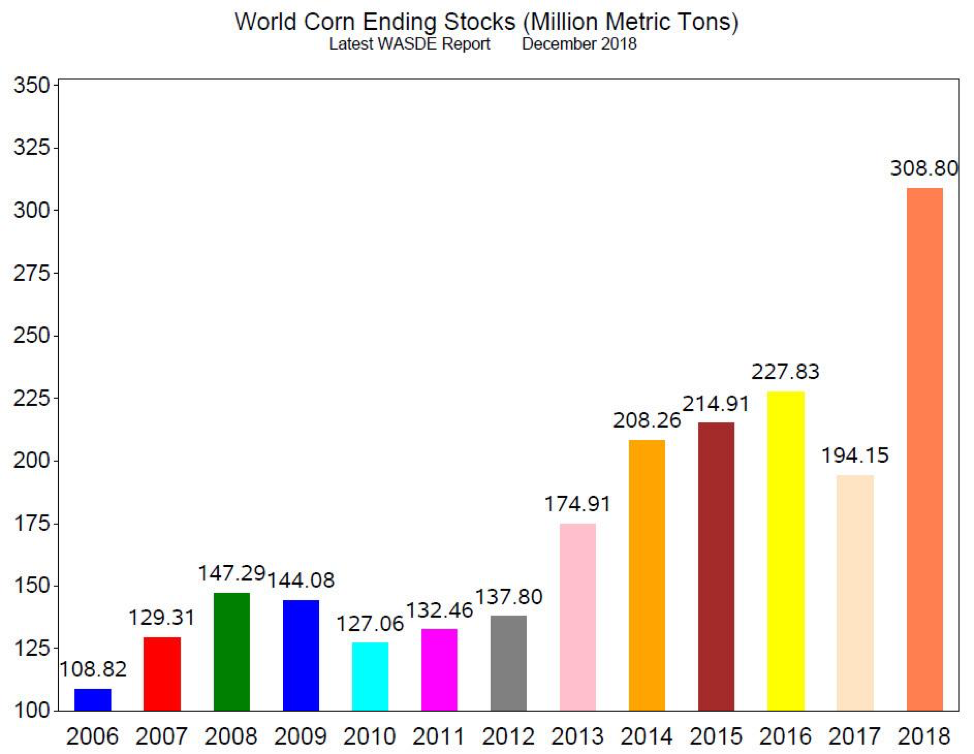

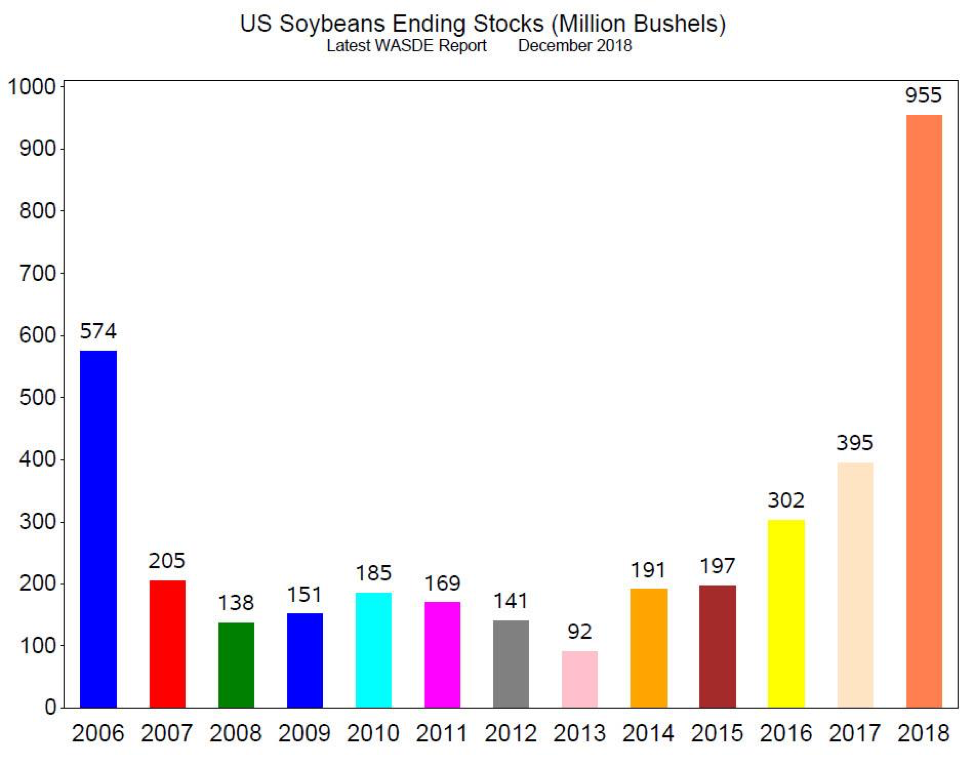

US Soybeans Ending Stocks were reported at 955 million bushels compared to estimates of 956 million bushels (Chart 4,2018). World Soybeans Ending Stocks were reported at 115.33 million metric tons compared to estimates of 112.79 metric tons (Chart 5, 2018). US and WorldEnding Stocks remain bearish to soybeans prices.

Chart 4

Chart 5