We would be happy to discuss this commentary with you and provide additional market insights. Feel free to call us at 312-348-7518 or email us at [email protected]

April 23, 2019 | by Joel Fingerman

Dear Joel:

Energy

The end of waivers on imports of Iranian oil announced by the US caused crude oil prices to jump more than $2 a barrel.

The Trump administration announced on Monday that it will not renew waivers granted last year to buyers of Iranian crude oil. With a May 1 deadline, major Iranian oil importers like China, India, and South Korean may be forced to find other sources of imports. There is fear that Saudi Arabia and other OPEC exporters will not be able to quickly replace the lost supplies, especially the oil cargoes booked for May delivery.

Evidently, there was some advance notice about the impending announcement, as NYMEX WTI Crude Oil prices ramped up in after-hours trading as shown in Chart 1. Beginning at 5:30 pm on Sunday, April 21, crude prices rallied over $1.50. The rally continued through Monday and Tuesday.

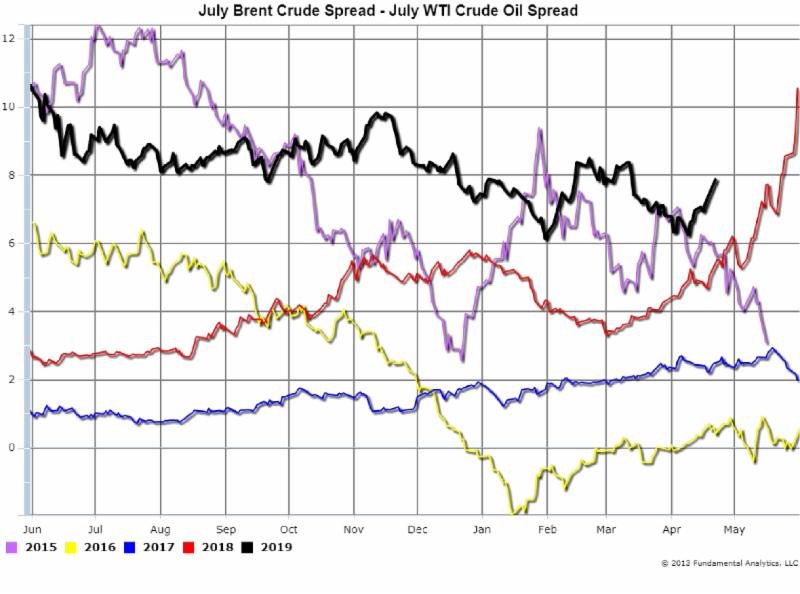

Brent Crude Oil, the European counterpart to NYMEX WTI Crude Oil, increased even greater than WTI, as Brent is more of an international benchmark than WTI. The Brent-WTI crude spread increased from $7 a barrel to $8 a barrel (Chart 2, black line). So while WTI Crude Oil price increased by over $2 a barrel, Brent Crude Oil price increased by over $3 a barrel.

Chart 1

Chart 2

For more insights and analysis or to find out about our free trial offer, go to www.fundamentalanalytics.com

Follow us on Twitter @fundanalytics or on LinkedIn

Regards,

The Fundamental Analytics Team