Mid-Week, Weekly Review of Gold, Silver, and Palladium

December 16, 2020

Gold remains slightly below the previous support of $1850 and silver is holding in a $22.5 – $25 channel. The Federal Reserve press release at 2PM and the following news conference at 2:30PM may provide sufficient impetus to move gold and silver in the coming days. Should the Federal reserve decide to shift from buying short-term to longer-term treasuries, this would have the effect of driving down yields which would tend to be good for gold and equities. However, volatility skew for February gold options show put volatility rose faster yesterday than call volatility potentially signaling the market is expecting a move down in gold price.

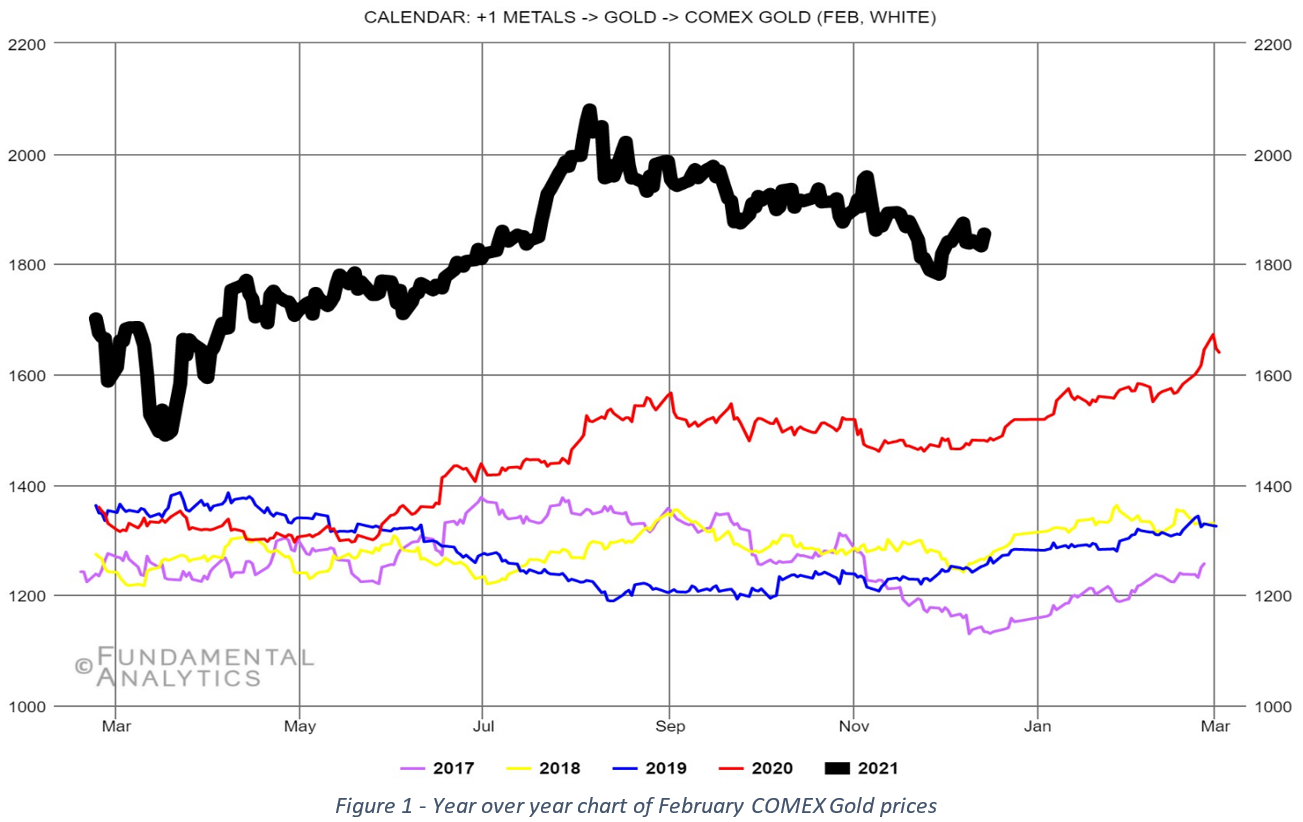

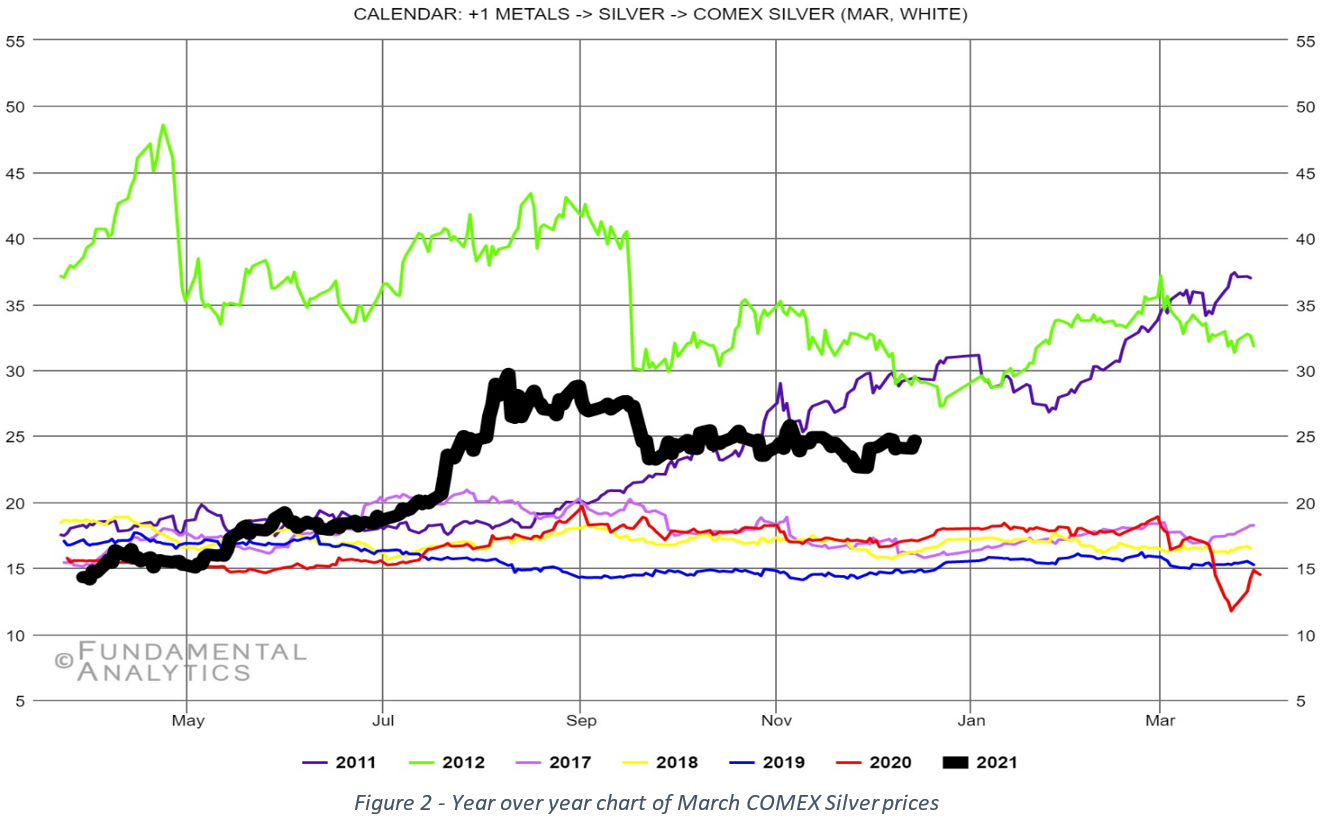

The front month contract for gold and silver were down 1% and 0.4% respectively at the close of trading yesterday, with respect to the close on December 8th, 2020. The ratio of the month 1 Gold contract to the month 1 Silver contract is down 0.6% compared to the close on the 8th, falling back to the low seen the first week of December. Should this ratio continue to fall, it may be a positive for gold in the future. With the front month gold and silver contracts closing yesterday at $1852.3 and $24.58, respectively, the gold/silver ratio is now 75.36, 12.9% higher than the corresponding 15-year average. February gold (Figure 1) closed yesterday at $1855.30, down 1.05%, and March silver (Figure 2) closed at $24.64, down 0.37% from the close on December 8th.

From an open interest perspective, gold total open interest has risen slightly since December 1st after gold hit a recent low of $1762.3 on November 30th. This increase in open interest mirrors a corresponding increase in the CFTC net non-commercial positions held. But all of this has occurred on volume much lower than the corresponding 50-day SMA.

Now on to silver… Silver total open interest rose 2.2% since last week on December 8th. The most recent CFTC report for silver shows net position of funds have once again continued their trend up. Both non-commercial shorts and longs are increasing, with longs edging out shorts. While silver volume was up in the previous weeks, this week has seen volume below the corresponding 50-day SMA. Traders in both gold and silver appear to have been biding their time until the Federal Reserve makes their announcement.

Now for Palladium. March palladium closed at $2324.00 yesterday, down 0.17% from the close last week Tuesday. Total open interest fell 3% from last week and 6.2% from two weeks ago. Total open interest is down 15.7% since November 13th. As with gold and silver palladium volume is lower than its 50-day SMA this last week. The latest CFTC report showed a 13.4% decrease in non-commercial net fund positions most of this being driven by an increase in non-commercial shorts. We will need to keep an eye on the price of rhodium as it has continued to rise over the last weeks, showing the market forces driving the need for the metal. As rhodium price increases manufacturers will be driven to move to palladium.

The final thoughts I leave with you today are around the price of gold. From a perspective of treating gold like a bond, it could be argued that gold is now overpriced due to increasing 10-year bond yields with both lower inflation and inflation expectations. However, should the Federal Reserve pivot to buying longer term treasuries, this could force yields lower which would have a minor positive impact on gold.

If you would like access to the great insights and analysis provided by the Fundamental Analytics platform, sign up for a 15-day free trial and demonstration!

If you have any questions, please contact our Technology Manager, Mike Secen at mike.secen@fundamentalanalytics.com

We also invite you to read our other articles and follow us on social media!

Best Regards,

The Fundamental Analytics Team

The information provided here is for general informational purposes only and should not be considered individualized investment advice. All expressions of opinion are subject to change without notice in reaction to shifting market conditions.